My Misadventures in Day Trading Pump and Dump Stocks – Part 1

Pump and dump stocks are perhaps the most volatile and risky trades that any investor or trader could implement. However, one can learn a great deal by observing how market volatility with these stocks occurs, especially if institutional investors or groups of investors are manipulating them with an abundance of capital and leverage power. But what are pump and dump stocks and why are they so dangerous, tempting, and controversial? First of all, trade volume is the key to determining the volatility of stock prices and the amount of shares being circulated to the public either for those going long or short with a stock. It’s basic supply and demand concepts that are taught in an Econ 101 course. Market prices in theory should evolve naturally and based on supply and demand patterns, however, this isn’t always the case. Stocks with low market shares and trade volumes are highly susceptible to these trading schemes.

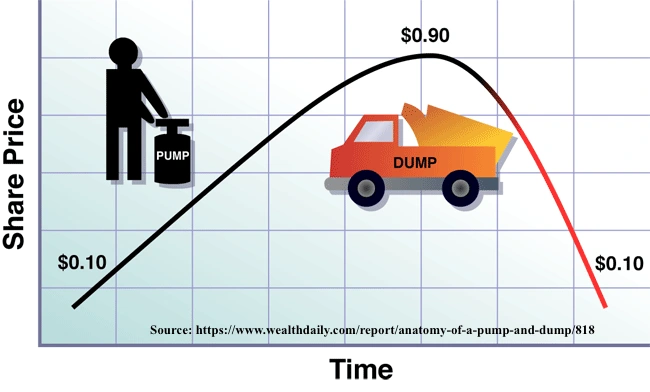

Pumping and dumping stocks is a form of securities fraud, however they are not always easy to prove both during and after it has occurred. Investopedia defines pump and dump schemes as “attempting to boost the price of a stock through recommendations based on false, misleading or greatly exaggerated statements. The perpetrators of this scheme, who already have an established position in the company’s stock, sell their positions after the hype has led to a higher share price. The practice is illegal based on securities law and can lead to heavy fines” for the parties instigating the scheme. Hype is the key factor in this scheme as speculators looking for a short-term fix are not really interested in looking at the fundamentals and inner-workings of a business as a whole.

This is why the mindsets and philosophies of traders and investors are very different as they take differing approaches to managing the risks associated with their trades and investments. Whether a trader is a day trader, swing trader, or momentum trader, their focus is to look at market, industry, and volume trends to search for patterns and indicators. Investors on the other hand treat their investments as if they are buying a business in the long or short term. They don’t focus on stock trading trends, unless they know the history of a stock/company and buy it at a temporary discounted price from a rare price dip, which is something Warren Buffet loves to do. Investors mainly look at the financial indicators such as cash flow, debt, profits, and overall value of the company to determine if it’s undervalued, overvalued, or fairly valued in terms of stock pricing.

These are truly the main differences between speculative traders and investors. Going back to pump and dump schemes, the former would be tempted in trading stocks associated with these practices due to the potential high payout. Usually the stocks susceptible to these practices are mainly ones where institutional investors like banks and hedge funds are non-existent as they tend to prefer more stable action that enables them to build their positions over time. This means the retail investors, also known as individual investors are the ones making trades and investments in these low capital companies that begin as cheaply priced stocks. They could be penny stocks or low priced stocks that are $1-$10 per share or more. It is important to note that retail investors/traders really don’t determine the volatility and volume of stock movement. The institutional investors and investing groups with high capital and leveraging power are usually the main culprits that drive stock trends for smaller less stable stocks and even the stable high end blue chip stocks.

So individual investors that get lured into pump and dump schemes can make a lot of money but they can lose a lot of it instantly. This is purely based on hype and volatility. If one recognizes this in advance, they can either choose to not get involved or go heads up knowing the risks in advance. Pump and dump doesn’t need to happen only once with a stock. In fact it can occur numerous times throughout a trading day, and for several weeks at a time. However, it will unexpectedly end at some point once the price manipulator decides to end the scheme. My observation has shown in the few examples (DRYS, VERI, and WINS) I covered in great depth is that the stock movement and volatility tends to significantly die out and remain flat for long periods of time. This clearly indicates that the stock was over-hyped and lacked the overall perceived value that individual investors/traders were led to believe.

But someone made money and it is usually the people that get in on the trades early on rather than later. This is something people should realize in advance for all types of trades and investments as any analysis or update that is processed into the 24/7 media, is mostly rendered useless to an extent since every Tom, Dick, and Harry will try to take advantage of it. This is why speculation can be very dangerous for the individual investor that failed to do the necessary due diligence prior to trading a highly volatile stock, or any other stock for that matter.

One of the reasons why I used the Investopedia stock-trading simulation was to get better acclimated with stock patterns and indicators to understand how pump and dump schemes were used in controversial trendy stocks at the time. In reality, I would be more hesitant in touching these stocks in a real portfolio, despite the potentially huge payout. Perhaps a small insignificant investment but frankly, there are far better investments that are the real deal, and these type of stocks require constant monitoring. In the simulation I often found myself preferring to trade these stocks and holding them for very short periods of time (less than one day and a few hours) due to the constant fluctuation. However, being proactive in the simulation enabled me to pay more attention to volume and price patterns more closely than before. This is crucial because these stocks have a nasty habit of having the SEC either temporarily halt the trading or even de-list them due to suspicious behavior and violation of compliance requirements.

Overall, this is something that ordinary people looking to trade and invest in cheap and highly volatile stocks need to be made aware, especially since they tend to create a lottery effect for those seeking that one big payout which is unrealistic most of the time. In other words, the novice trader and investor should not get into these types of investments very willingly. There are far better stocks and derivatives that can still be worth your while as well as being less risky and susceptible to pump and dump schemes. [End of Part 1]

Subscribe To My Blog!

Like this project

Posted Aug 22, 2024

Blog article discussing and informing about the uses of day trading pump and dump stock schemes.

Likes

0

Views

9