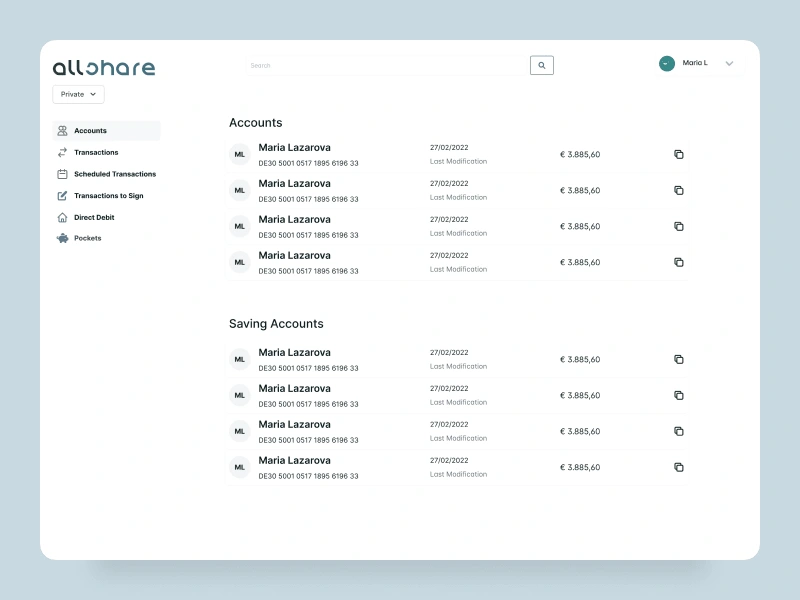

Private Banking Experience

Briefing

This case study highlights the journey of transforming a complex private banking experience into a simplified and user-friendly digital platform. Leveraging Figma's design collaboration tools, the project aimed to create an intuitive and streamlined banking experience. The case study follows the three main phases: Discovery/Research, Ideation, and Design Sprints, leading to the final outcome.

The Process

Discovery/Research Phase:The project started with a comprehensive discovery phase to understand the challenges faced by private banking clients and identify pain points in the existing banking process. Through user interviews, client observations, and industry analysis, key insights were gathered:

Complexity and Overwhelm: Clients found the private banking process overwhelming due to complicated financial terms, excessive paperwork, and confusing navigation within the banking system.

Lack of Personalization: The existing banking experience lacked personalization, making it difficult for clients to access relevant information and services tailored to their needs.

Inefficient Communication Channels: Clients faced issues with limited and fragmented communication channels, leading to delays and confusion.

Ideation Phase:Using Figma's collaboration features, the design team engaged in collaborative brainstorming sessions to generate innovative solutions for the identified pain points. Initial design concepts were sketched, and the team narrowed down the options that aligned with user needs and project goals.

Design Sprints:The project progressed through iterative design sprints to refine and validate the chosen concepts. Each sprint focused on specific aspects of the private banking experience, such as onboarding, account management, investments, and communication. Figma's prototyping features facilitated the creation of low-fidelity wireframes and high-fidelity mockups, which were tested with representative users for feedback.

The Results

The project culminated in a simplified and user-friendly private banking experience that catered to the needs of clients. The digital platform offered seamless onboarding, personalized financial insights, intuitive navigation, and efficient communication channels. Clients could easily access relevant information, make informed investment decisions, and communicate with their relationship managers within a secure and intuitive environment.

Like this project

Posted May 30, 2023

This case study highlights the journey of transforming a complex private banking experience into a simplified and user-friendly digital platform.

Likes

0

Views

17