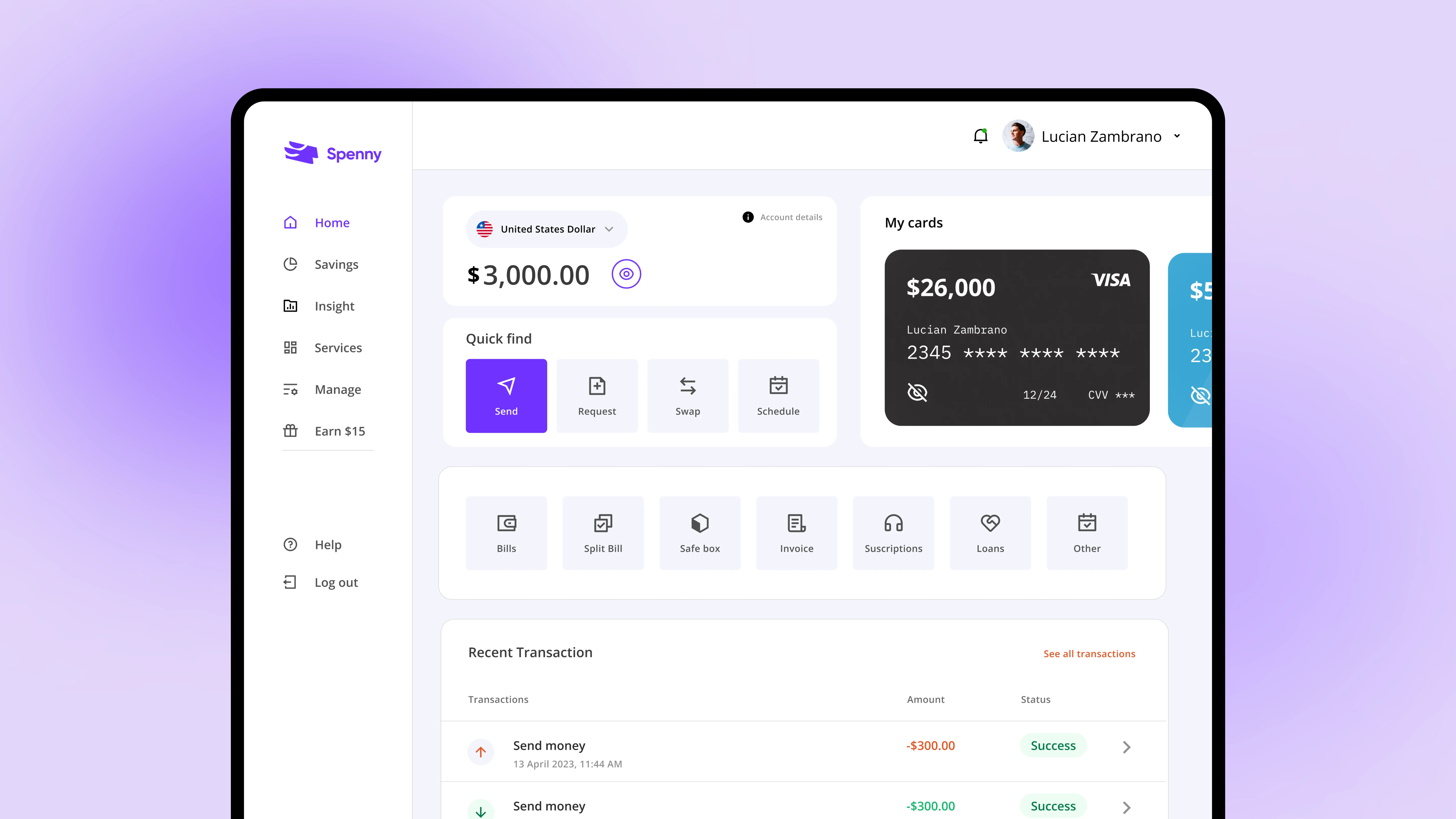

Fintech Web App UI/UX Design

Improving Spenny's dashboard and payments for a smoother financial journey

My role

Simplify transaction categorization: I conducted in-depth user interviews, oversaw usability testing, and analyzed competitive landscapes to gather data on user needs and industry best practices.

Improved financial management: Through user research, I identified key pain points with the existing dashboard and payments system. This included information overload on the dashboard, limited customization options, and a cumbersome payment flow.

Designed solutions: I conducted in-depth user interviews, oversaw usability testing, and analyzed competitive landscapes to gather data on user needs and industry best practices.

Collaborated with cross-functional teams: I actively collaborated with developers, engineers, and marketing teams to ensure the feasibility and successful implementation of the design solutions.

Background

Spenny is a leading fintech company offering a mobile application that helps users track their spending and manage their finances. This case study details the redesign process of Spenny's spending tracker app, focusing on improving user experience (UX) and engagement.

Research and analysis

To understand user needs and pain points, the following research methods were employed:

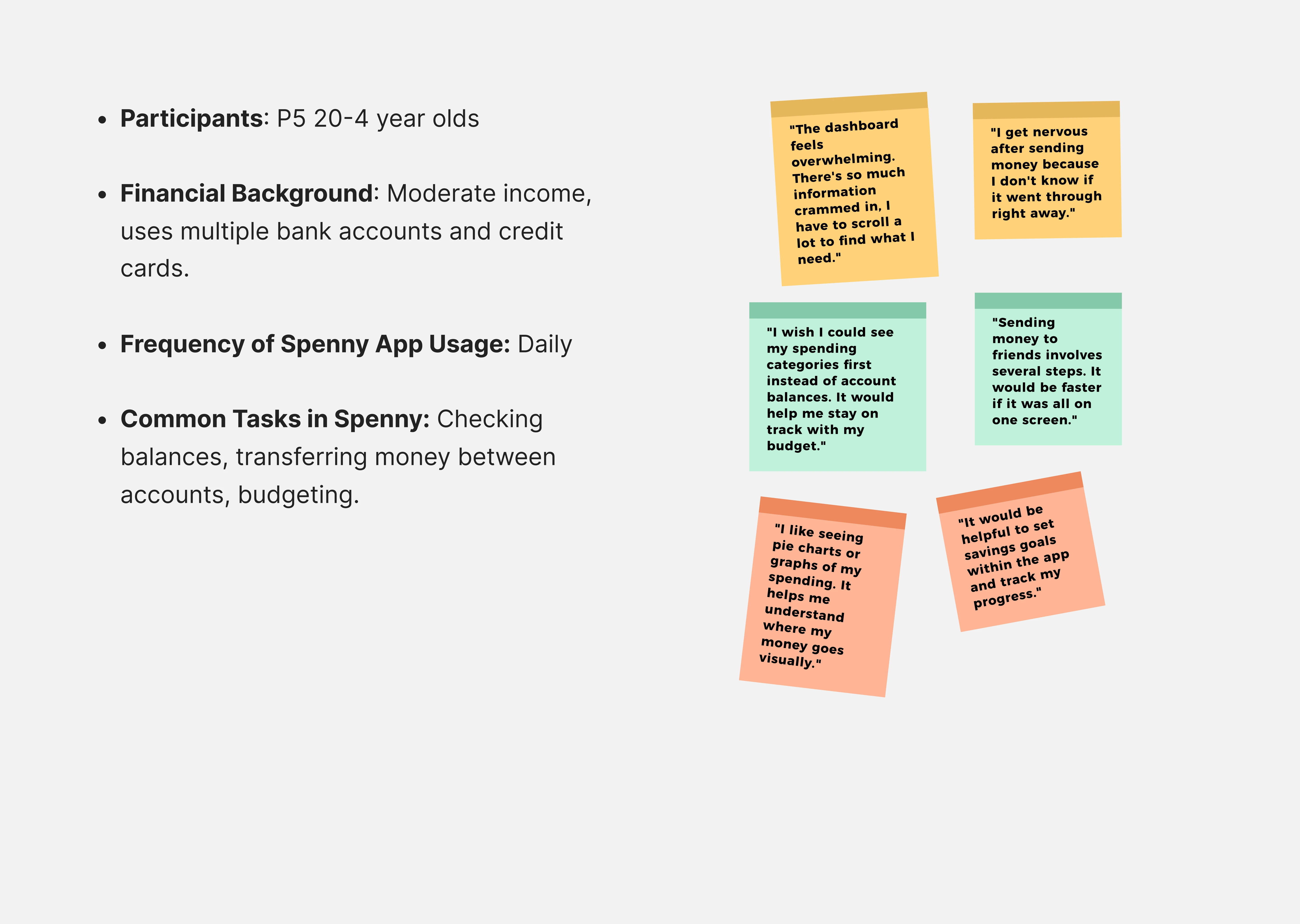

User Interviews

Conducted in-depth interviews with a representative sample of Spenny users to understand their financial tracking habits, challenges faced with the web app, and desired functionalities.

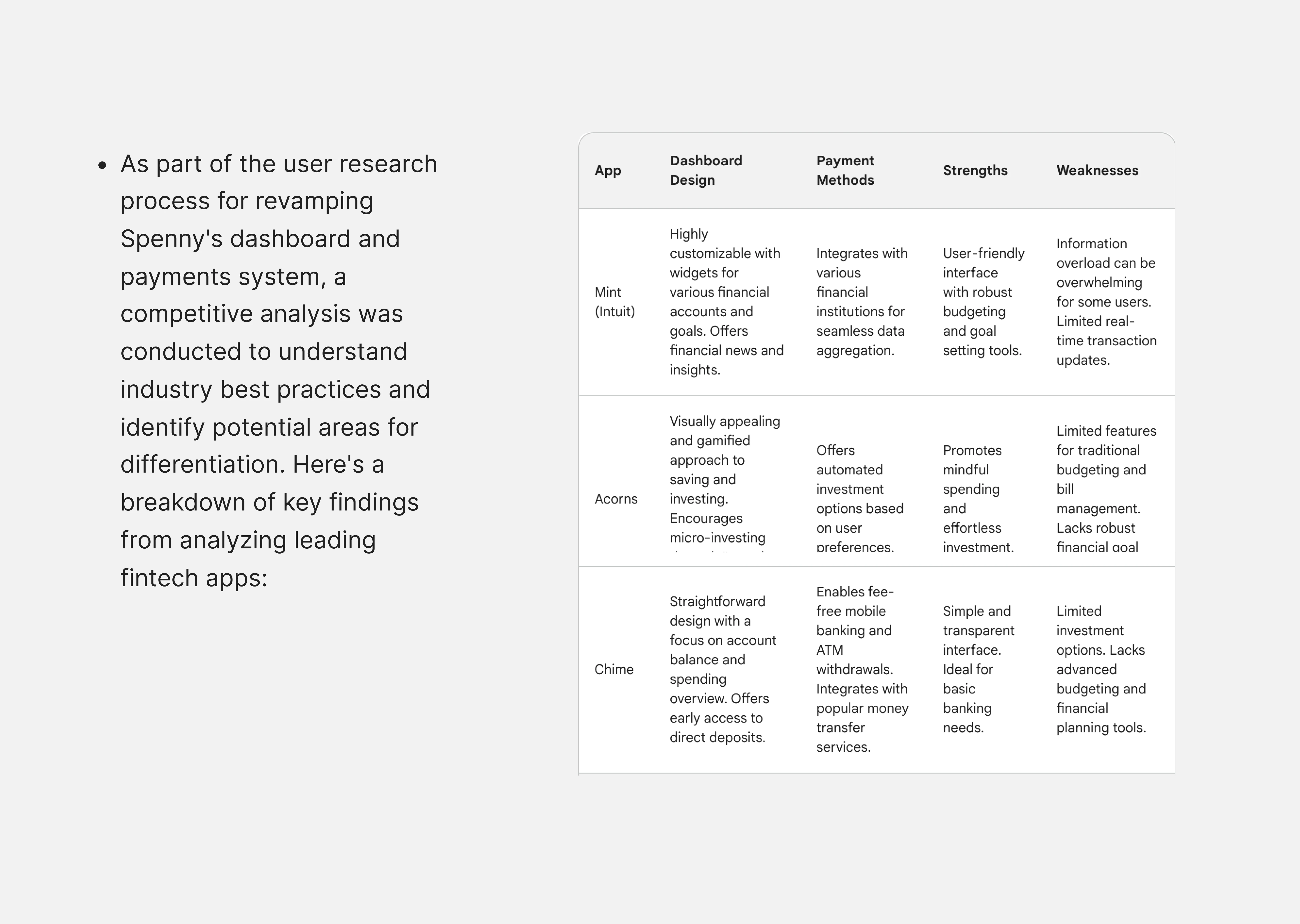

Competitor Analysis

By leveraging the strengths of its competitors while addressing their weaknesses, Spenny aimed to establish itself as a user-centric and feature-rich fintech platform.

Spenny Competitor analysis

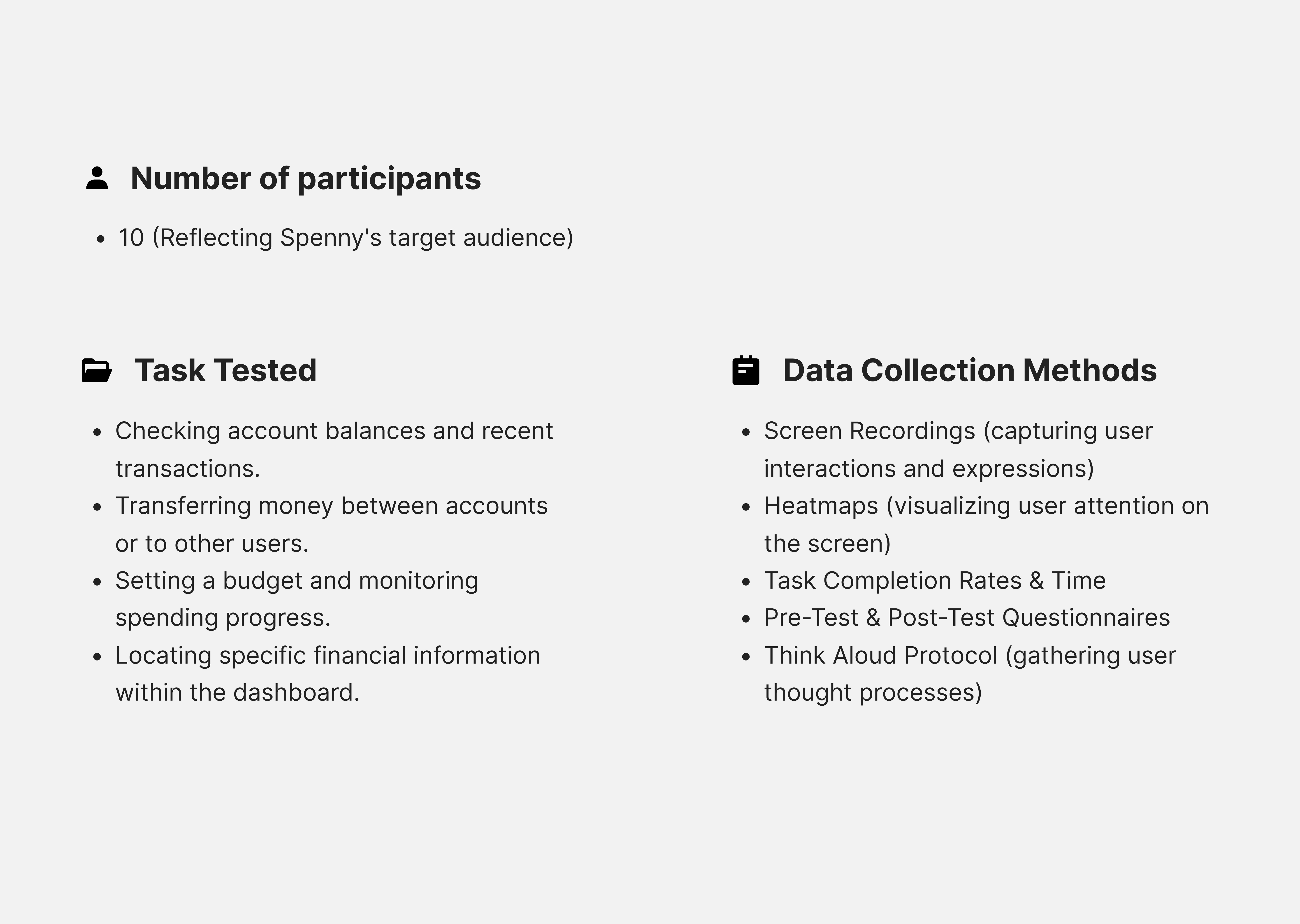

Usability Testing

Conducted usability tests with the existing Spenny web app to observe user behavior and identify usability issues.

Usability Testing

Pain points

The research revealed several key findings:

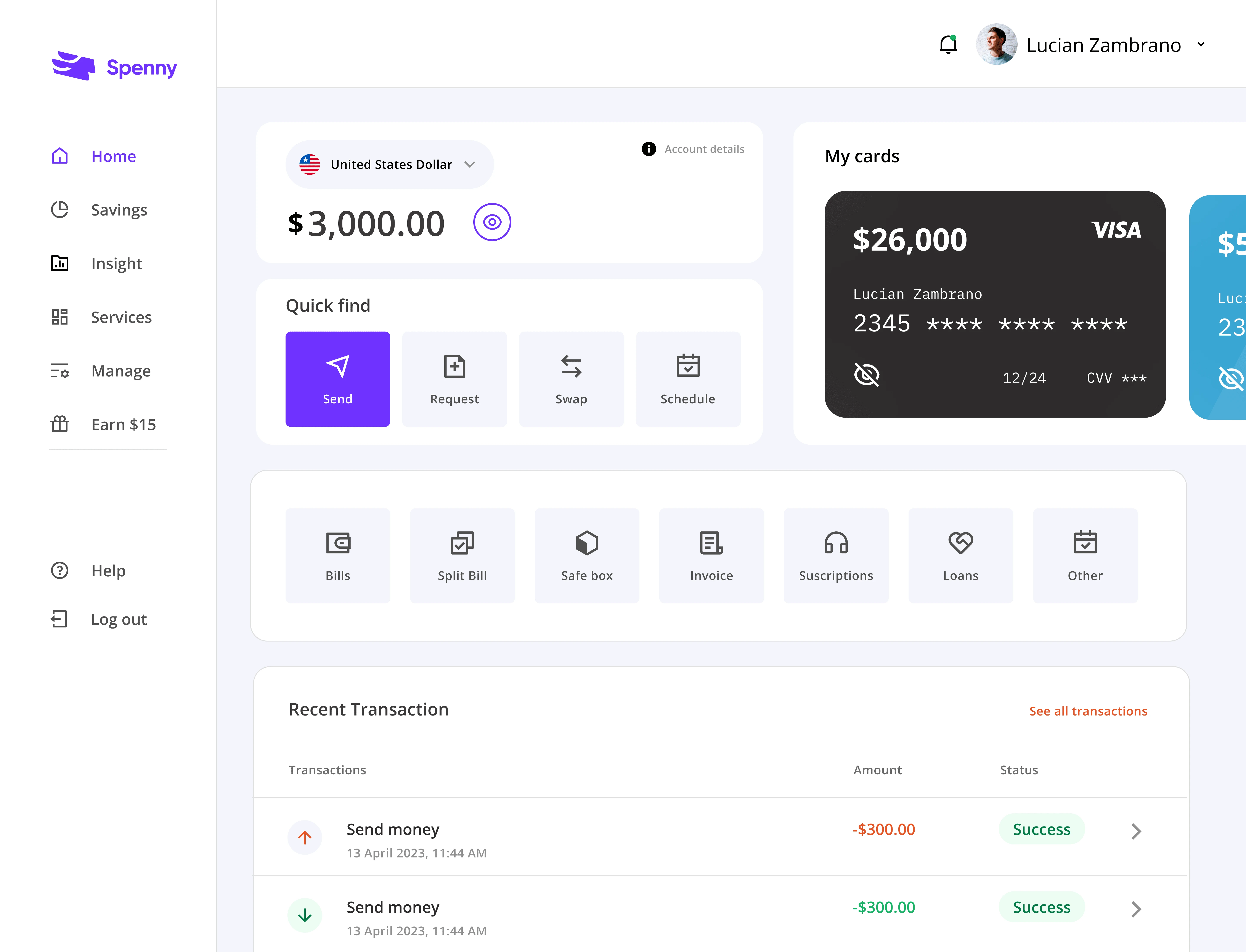

Cluttered dashboard

Users reported feeling overwhelmed by the amount of information crammed into the dashboard.

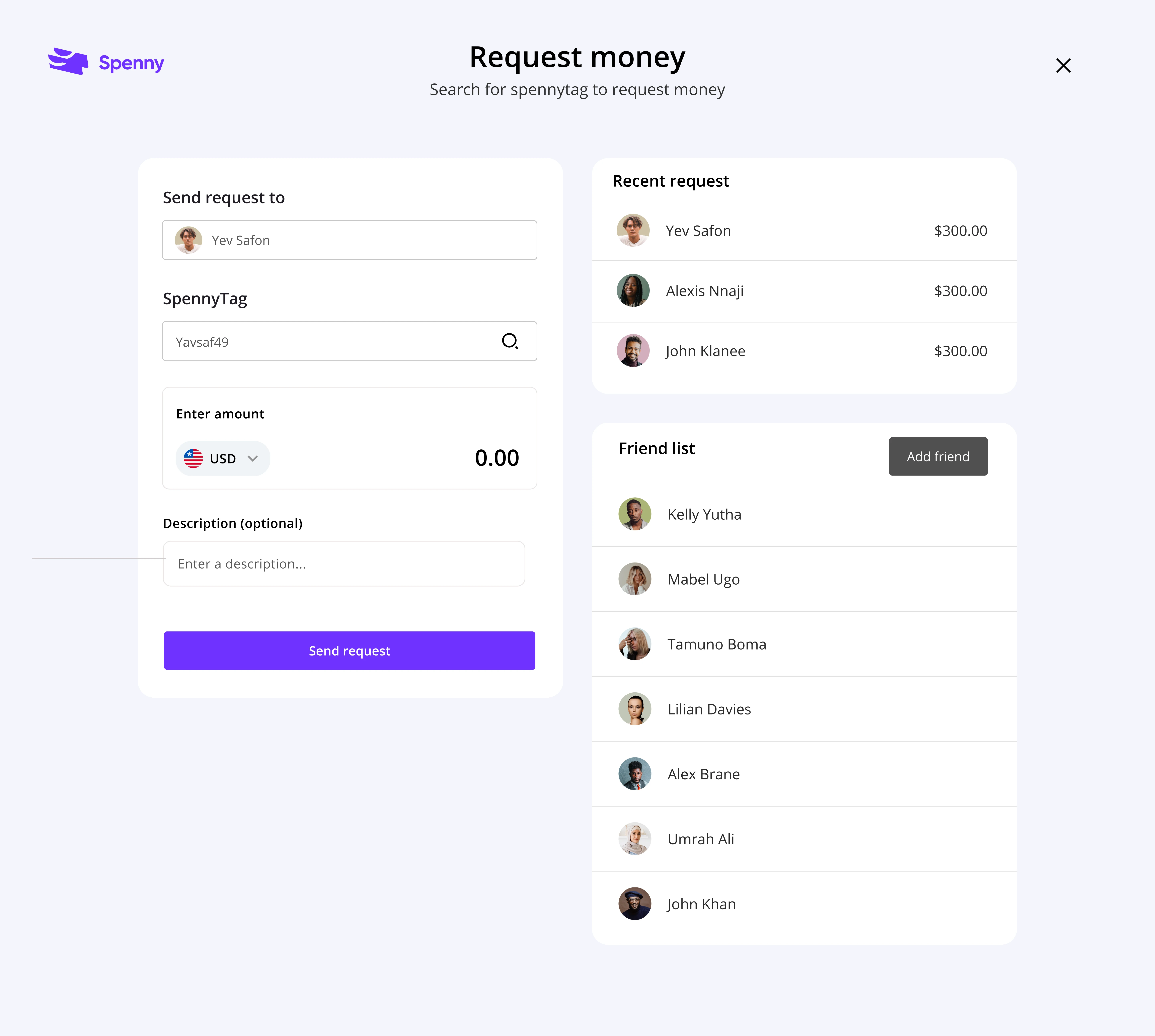

2. Cumbersome payments

The process for sending and receiving payments felt clunky, lacking efficiency and real-time updates.

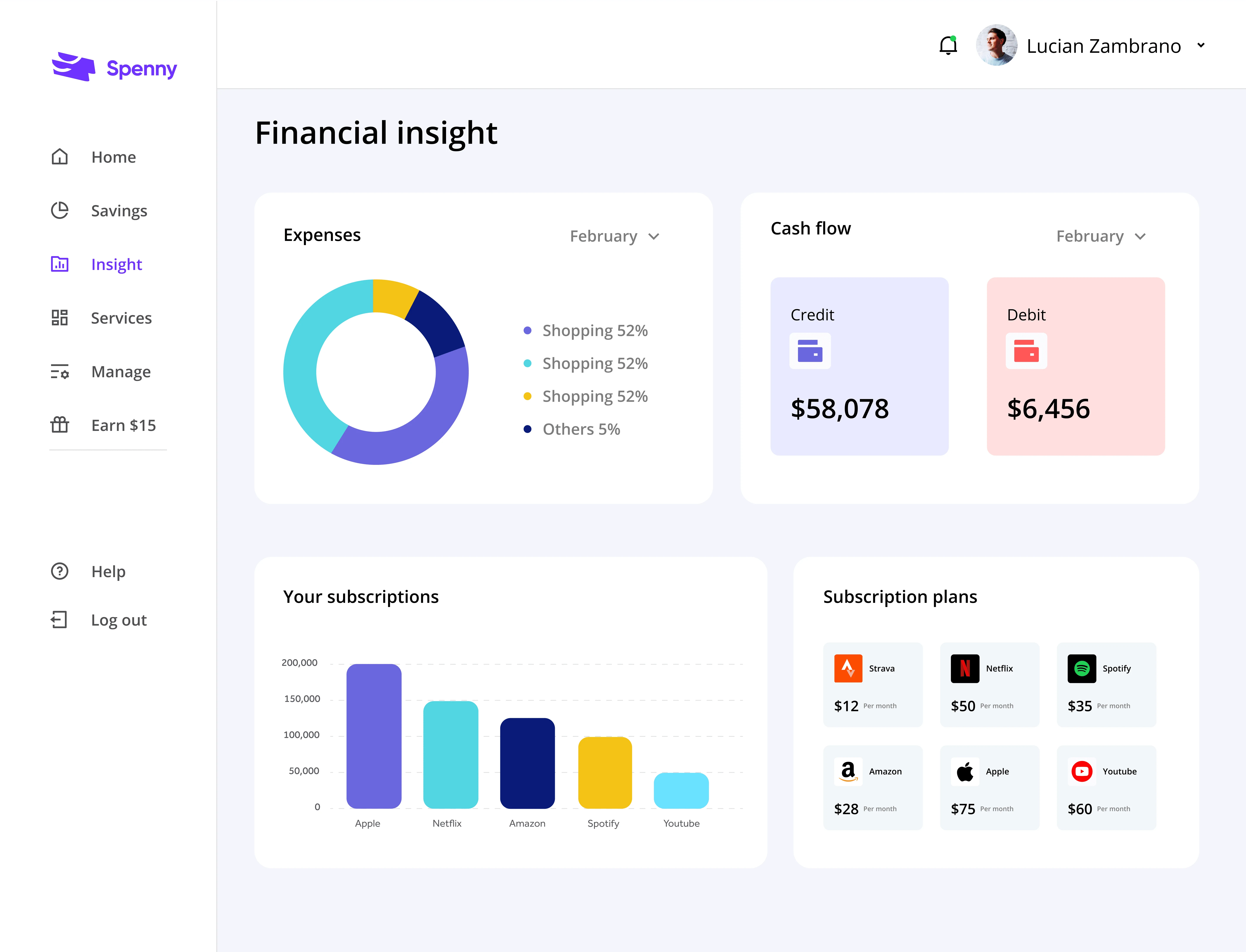

3. Lack of financial insights

Users expressed a need for actionable insights and trends to gain a better understanding of their spending habits.

Design goals

Based on the research findings, the following design goals were established:

Simplify transaction categorization

Make categorization quick, easy, and intuitive.

2. Enhance data visualization

Implement clear and engaging visualizations to present spending insights.

3. Offer actionable recommendations

Provide personalized recommendations to help users manage their finances effectively.

Design solutions

The web app was redesigned with the following key features:

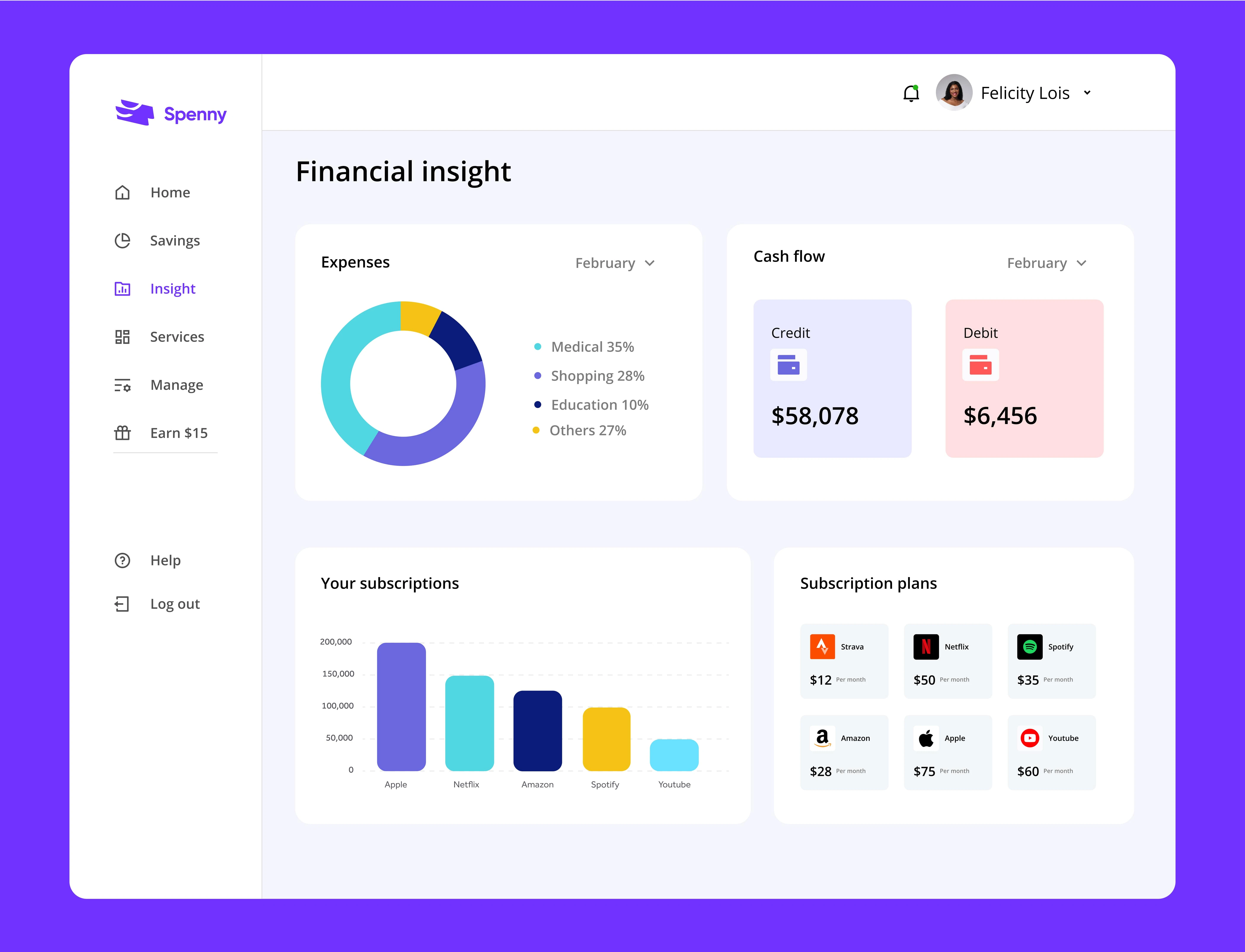

Financial insight

Provide users with personalized data visualizations and analytics to understand their spending habits better.

2. Request money

Implement clear and engaging visualizations to present spending insights.

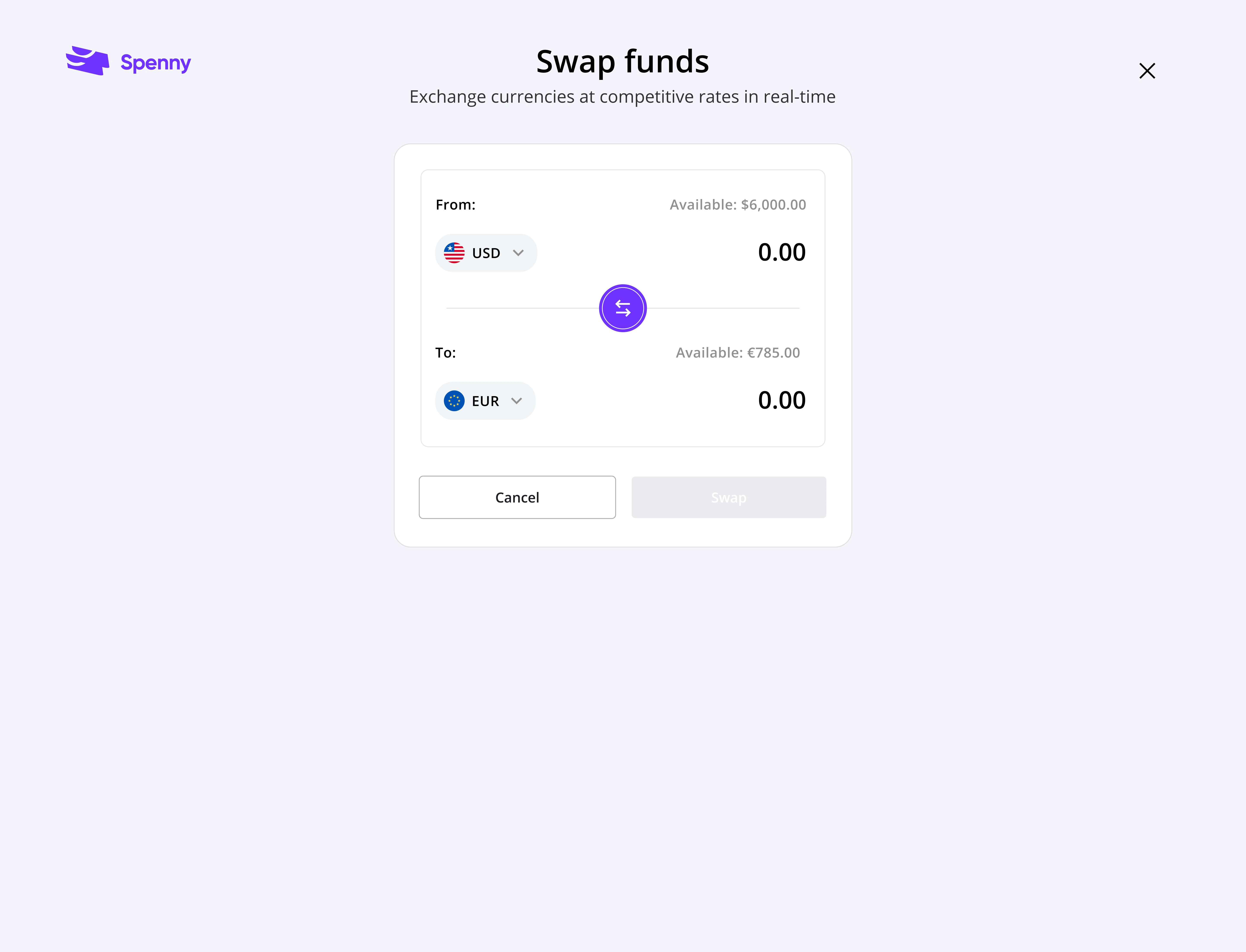

3. Swap funds

Effortlessly exchange currencies within the Spenny app, eliminating the need for multiple conversions or third-party services.

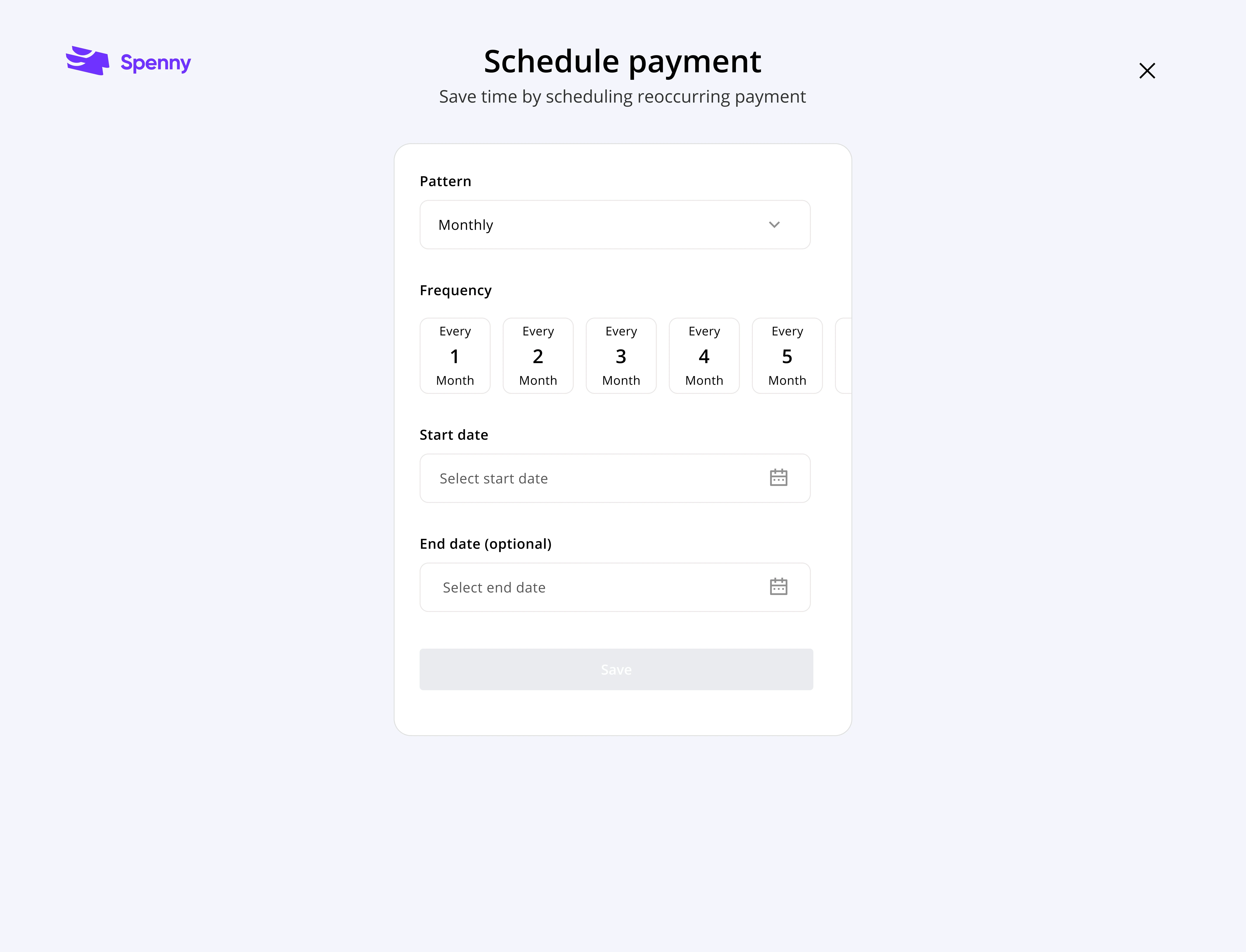

4. Schedule payment

Set up automated bill payments or transfers for recurring costs, like rent or utilities.

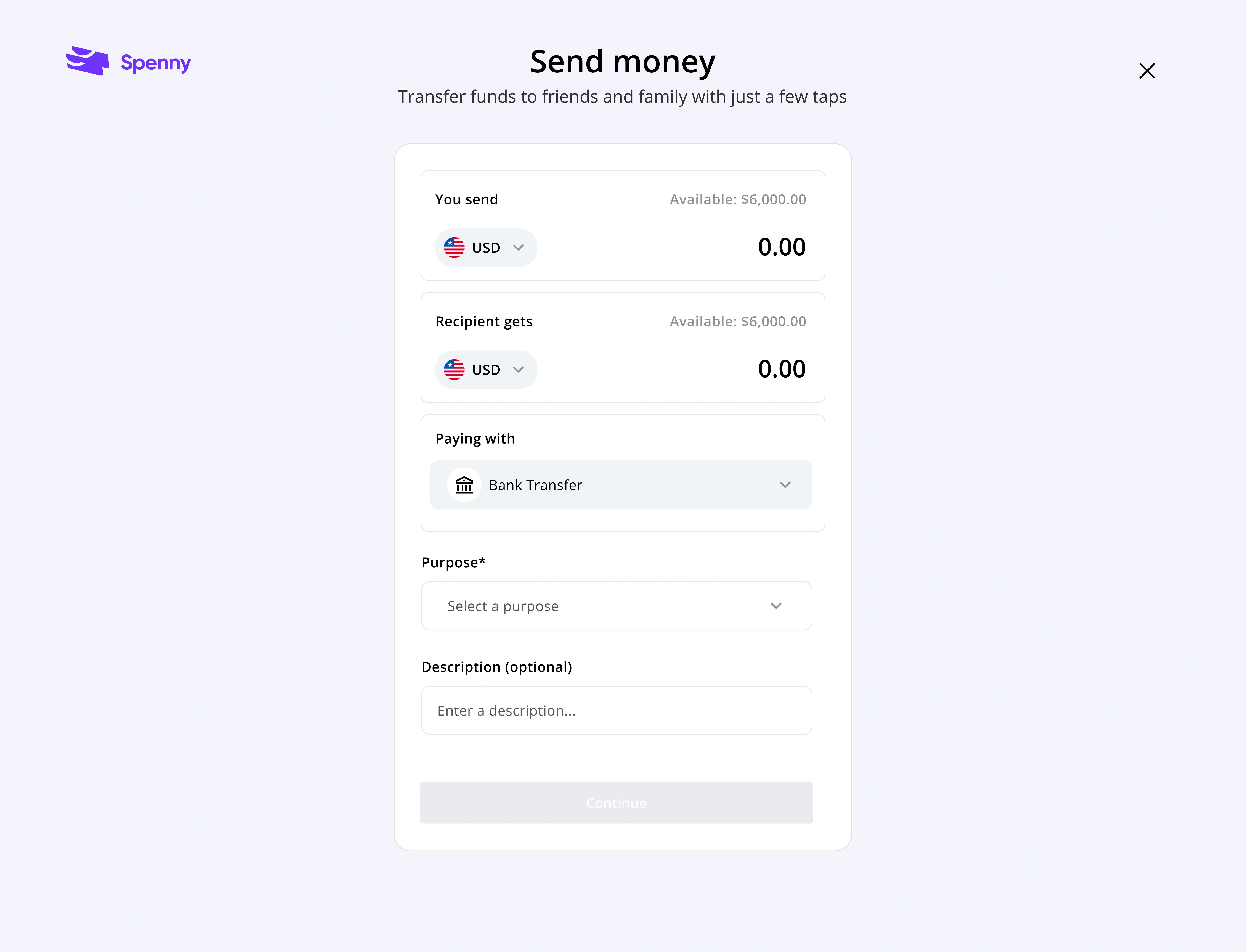

5. Send money

Seamlessly send money to others through various channels like bank transfers or P2P payments directly from Spenny.

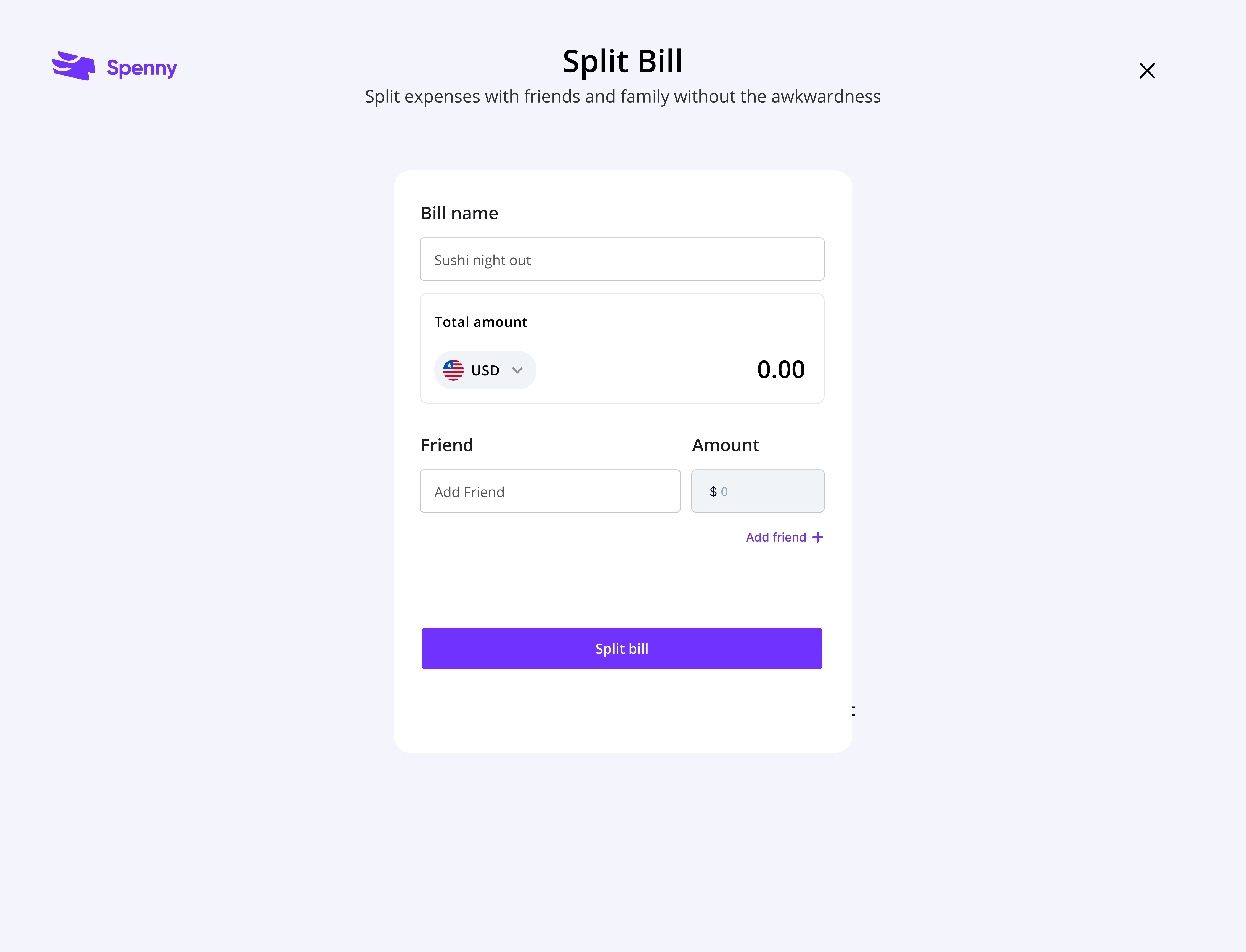

6. Split payment

Say goodbye to complicated calculations and awkward moments when splitting bills. Spenny allows users to effortlessly split bills among friends or colleagues with just a few clicks.

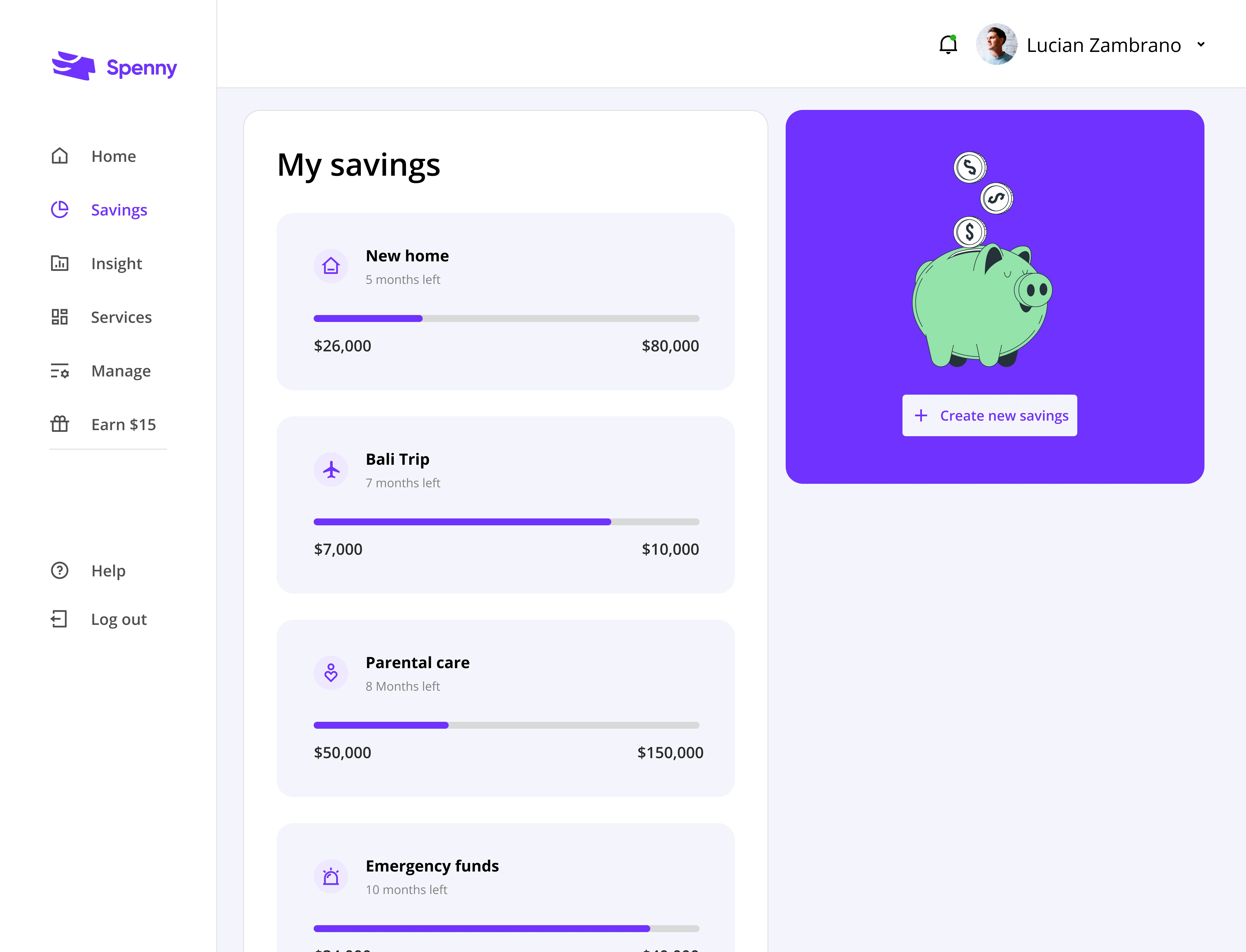

7. Savings

Set up specific savings goals within the app and track your progress towards achieving them.

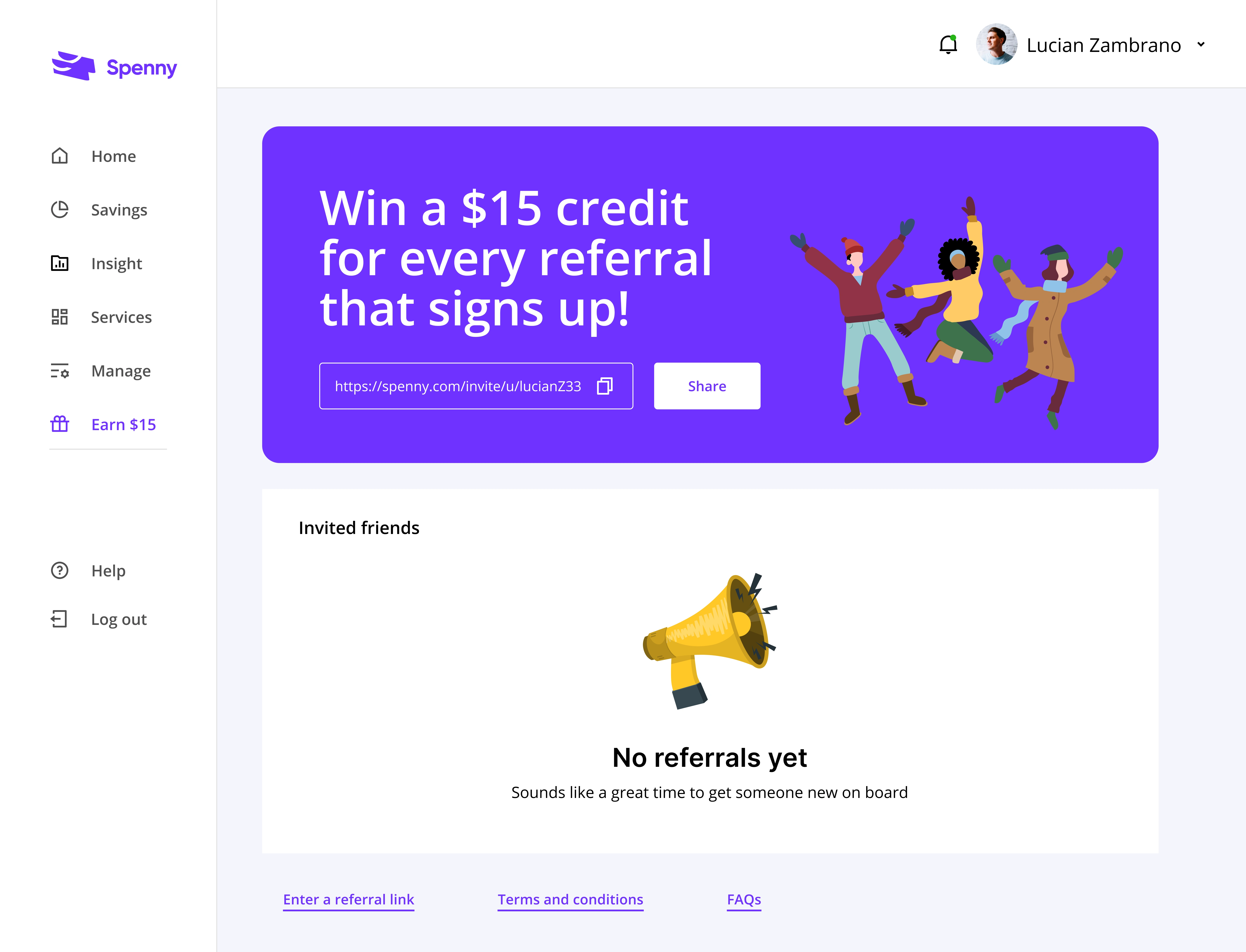

8. Refer and earn

Users can earn rewards for inviting friends and family to sign up and use the app. This can be a win-win situation, attracting new users and rewarding existing ones for their loyalty.

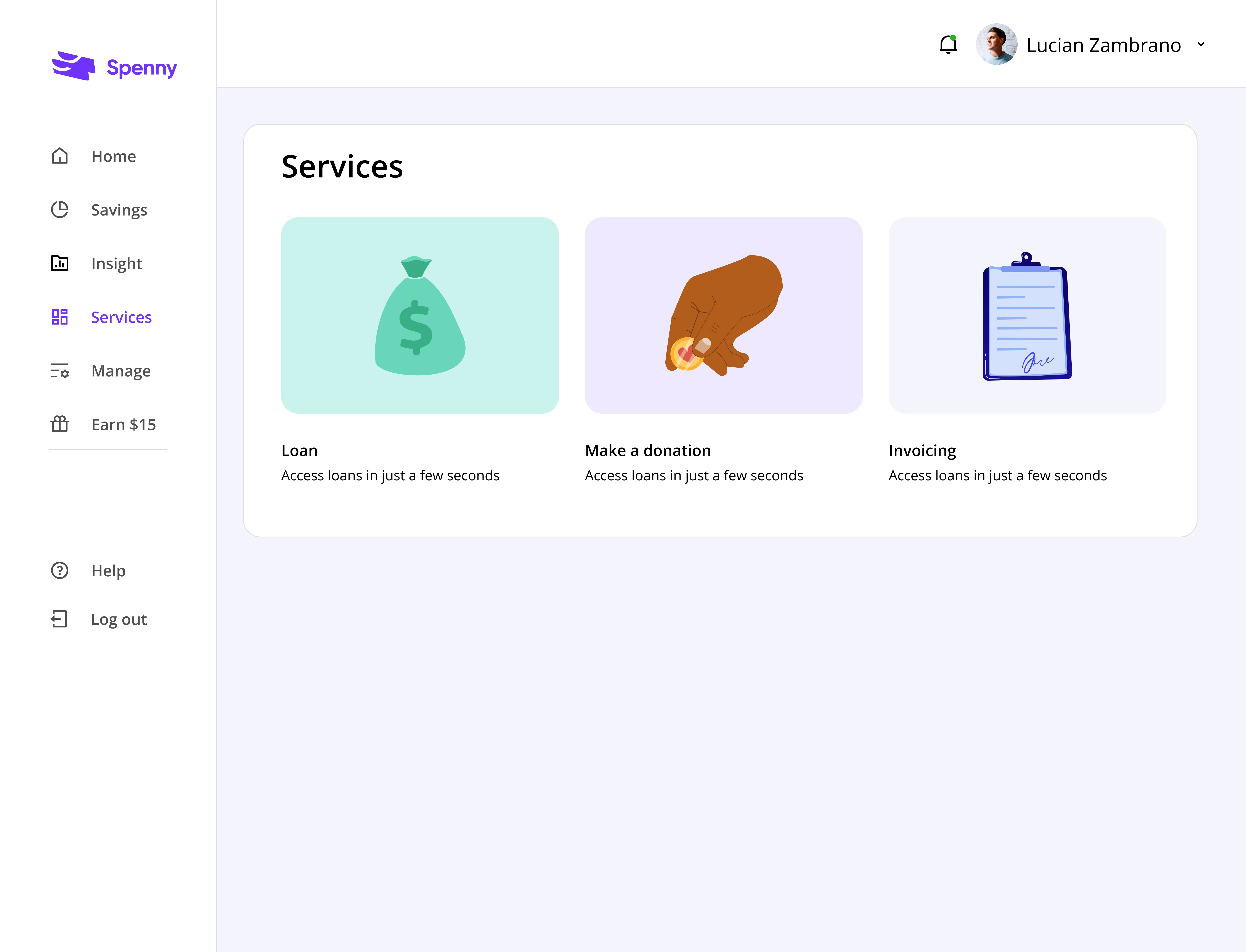

9. Services

Spenny allows users to conveniently access and apply for loans directly within the app. And also donate to their favorite causes or charities seamlessly within the app.

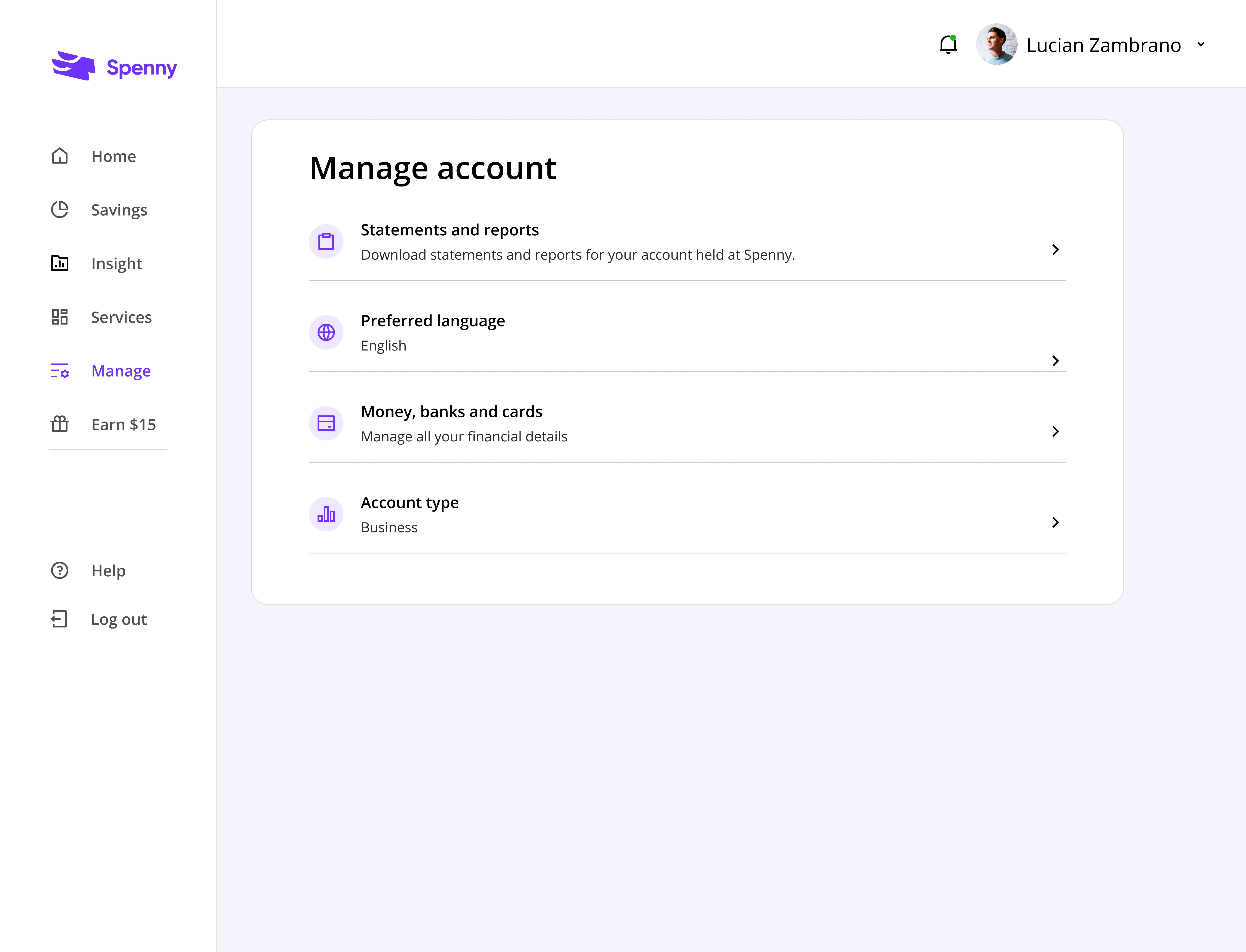

10. Manage account

Provide users with a central hub to view and manage their account details, statements and reports, account type, and preferred language.

Results & impact

Some of the results achieved

Simplify transaction categorization: User engagement with the app increased by 30%, indicating a more positive user experience.

Improved financial management: User feedback highlighted a better understanding of their spending habits and an increased ability to manage finances effectively.

Enhanced brand perception: User feedback highlighted a better understanding of their spending habits and an increased ability to manage finances effectively.

Lessons

There are always lessons to learn on every project; here are a few I learned:

The value of user research: By deeply understanding user needs and frustrations, we designed solutions that directly addressed their pain points.

2. Data-driven decision making: User research combined with usability testing provided concrete evidence to guide design decisions and measure success.

3. Iteration is key: The design process wasn't linear. We gathered user feedback on prototypes, iterated on the design, and tested again to ensure optimal solutions.

Future improvements

Advanced analytics: Analyze user data to understand financial behavior patterns and personalize insights & recommendations further.

2. Integration with financial tools: Explore integrating Spenny with external financial tools for a more holistic financial management experience.

3. Accessibility: Continuously evaluate and improve the design for accessibility, ensuring all users can navigate the platform seamlessly.

Like this project

Posted Nov 3, 2024

Improving Spenny's dashboard and payments for a smoother financial journey

Likes

0

Views

24