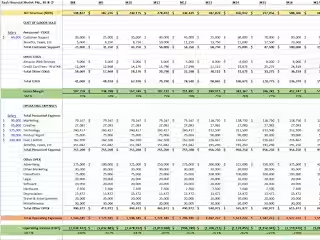

Financial model for Marketplace (athleisure) startup

Problem:

This influencer marketing-driven marketplace (athleisure) didn't have a steady cash-flow and any idea of what revenues would look like because ad-placement sales were infrequent and the amount of money influencers made was inconsistent. With plans to scale, this platform needed the right financial projections to understand how much funding was required for building a sales team and improving the software.

However, partial visibility into metrics such as gross margin, ad placement purchase rates, and influencer take-rate made communicating the value of this platform pitted against direct-to-publisher ad purchasing a rather hard sell to potential investors. The ambiguity here could dampen investor confidence in the scalability of the business.

Action:

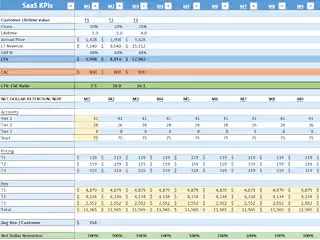

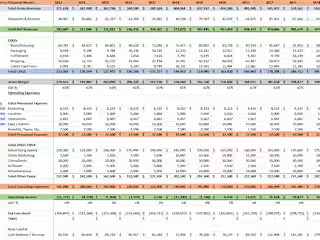

The financial model outlined the cash-flow requirements for the onboarding of influencers, different scenarios of revenue, and pointed out some of the important metrics in the industry: GM, TAKE RATE, and cost of influencer acquisition (CPA). Transparent financial projections demonstrated an attractive growth curve to help the team make better decisions regarding the size of the seed round and priorities.

Result:

With the financial model in hand, the company raised a $500k+ seed round, allowing them to grow their sales team for onboarding influencers and building the capability of the platform. Ad placement purchases reached 55% of inventory, with a 20% month-over-month increase in GMV to $100,000.

Like this project

Posted Oct 27, 2024

Seed round raised: $500k+ | Conversion per Sales Headcount increased | Ad placement purchase reached 55% of inventory | 20% MoM increase in GMV to $100k