Transforming DeFi Credit Delegation

Crafting Intuitive UX/UI Designs for Enhanced Borrower Credibility and Lending Risk Management

Overview

GHO Forward, born from the LFGHO hackathon by EthGlobal, addresses credit delegation risks in the AAVE ecosystem by integrating on-chain and off-chain credit scoring. Our innovative approach secured the Family Pool Prize at the hackathon.

Role

As the product design lead, I collaborated closely with a team of three developers to leverage UX strategy, design, prototyping, and rapid iteration. Key activities included:

Brainstorming and Concept Creation: Collaborated in ideation sessions to refine concepts and define core platform features.

Concept Definition: Translating abstract ideas into a design vision with actionable goals that balanced user needs with technical feasibility.

Design Execution: Created simple, engaging interfaces with accessible, user-centric design.

Problem

AAVE's native Credit Delegation feature faced significant challenges due to the absence of standardized credit evaluation tools. Unlike traditional finance, which relies on established credit reports, credit delegation on AAVE lacked comprehensive mechanisms to assess borrower reliability. This gap created several issues:

Lack of Borrower Credibility Assessments: The absence of standardized systems for evaluating creditworthiness in DeFi.

Risk of Bad Debt for Lenders: Lenders had no effective tools to verify borrowers' reliability, increasing risk.

Trust Gap in Decentralized Lending: Mistrust due to a lack of robust verification methods, hindering the credit delegation process.

Missed Opportunities: Borrowers’ inability to prove credibility increased lender reluctance to delegate credit, reducing capital efficiency and leading to lost opportunities.

Solution

The GHO Forward team aimed to enhance AAVE's native Credit Delegation feature by integrating additional trust-building and risk-reduction mechanisms. Our goal was to create a more secure system that would allow lenders to confidently delegate credit, knowing that risks were effectively mitigated. Two core ideas emerged:

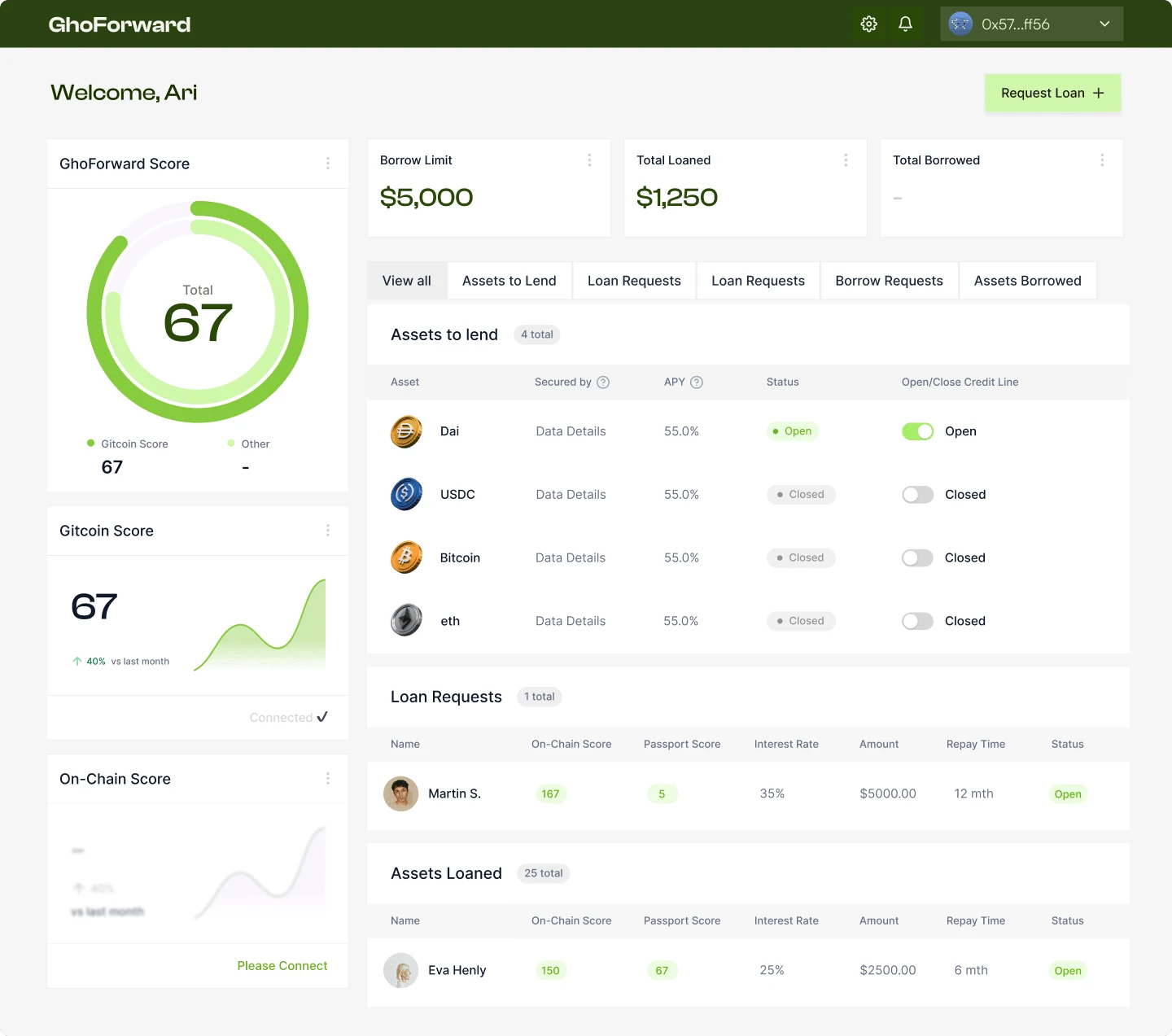

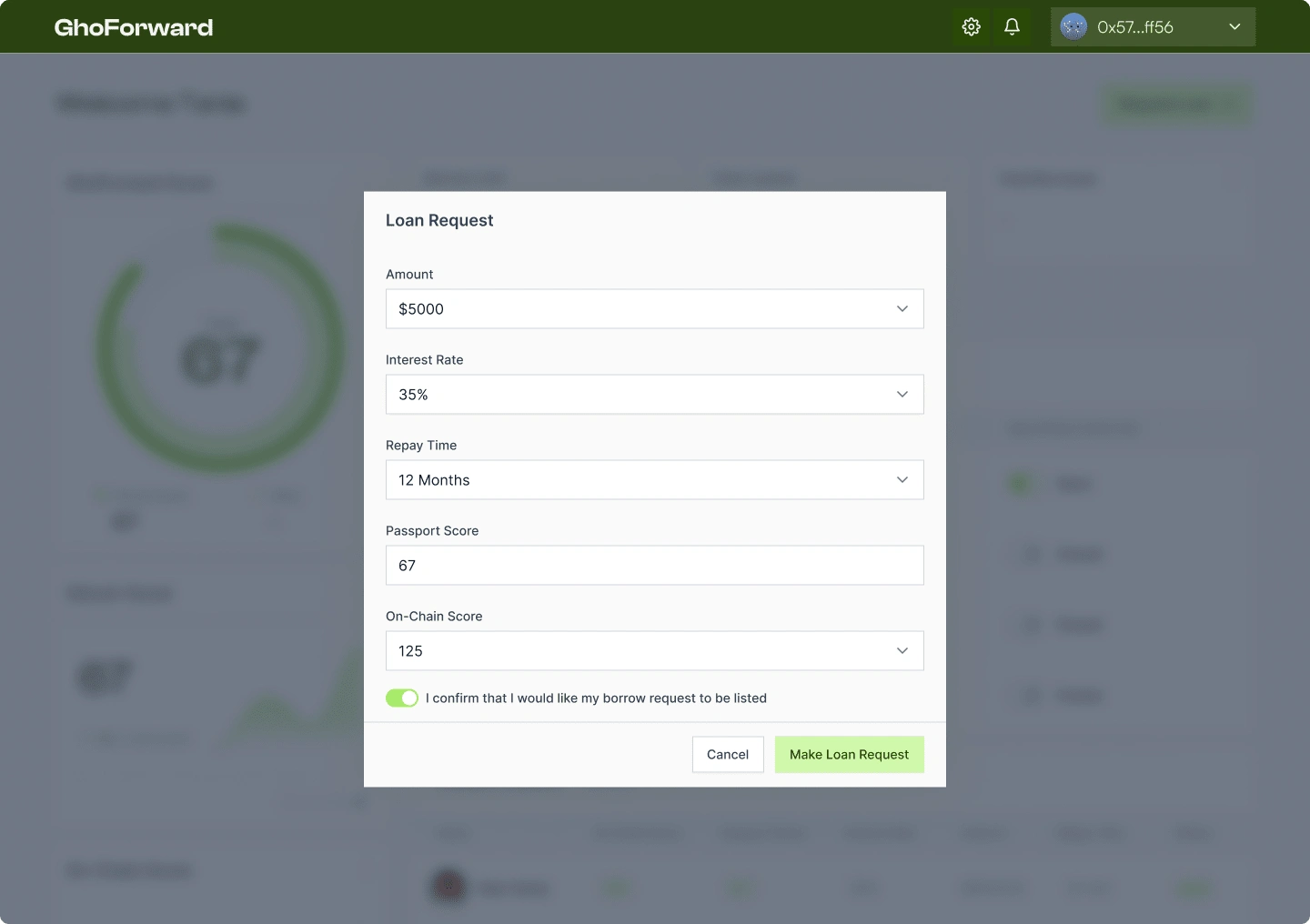

On-Chain and Off-Chain Credit Scoring Integration: By integrating decentralized identity protocols like Gitcoin Passport, we could bring off-chain credit information into the Aave Credit Delegation ecosystem. This allowed borrowers to import credibility from traditional financial systems or web3 social reputations, providing lenders with a comprehensive view of borrower reliability.

NFT-Backed Borrowing (Explored but Not Implemented): We explored using NFTs as collateral to secure loans, allowing borrowers to access liquidity without selling their assets. Although not implemented due to time constraints, this remains a promising avenue for future development.

Additionally, while credit delegation was technically feasible, there was no existing user interface to enable its practical use. Developing a solution with this capability was crucial to make the feature actionable and user-friendly.

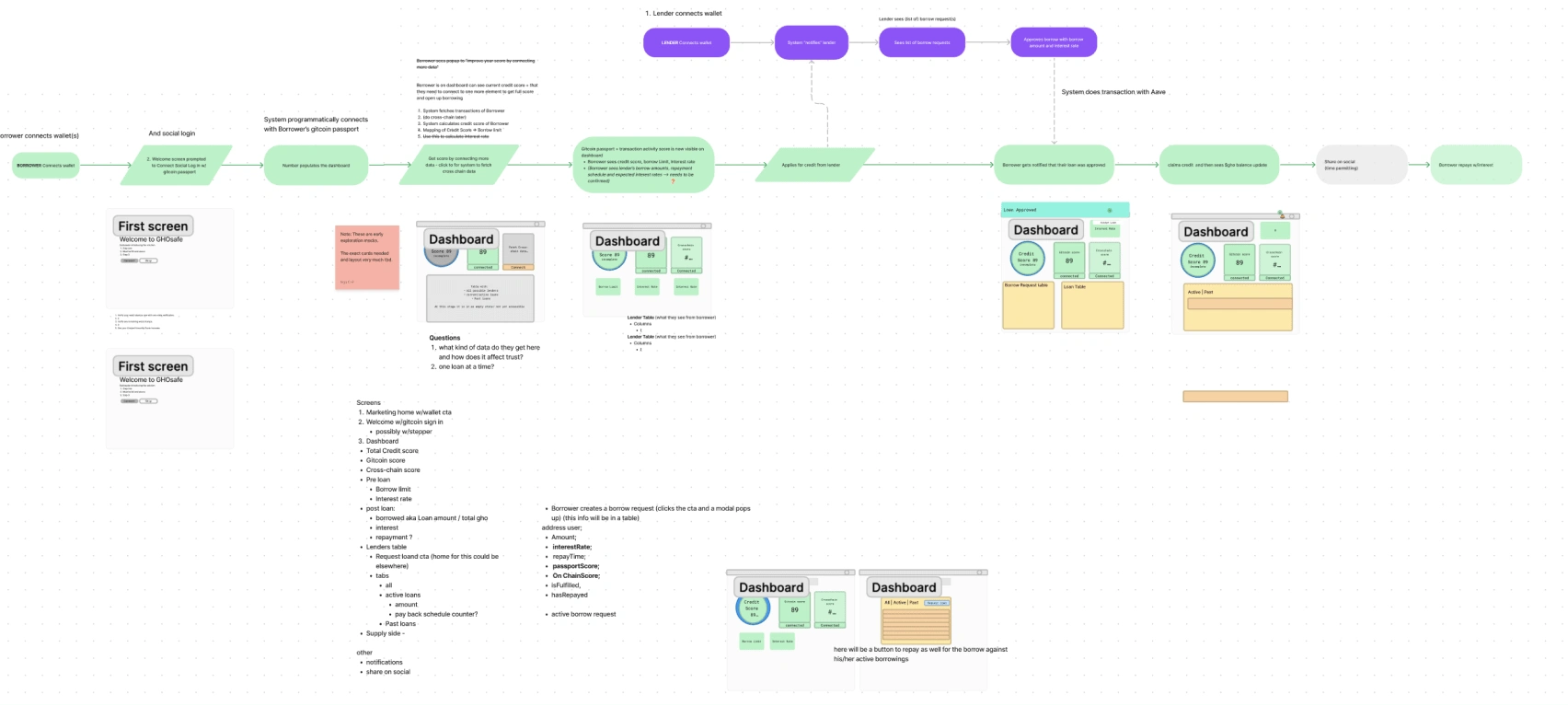

User Flows & Prototyping

To begin visualizing our solution, I mapped out user flows for borrowers and lenders, detailing their interactions from onboarding to loan approval. This dual-track approach evolved into a unified user journey, enabling seamless transitions between roles. Low-fidelity sketches were created to outline the platform’s layout and functionality, serving as a communication tool between design and development.

UI & Visual Design

Once the foundational structure was established, wireframes were transformed into high-fidelity UI designs. The design aesthetic was crafted to be modern and innovative, utilizing a color palette that complemented AAVE’s signature purple with GHO’s green. This reinforced the platform’s identity.

Typography choices included Clash Display for bold headlines and Inter for body text, creating a unique yet approachable interface that resonated with the platform's forward-thinking nature.

Result

GHO Forward successfully created a blockchain-based platform that enhanced borrower credibility and mitigated lending risks within the AAVE ecosystem. By integrating on-chain and off-chain credit scoring, the platform empowers users to engage in lending and borrowing with greater confidence.

For more innovative design solutions and insights, explore Astro Design Studio, where we transform ideas into impactful digital experiences.

Like this project

Posted Oct 30, 2024

Led design and strategy to create GHO Forward, blending compelling visuals and user-centric design to make DeFi credit delegation accessible and trustworthy.