How I Designed a Fintech App for Managing Financial Statment

Overview

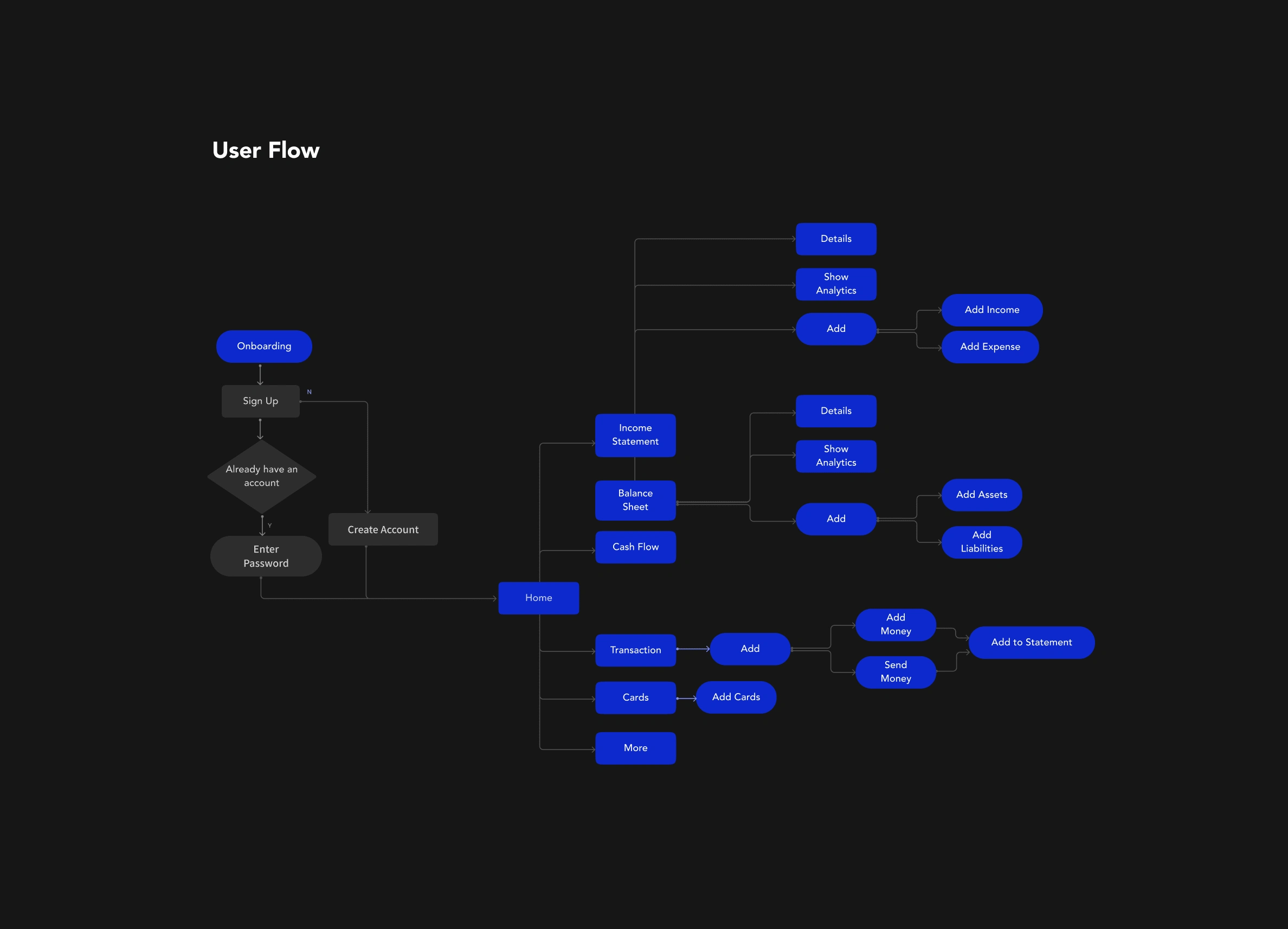

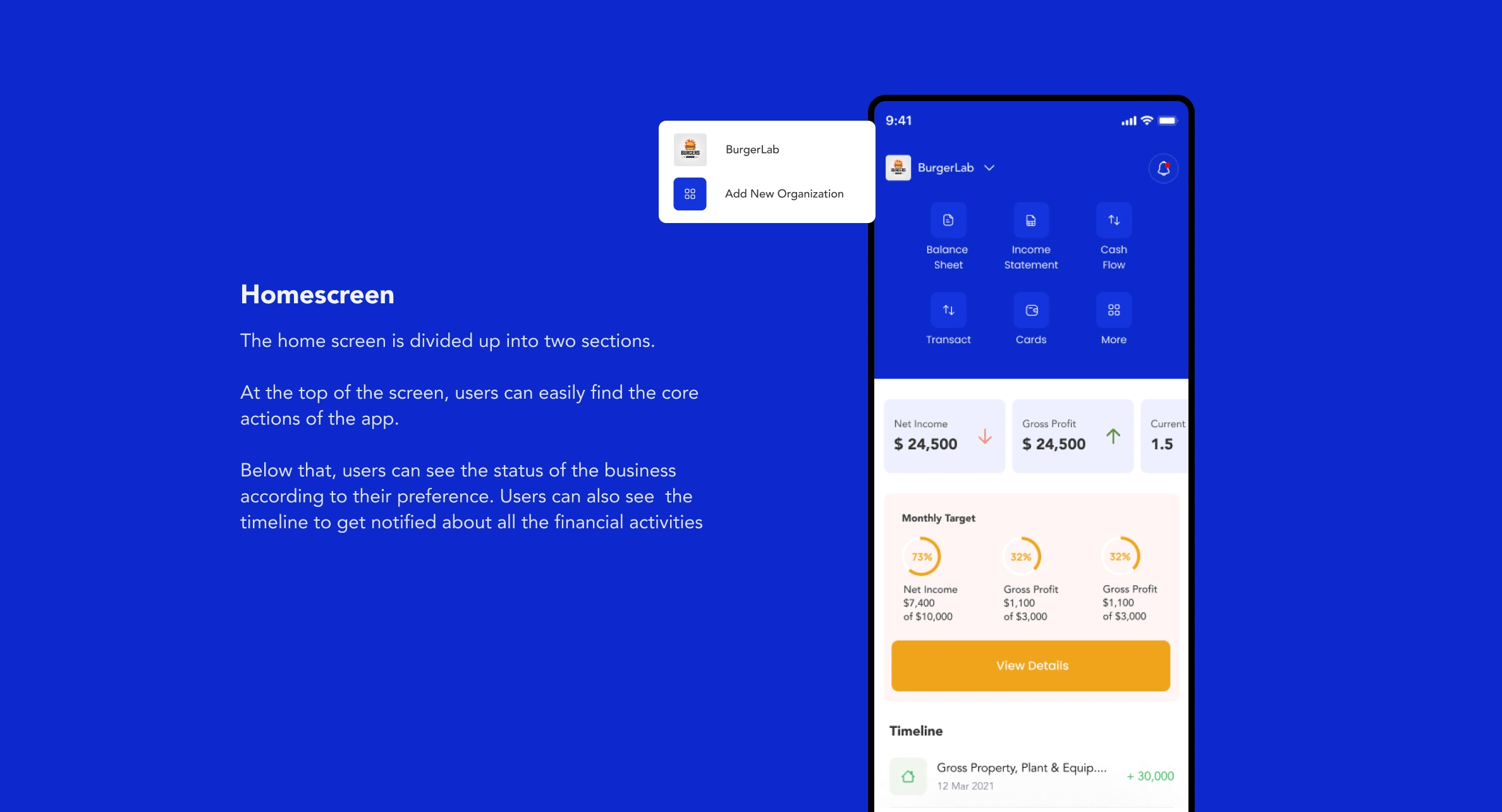

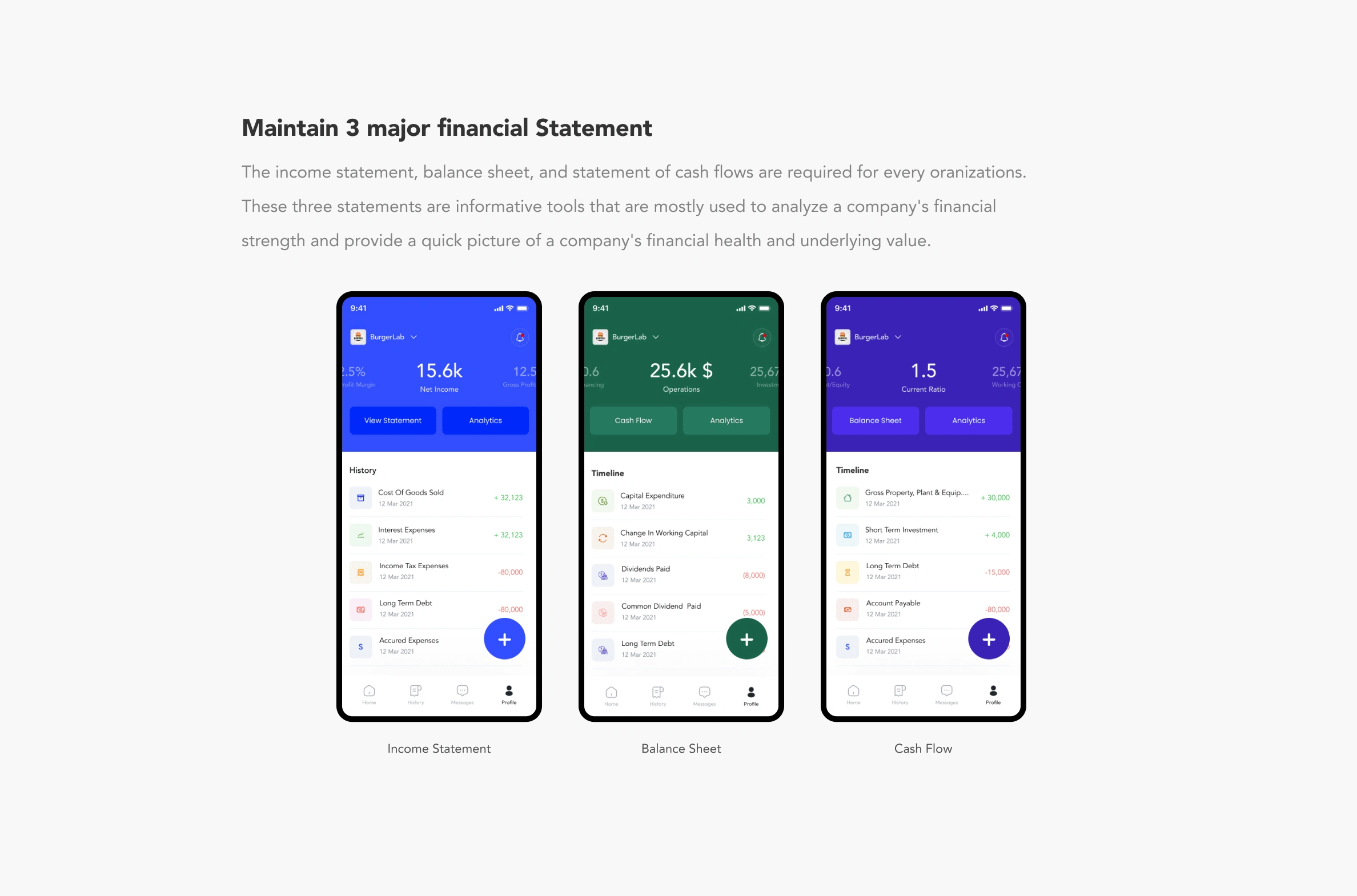

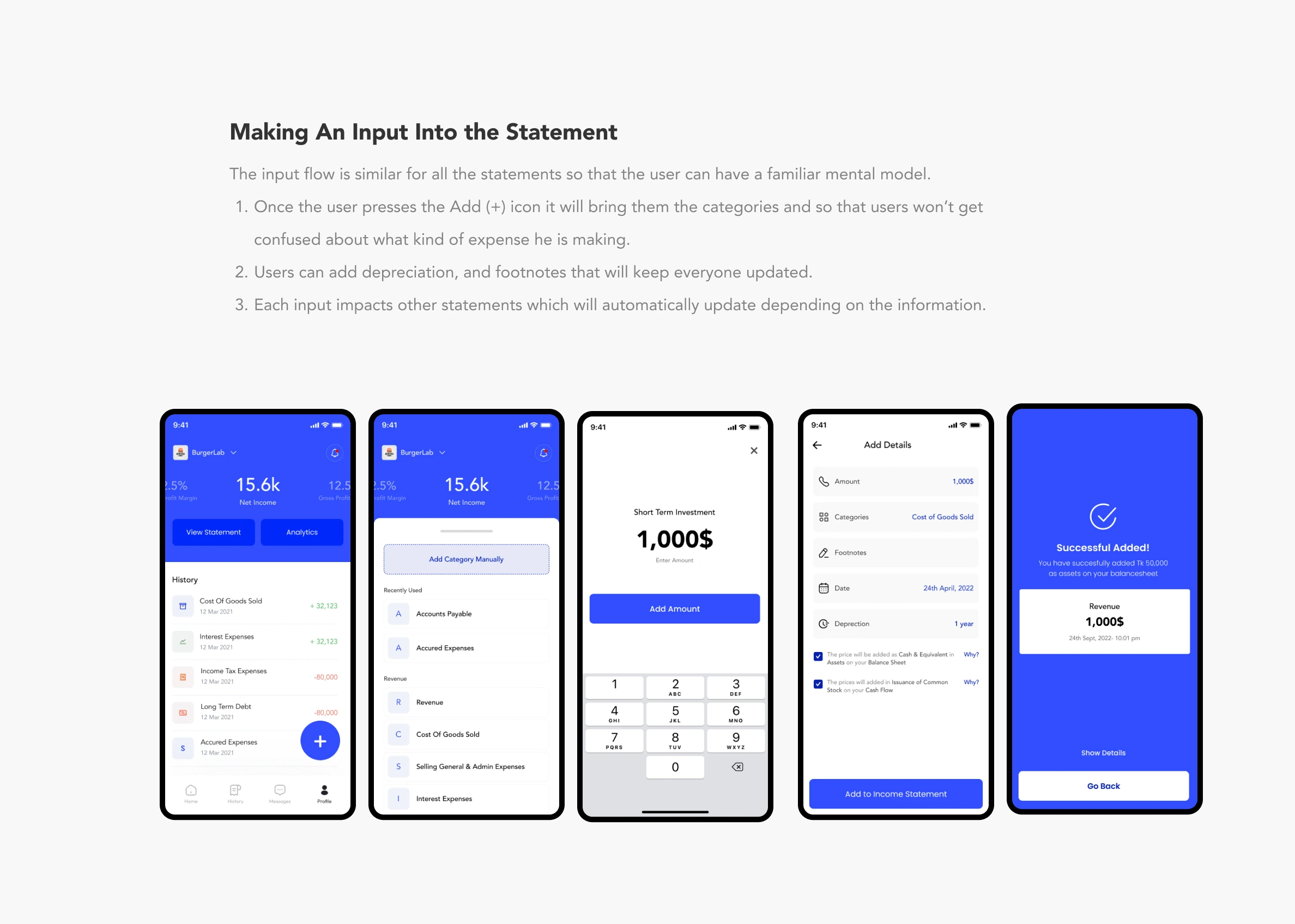

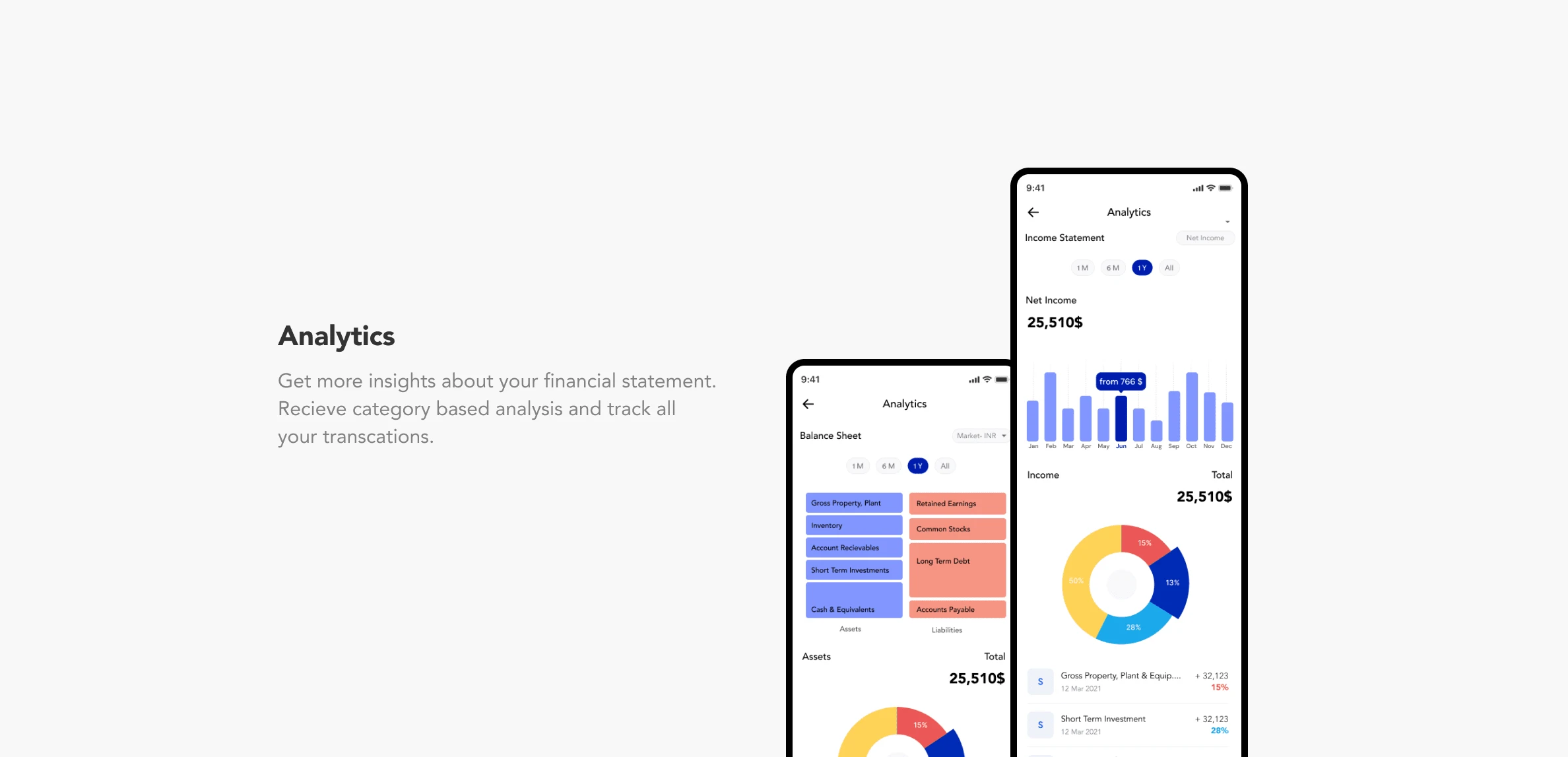

FinInt is a mobile app that helps users to maintain their financial statements more effectively focusing on business growth. It helps the user to track their daily financial activities and provides insights on Income statements, Balance Sheets, and Cash Flow.

Problem Statement

Finance is the engine of any business. Maintaining financial statements is essential since they provide information about a company’s revenue, expenses, profitability, and debt. But a large number of small businesses face problems with maintaining their financial statement due to complexity, time, and effort. Often unable to project the growth of the business and resulting in a loss.

Goals

The goal is to design an app focusing on solving the three major types of financial statements which are Income Statements, Balance Sheet, and Cash Flow. Also, the focus is also to build financial literacy among the users so they can have a better understanding of the financial status of their business.

Allow stakeholders to search, filter, and sort data

Financial statements include lots of data. Users just can see a spreadsheet. My first priority is to simplify the data so that users can search and filter the data to see the depth of each financial activity.

Bring transparency to the stakeholders

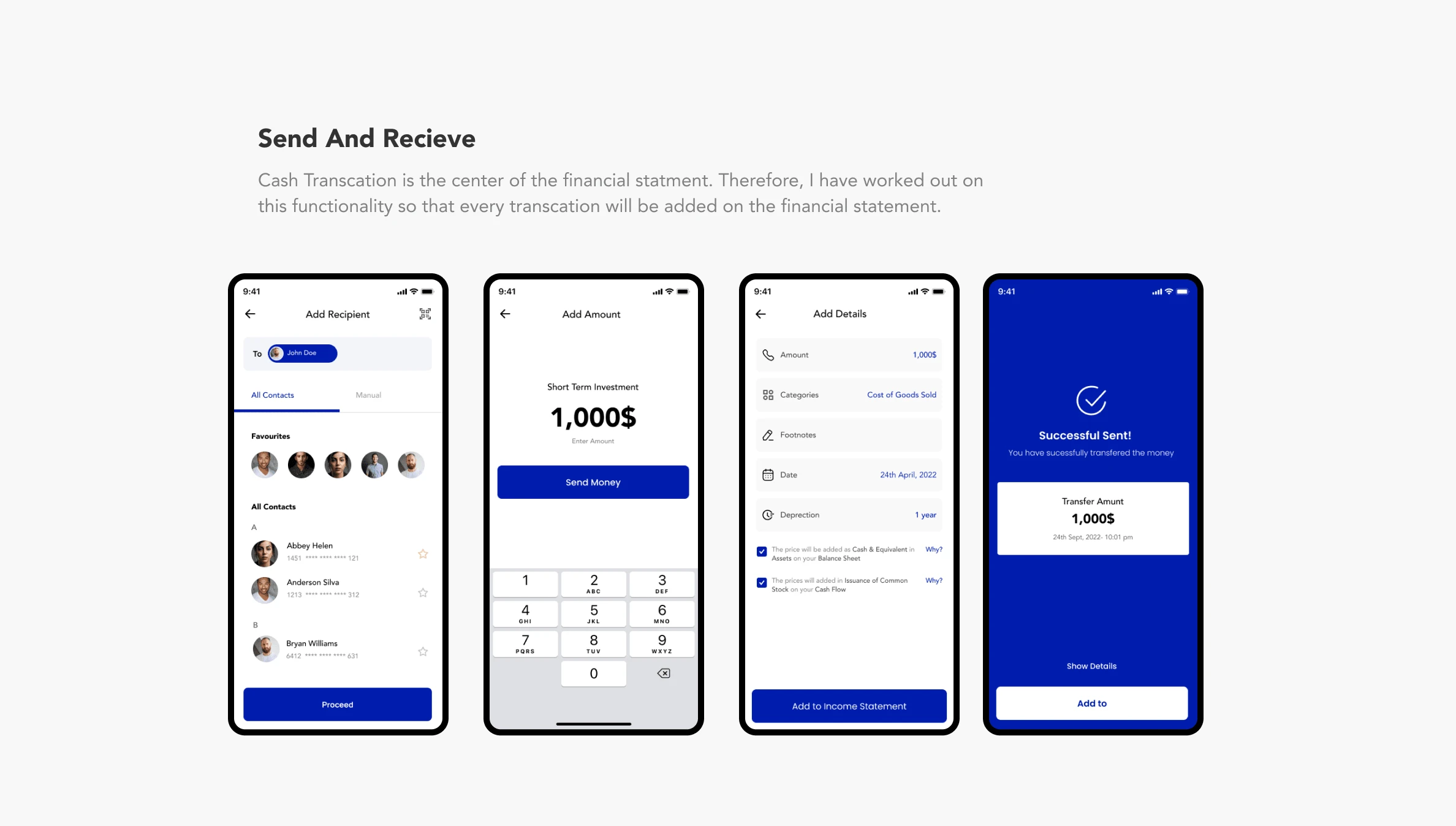

Bringing transparency among stakeholders helps drive significant progress, both on an individual and a company-wide level. It keeps everyone notified about the cash flow.

Provide an understanding of how the financial statement works

There are tons of financial terms that users are not familiar with and how it reflects the business. The goal is to educate the users about those terms as well.

Help users make better financial decisions

Introducing insights into financial activities as well as showing analytics so that users can take better financial decisions depending on the decisions.

Challenges

Data Reliability

Unreliable data is one of the most common hurdles companies face. Inaccuracies can be due to the use of multiple disparate sources. So bringing solutions to bring reliability to those data is crucial.

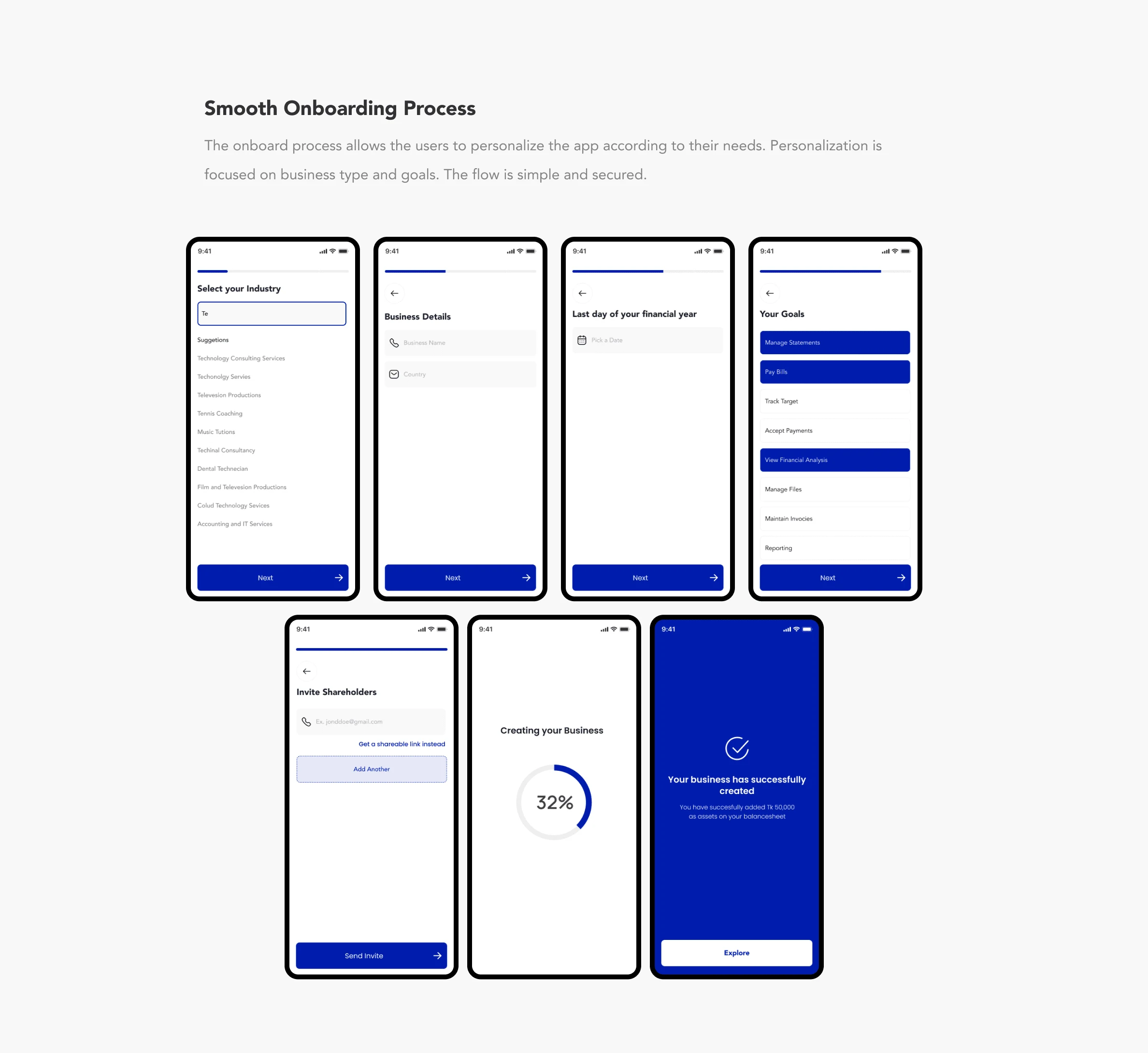

Personalized according to the needs

Different business has their own way to manage finance. So it’s important to design the app so they can customize the app according to their need.

Importing Previous Data

Users may sign up at any state of the business. So it’s essential to import the previous transactions from their bank to the platform.

Secondary Research

Before simplifying the problem, it’s important for me to know how financial statements work. So I started with secondary research by reading the book called Financial Intelligence – A Manager’s Guide to Knowing What the Numbers Really Mean. By reading the books, I have understood the financial terms, how different financial statement works, and the connection between them. Learning what the numbers reflect so that businesses can take better decisions. It helped me a lot to design the app. I have also read plenty of blogs, and book summaries to understand the impact of finance on a business.

Interview & questionnaire

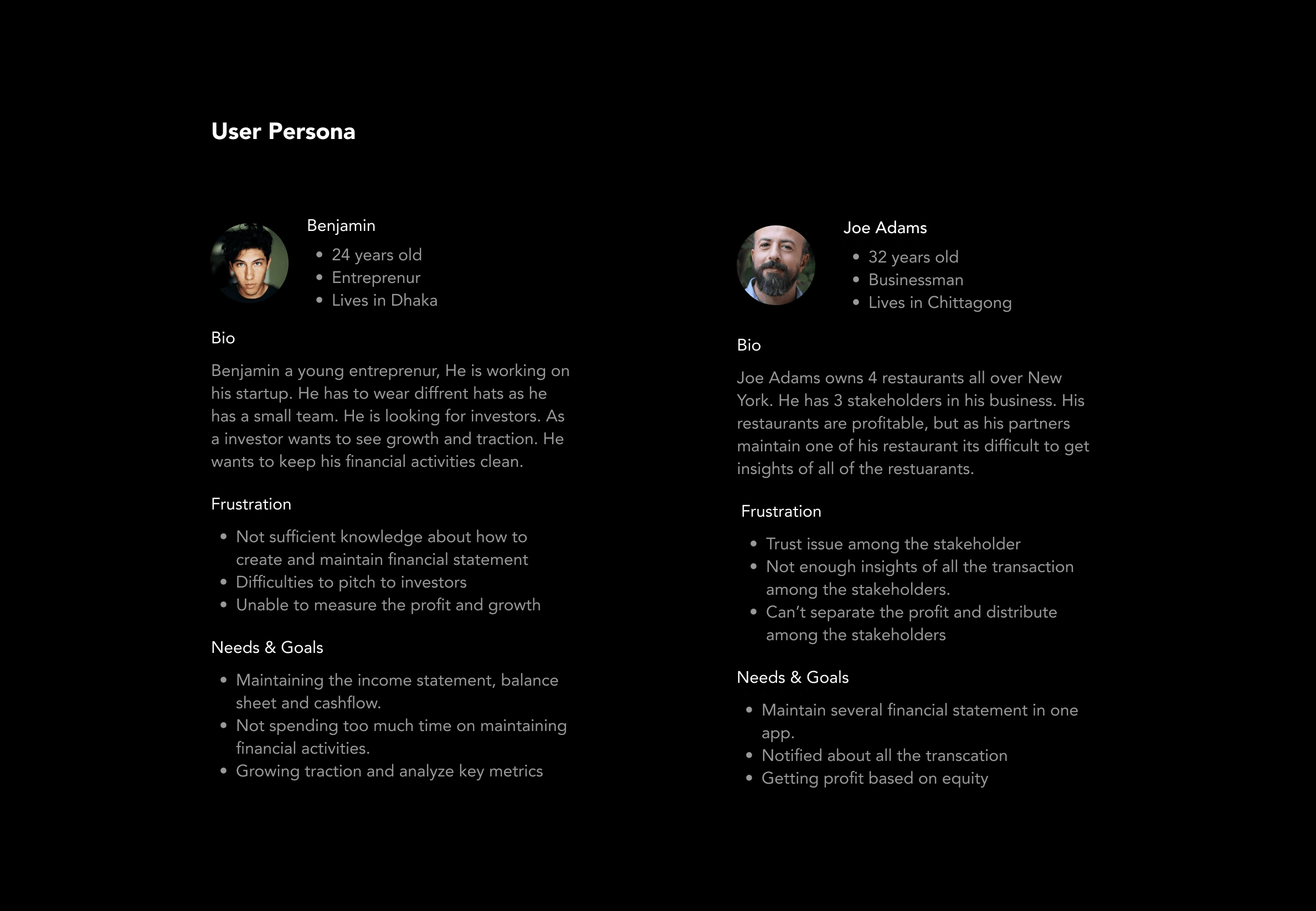

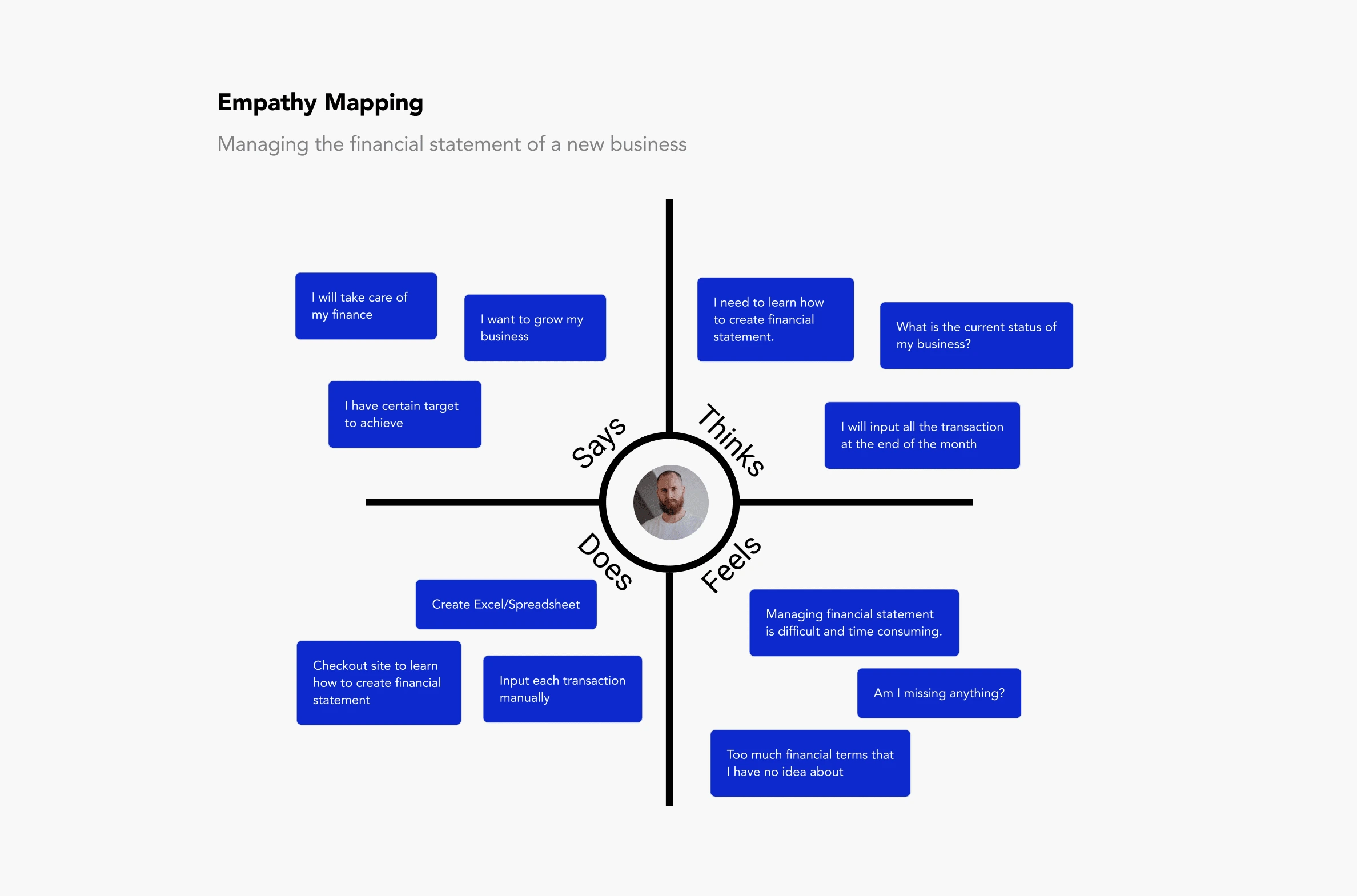

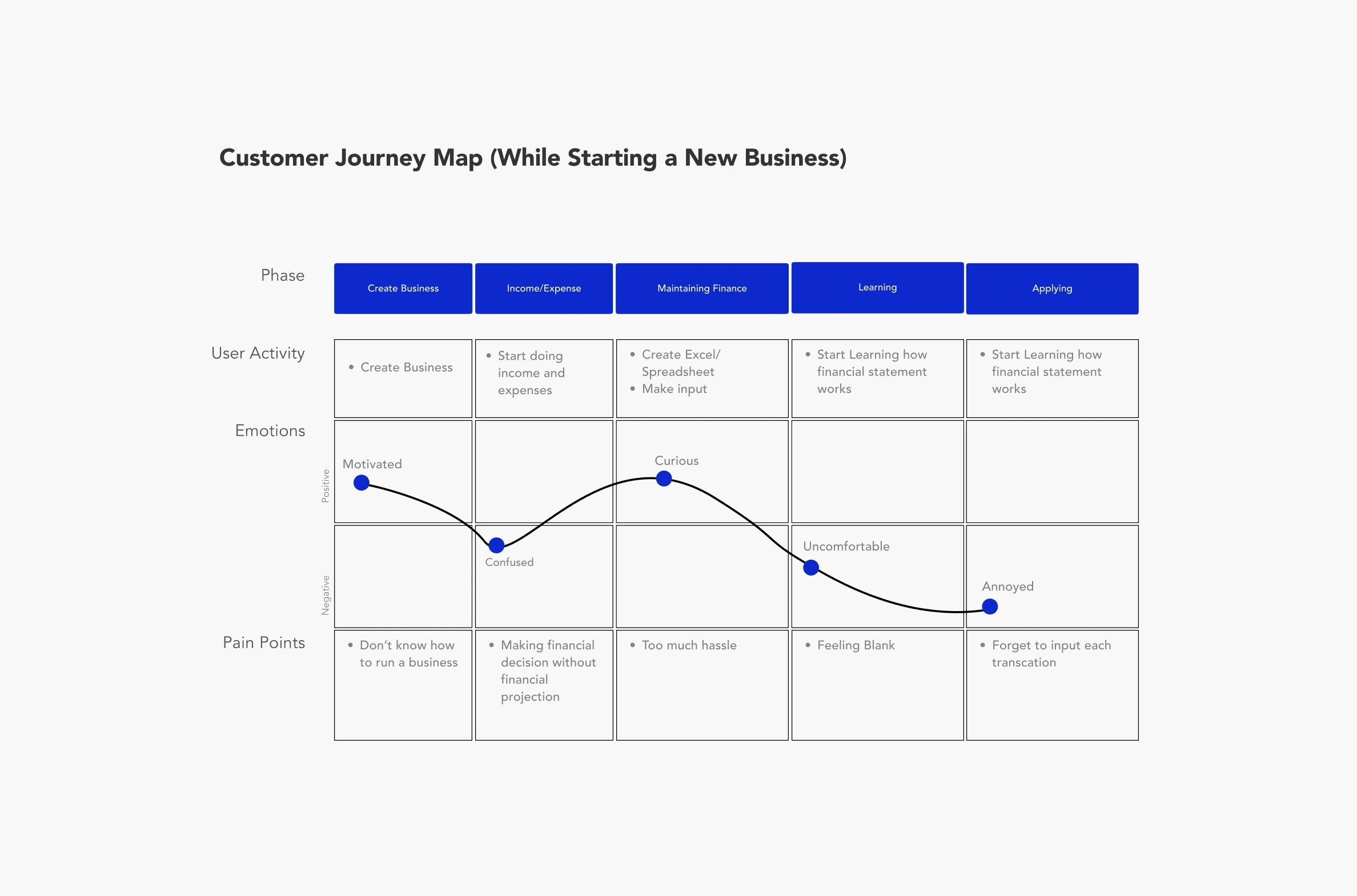

After doing the research, I interviewed 10 entrepreneurs from different industries and asked questions related to their financial management. 80% of participants have experienced difficulties to manage financial statement, and over half of them believes it is impacting their business by not maintaining the financial statement properly. When asked about creating a financial statement, 90% of participants expressed concerns about their literacy about financial statements, as most of them don’t know how to create a financial statement. The interview was conducted face to face. As I have so many groceries in my neighborhood, I started talking with them about their daily life. It was like a friendly conversation to understand how a day in life goes like working as a seller.

Problems for Users

Limited Financial knowledge

7 users aren’t familiar with financial literacy.

Bad Financial Habits and Patterns

5 users manage their finance in their own way and believe that is not bringing positive output in the long run.

Too much hassle to maintain an excel/spreadsheet

All of the users believe it’s too much hassle to maintain a spreadsheet to maintain financial statements.

Problems for Business

Decrease in Trust

Without trust, transactions cannot occur, and influence is destroyed. Trust and relationships, much more than money, are the currency of business. All of the users believe financial activities should be transparent.

Unable to measure the impact

7 users can project the financial goals of the business, but break them down into small milestones.

Fail to pitch to Investors

Financial statements are important to investors because they can provide enormous information about a company’s revenue, expenses, profitability, debt load, and ability to meet its short-term and long-term financial obligations. All the users were asked by the investors to show them the balance sheets.

Limited Insights

8 users are unable to say what is the current financial status of their business rather than saying it’s in profit or loss.

Reflection

Consideration

The financial statement is based on numbers. And users can’t always just trust the numbers. Users need to spot the assumptions, estimates, and biases based on those numbers.

Possibilities

With Blockchain it’s possible to make this app more transparent, and less susceptible. Blockchain focuses on reducing the risk of financial institutions and providing secure, encrypted data that are safe and unaltered.

Challenges and Takeaways

The different business manages their financial statement in a way. Every business has its own principal to manage the financial statement and users like to customize the financial statement according to their needs.

Next Steps

Personalization is important. Different users have different needs. The goal is to allow the users to use the app according to their needs.

Like this project

Posted Dec 4, 2022

Managing financial statements is always a nightmare for me. So I gave it a shot to reduce the complexity of maintaining it. See how it turned out.