Driving over $2M in revenue in digital payments for merchants -

Integrating digital currencies (crypto) into daily business operations, isn't as easy as it sounds. It's a struggle many companies face, trying to adapt to these new innovations and avoid being left behind.

I designed Tender Cash platform to solve this problem and have helped business generate over $2M in revenue seamlessly since launch.

In today's fast-paced financial world, cryptocurrency has emerged as a game-changer. Many businesses are eager to jump on board with these new technologies, especially when it comes to accepting payments. The numbers speak volumes: the cryptocurrency market has grown into a multi-trillion-dollar industry.

Although online payments have taken payments for services further, A lot of physical stores business still use the POS to process payment. Which begs the question:

"How can we support businesses that wants to adopt digital payments, promote innovation and customer service without unnecessary hassle? "

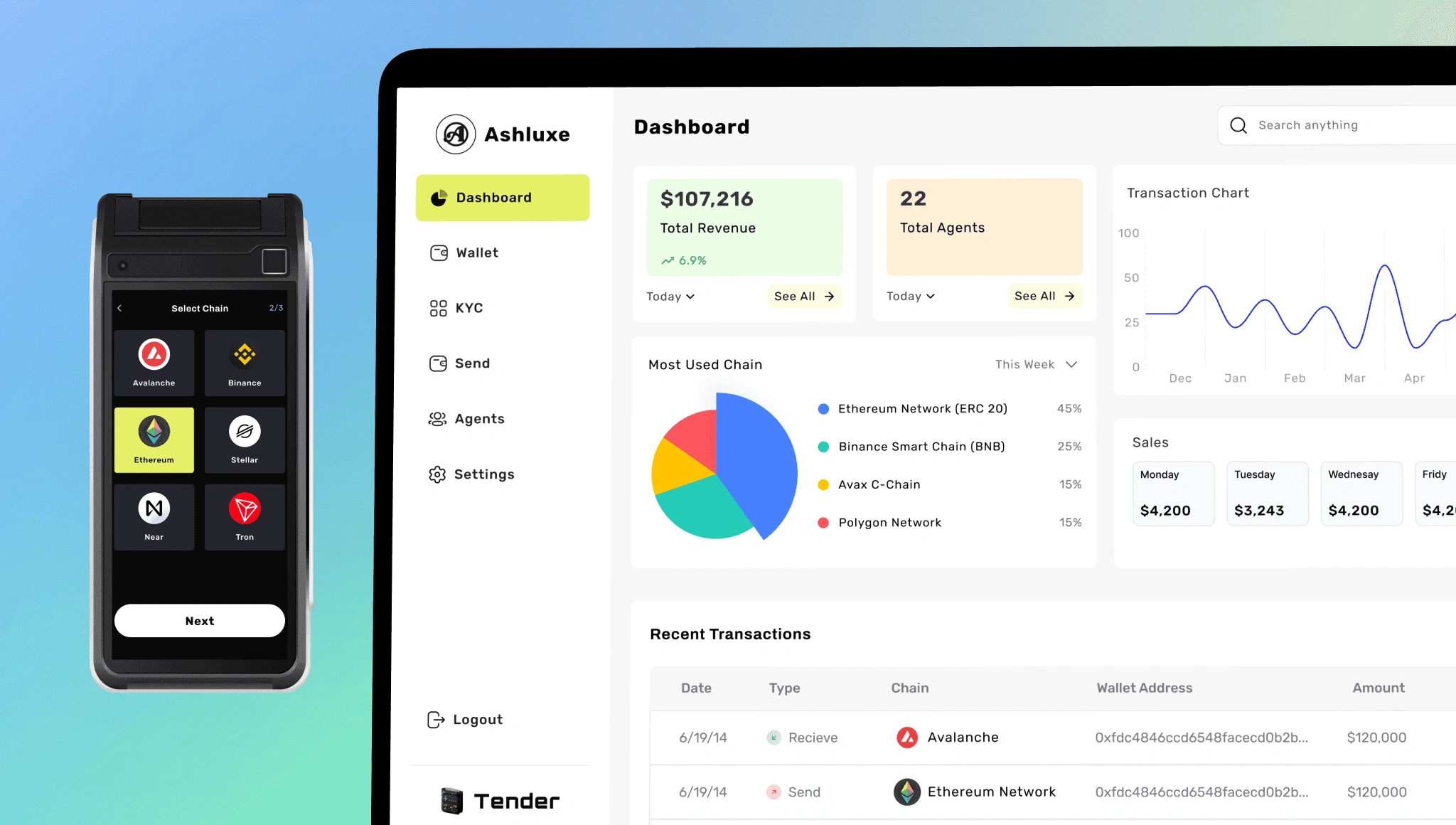

Goal: Design a POS interface that allows business merchants accept payments in digital currency

Having had experience in the Fintech industry, I took a streamlined approach to create a user-friendly crypto payment solution for merchants. Leveraging my deep knowledge of cryptocurrencies, I crafted an intuitive flow for the POS interface

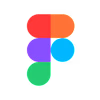

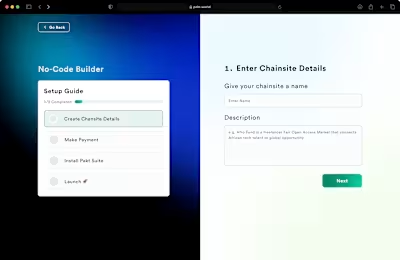

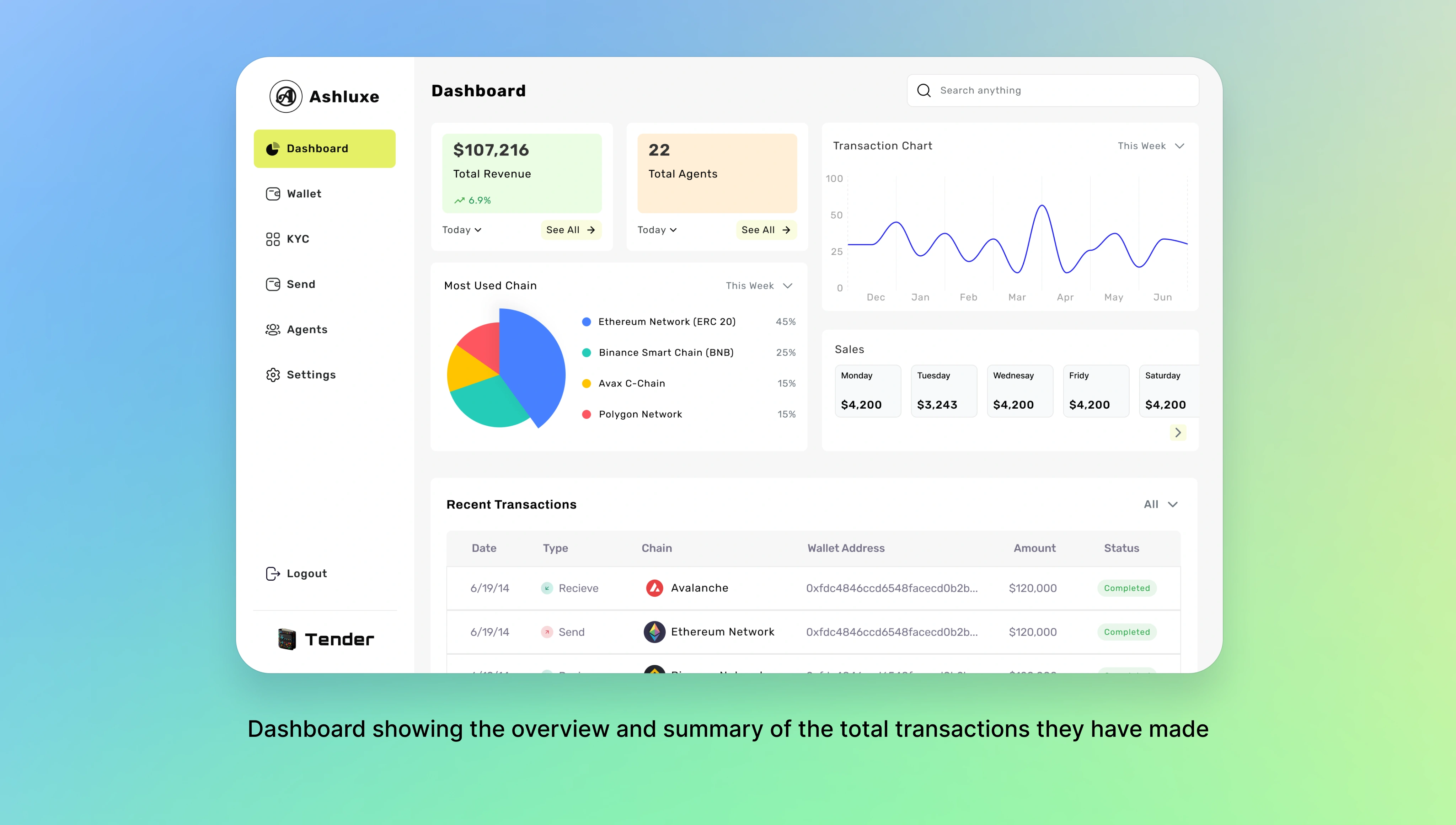

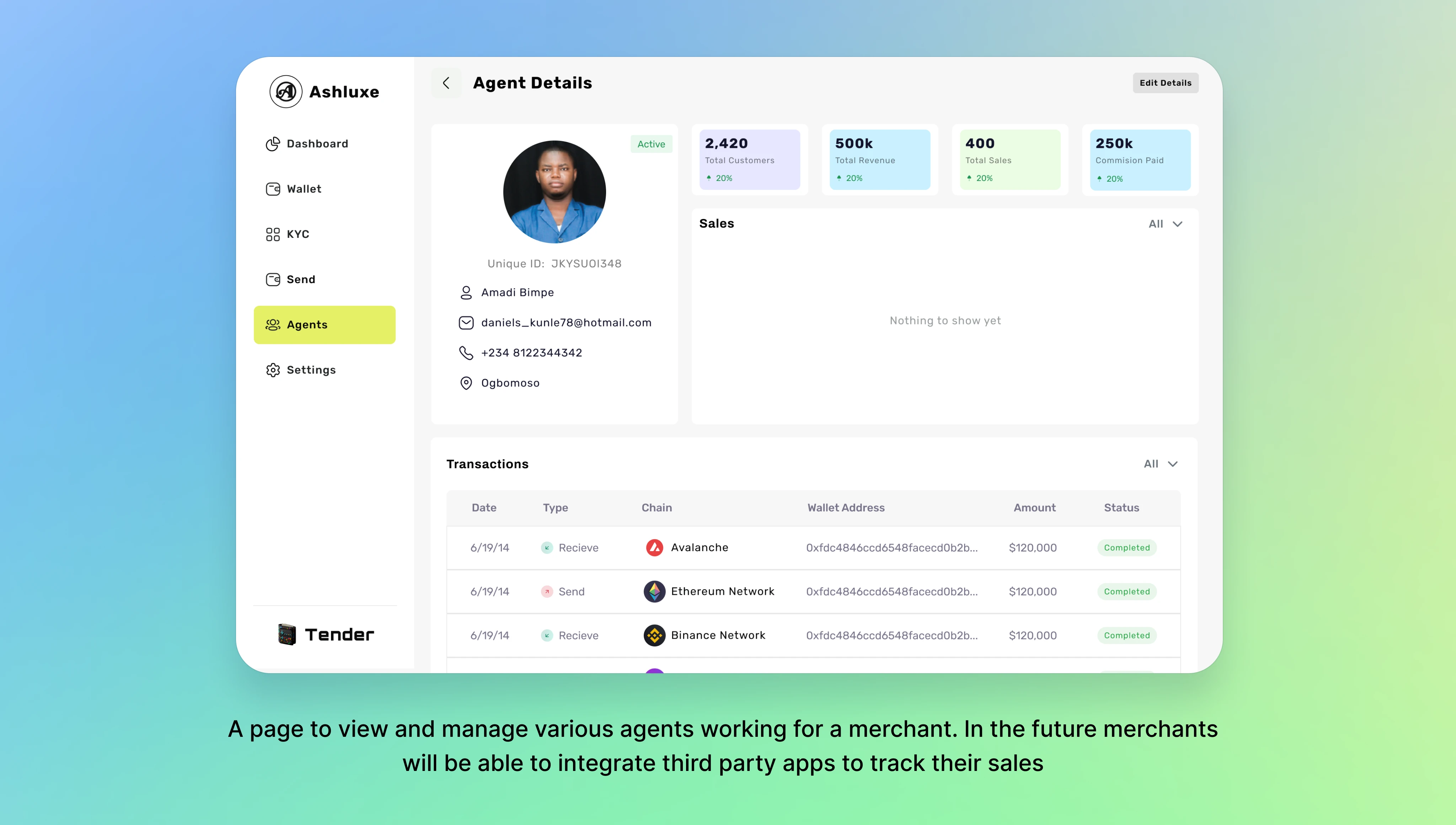

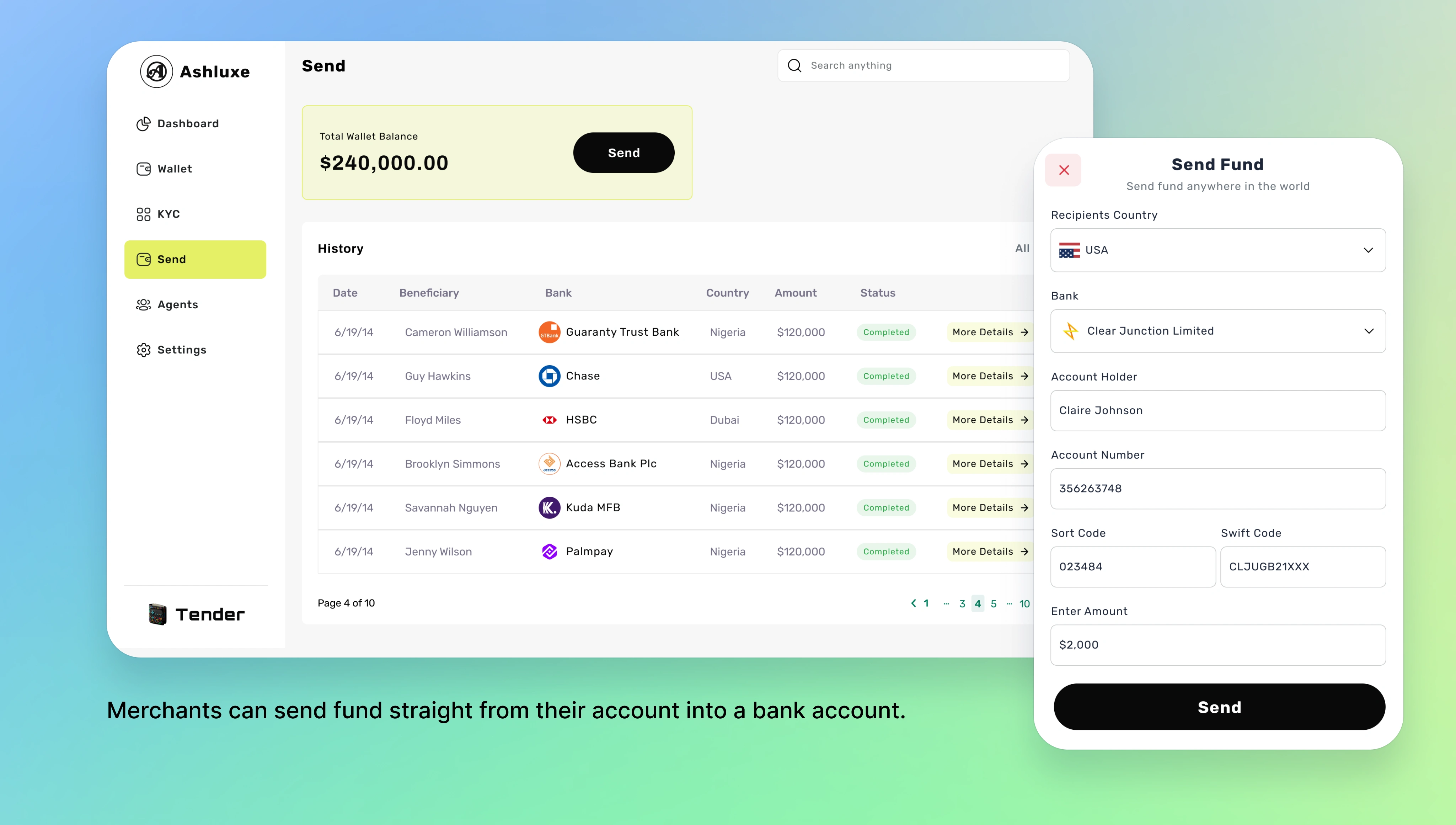

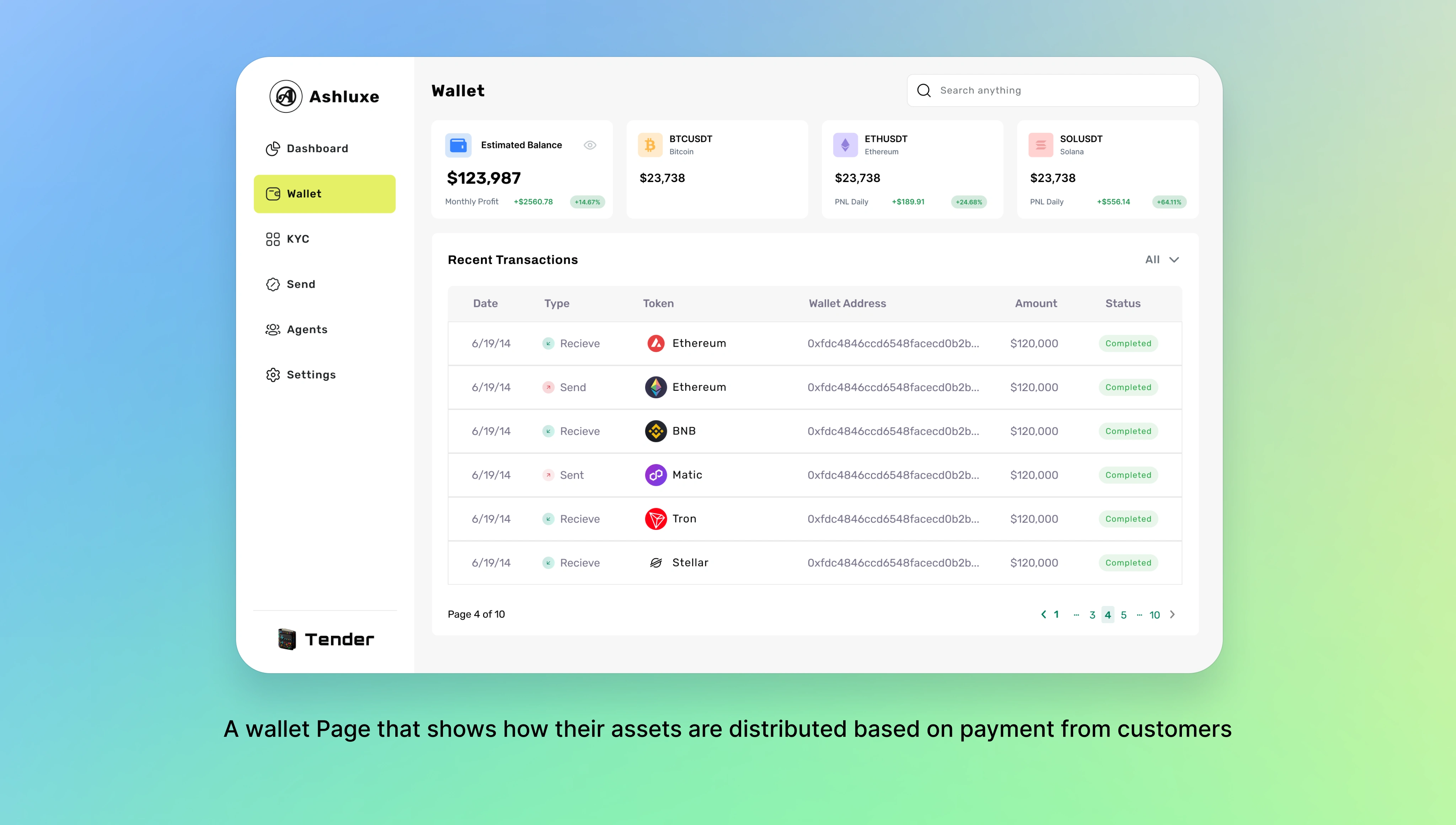

Now that users can make payment and merchants can accept payment with crypto, merchants will need to manage these transactions. I moved to designing a web platform for this. Below are some major screenshot from the application

Goal: Design a web interface for merchants to manage their day to day payment transactions

Below are some major screenshot from the application

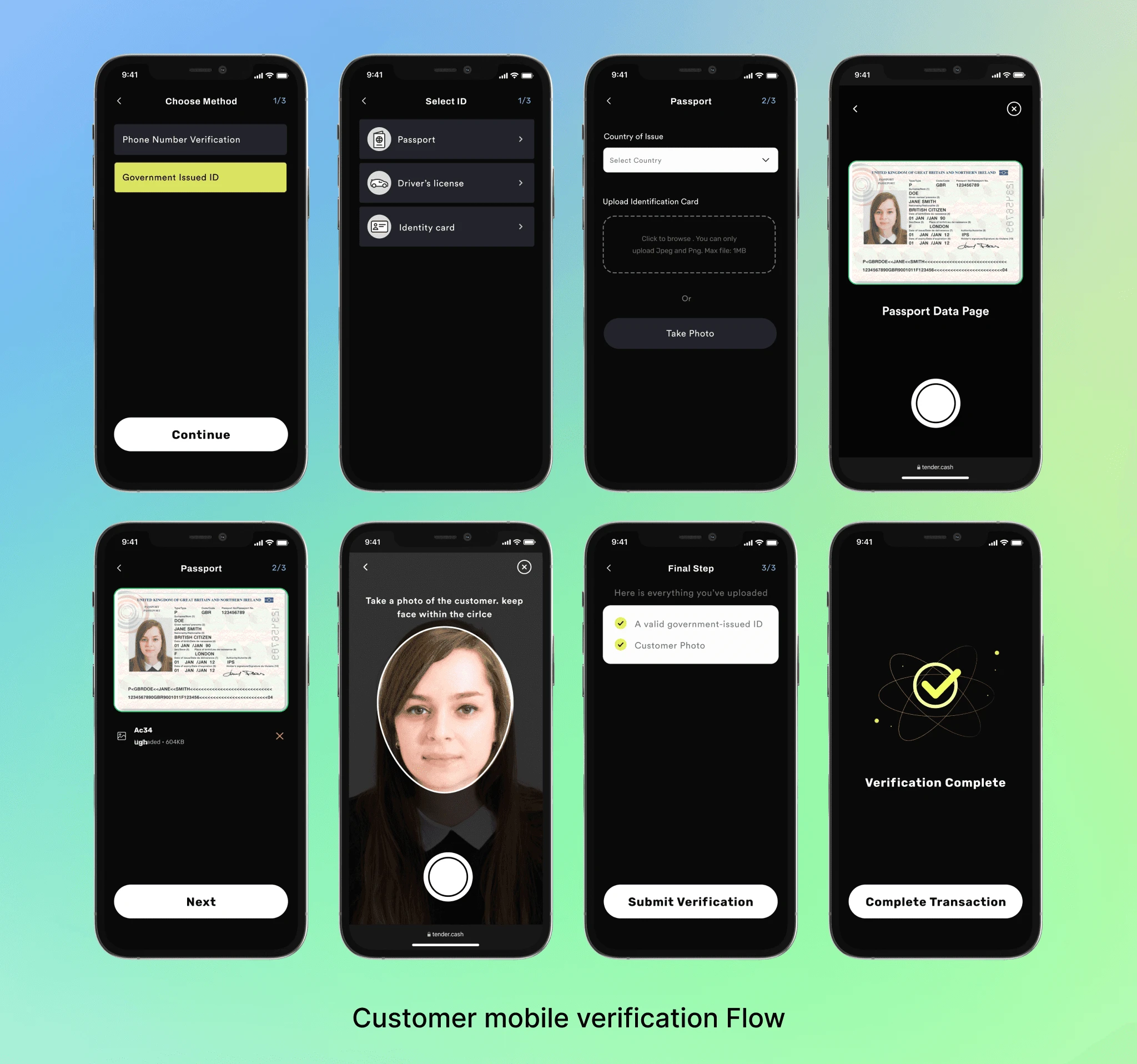

After rolling out for Beta, we noticed a loophole we missed earlier in building the platform; especially the POS system. Merchants needed a way to verify customers when they want to carry out transaction.

Seeing that most POS has limited feature, we had to device a flow that would make customer doing KYC on the spot seamless. How did we solve this?

Goal: Design a flow for users to verify their Identity.

Since a lot of crypto adopters are familiar with how KYC works, all I had to do was find a way for merchants to be able to verify their customers on the sport. Ideally this is what the flow looks like:

Drafting out this flow helped me figure out how to approach the KYC situation. Knowing that in most cases it is quite difficult for a POS machine to carry out a the KYC process, It made sense to trigger the KYC request from the POS while the customer completes the process via their mobile device which is much more feasible, seamless and Intuitve.

The user gets a verification link sent to their phone number given the method chosen to verify their Identity (Government Issued ID)

In retrospect

Merchants that use tender, have being able to save a total of over 4% spent on card chargebacks and declined transactions because with digital currencies, there is no chargeback or declined transactions.

Moreso, some business report that the need for sales agents to calculate conversion rates in local currencies has been eliminated, making payments seamless foe them.

Like this project

Posted Feb 15, 2024

Designing a Web3 payment solutions that have helped merchants generate over $2M in revenue in digital currency transactions.