The Walt Disney Company: Business Environmental Analysis

Executive Summary

The Walt Disney Company is a world renowned company, whose aim is to spark magic through the use of imagination and creativity. Within 98 years, the company landed itself a spot in five different industries: media networks, parks and resorts, studio entertainment, consumer products, and interactive. The company’s products and services are internationally established in over 160 countries and has theme parks in four countries.

Overview

In this report, I have addressed and analyzed issues that the company faces by giving a SWOT, PESTELE, and Porter’s Five Forces Model analysis. Each analysis gives insight on the company’s internal and external factors that contribute to the success and/or failure of the Walt Disney Company’s brand. These analyses include information pulled from different, credible research sources, as well as recommendations on how the company may be able to solve their issues. The issues addressed are in conjunction with the PESTELE model, which allows me to understand what external factors contribute to the companies politically, environmentally, sociologically, technologically, ethically, legally, and economically.

Problem

I decided to research if the Walt Disney Company would have a successful expansion into Dubai, United Arab Emirates. I was able to create another PESTELE analysis for the issues the company might face while expanding its theme parks into a new country. Although there are many opportunities for the company to expand, there are also threats that the company simply cannot ignore. Through my research, I was able to provide a recommendation, as well as conclude whether the Walt Disney Company should execute this new business venture.

Company Introduction

The Walt Disney Company is headquartered at 500 S Buena Vista St, Burbank, CA 91521. The company’s mission is “to entertain, inform and inspire people around the globe through the power of unparalleled storytelling, reflecting the iconic brands, creative minds and innovative technologies that make ours the world’s premier entertainment company” (The Walt Disney Company, n.d.). The Walt Disney Company has products and services that are quite diversified and operates through the following segments: media networks, parks, experiences and products, studio entertainment, and direct-to-consumer and international business. Walt Disney media networks segment includes cable and broadcast television networks, television production and distribution, like ESPN and Disney Channels (“MarketLine Company Profile,” 2021).

Furthermore, Walt Disney’s parks, experiences, and products segment include the Walt Disney Resort and Disneyland in Florida, California, Hawaii, Paris, Shanghai, Japan, and Hong Kong. In addition, the Walt Disney Company manages and owns 81% of the Disneyland in Paris, 47% in Hong Kong Disneyland Resort, and 43% of Shanghai Disney Resort. The segment also provides licenses under the company’s trade names and characters to various manufacturers, game developers primarily for mobile platforms, publishers of comic books, and retailers around the world (“MarketLine Company Profile,” 2021). The wide range of products and services boosted revenues by $69.388 billion during the year 2020. This is a representation of how loyal their customers are because they seem to support any product or service Disney offers. The company’s diversified strategy allows them to spread their business risks. This diversification allows for cross selling opportunities for the Walt Disney Company, enabling them to maximize their revenue per customer (“MarketLine Company Profile,” 2021).

The studio entertainment business segment produces animated motion pictures, live-stage plays, musical recordings, and video contents. It then publishes those full length animated films to the public and distributes them under Walt Disney Pictures, Pixar, and Marvel banners. In the television industry, Walt Disney has licensed titles for Video-on-Demand, pay television, free television, and international television service providers (“MarketLine Company Profile,” 2021). Their license allows them to do electronic delivery to customers for a specified rental period and allows for films to publish outside the USA. Finally, Walt Disney’s direct-to-consumer and international segment focuses on producing local programs and operating 100 Disney branded television channels outside the US. These channels broadcast in 35 different languages in 165 countries (“MarketLine Company Profile,” 2021).

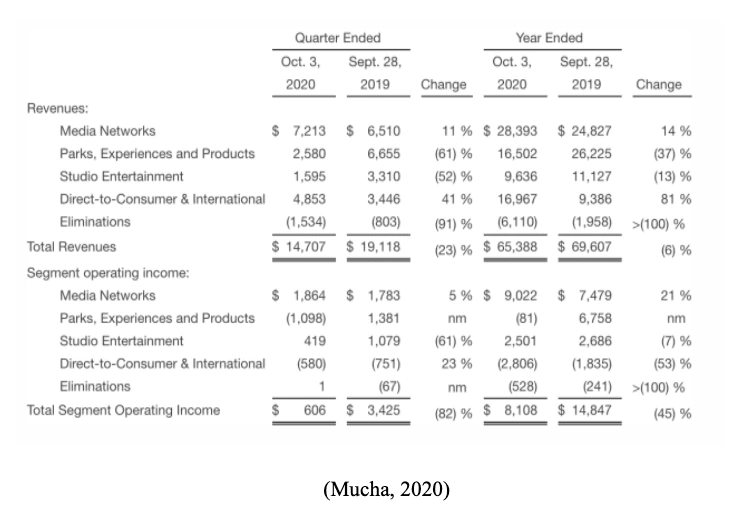

The Walt Disney Company gets most of its revenue from the media networks segment. The media network segment accounts for 43.4% of the company’s total revenue. In the financial statements for the year 2020, it was reported that media networks had revenues of $28,393 million (“MarketLine Company Profile,” 2021). The second highest segment is direct-to-consumer and international segment, reporting revenues of $16,967 million and accounting for 26% of the company’s total revenue. Parks, experiences, and products segment accounts for 25.2% of the company’s total revenue and revenue was reported to be $16,502 million in 2020. The studio entertainment segment has shown revenues of $9,636 million in 2020 as shown in the figure below and accounts for 14.7% of the company’s total revenue (“MarketLine Company Profile,” 2021). The Walt Disney Company has operations classified in three regions: America, Europe, and Asia Pacific. In the financial statements of the 2020 fiscal year, America was shown to have 79.5% of the company’s revenue, Europe accounts for 11.2%, and Asia Pacific accounts for 9.3% of the company’s revenue (“MarketLine Company Profile,” 2021).

The Walt Disney Company’s critical value-creating activities are its theme parks. The marketing is so well done to capture its audience for life. The feeling that individuals experience when they’re at the park, is that it is the “happiest place on earth.” This is a strong marketing tactic that has been so well developed to make its customers feel this special way, so they want to keep returning. Once a guest is visiting the park, they will get hungry and thirsty which will result in them buying delicious treats from the park vendors. Then at night, they might get cold or want to bring a souvenir home by purchasing something from the gift store. These long experiences filled with joy, excitement, thrill, and character leaves a lasting impression on people that continue to uplift the brand. This creates powerful value for the company because when people watch a streaming show on Disney Plus, they are not only thinking of the show, but they think of how the show brings back the memories they had on their trip to the happiest place on earth, Disneyland.

Company Issues

There are several unethical practices that occur in the entertainment industry. The biggest one is the mistreatment of employees. There are several ways companies mistreat their employees. For example, companies provide employees with long hours for little pay, bad benefits, wrongful treatment, and expensive insurance plans. Other ethical issues are harassment, discrimination, and safety concerns (SpriggHR). These issues started before the twentieth century and continue to occur, but they are not nearly as bad as they used to be. This is because in the twentieth century unions started forming. Unions protect the rights of those in them, but many companies try to fight the forming of unions as it puts them at a disadvantage. (Encyclopedia.com).

Furthermore, according to the Columbia Climate School, “The entertainment industry generates carbon and greenhouse gases from travel, transportation, production material deliveries, onsite generators and even pyrotechnical scenes” (Harper, 2018). To elaborate, the entertainment industry is an essential sector that boosts our economy and benefits the population, however, there comes with environmental risks. The good news is that many companies are aware of this issue and are going the extra mile to help combat this. For example, companies can hire a third party contractor that specializes in carbon and life cycle analysis surrounding their production. Based on the analysis, they can take action steps to combat these high numbers. Additionally, companies can invest in working with sustainable products such as utilizing recyclable materials or using rechargeable devices instead of battery operated. On the other hand, transportation is the second largest contributor of greenhouse gases in the United States, so companies can also take measures to avoid adding to this. Specifically, CBS Entertainment introduced fuel efficient hybrid vehicles in 2011 to help lower their greenhouse gas emissions.

Additionally, amusement park attractions fall within the entertainment industry. The government has failed to pass safety laws, especially since there are still people getting injured from rides due to mechanical failures, such as when a lap bar detaches in the middle of the ride (Vujasinovic, 2017). For example, in July, 2017, one person was killed and seven people were injured in a ride accident at the Ohio State Fair. The US Consumer Product Safety Commission has no jurisdiction to investigate any incidents at fixed-site rides like in Disneyland and Six Flags and theme parks are not required to report ride malfunctions to authorities.

The commission only obtains the data from the National Electronic Injury Surveillance System to check how many people were hospitalized in emergency rooms due to a ride accident (Vujasinovic, 2017). However, no one knows how many times rides malfunction or operators make mistakes that do not result in an injury. Injuries, fatalities, and malfunctions are under-reported. Regulations are also lacking in 16 states, meaning these states do not have state-administered inspections programs for fixed-site rides and mobile rides. The American Society for Testing and Materials only provides safety standards for the development of ride designs, operations, quality control, testing, and maintenance (Vujasinovic, 2017).

Moreover, the Walt Disney Company is going to introduce a new tier to their ticket system because this decision may cause an increase in ticket prices. When buying tickets to any of Disney’s theme parks, consumers are presented with the company’s tier system, which basically displays how different days of the week may cost more than others. This allows the company to make a higher profit on days that are deemed to be more enticing to their customers, such as weekends, holidays, and specific seasons. In an article written by Katie Dowd, she states, “In 2000, a single-day ticket to Disneyland cost $41. Adjusted for inflation, that ticket would cost $62 today” (para. 3). In comparison to what a ticket from 2000 would cost today, consumers can expect to pay up to $164 for a single-day ticket starting in March of next year. This increase in ticket prices has made headlines across multiple news articles, especially since this has been their fifth increase within the past five years.

Hong Kong Disneyland is expected to increase the price of its annual pass and day pass tickets by 12%. This is because Disneyland in Hong Kong has been experiencing losses for the past six years. This is the sixth time prices are increasing since Disneyland opened in Hong Kong in 2005 (Magramo, 2021). The last time it raised prices was in April 2019, charging an extra 3% per ticket. According to the company’s latest financial year results, Disneyland managed to increase the sales of its annual passes to local visitors by 8% during the pandemic when travel was restricted and borders were closed, keeping tourists away for 20 months.

As Hong Kong’s tourism lawmaker, Yiu Si-wing, examined the economic circumstance and demand for Walt Disney theme park attractions, he determined that a price increase will not change customer’s purchasing behavior and instead customers would be more likely to renew or even upgrade their Magic access membership passes to get a better deal. In the year 2020, Hong Kong Disneyland had a net loss of HK$2.66 billion, marking Hong Kong Disneyland’s sixth year without a profit (Magramo, 2021). This is because Disneyland was only open 40% of the time in the year 2020 due to social distancing restrictions, allowing only 1.7 million local visitors from 6.5 million people that used to visit regularly before the pandemic. The team also found out that the Hong Kong government owns Hong Kong Disneyland Resort by 53%. The Walt Disney Company has the rest of the ownership as a joint-venture with Hong Kong International Theme Parks (Magramo, 2021).

SWOT Analysis

Disney is a company that has taken over the world. Everybody knows and loves Disney, but there is more to it than what meets the eye. There are definite strengths of the company, but what comes with strengths are weaknesses. Some of these weaknesses come from the many threats that the Walt Disney Company faces on a daily basis. There are also many opportunities for the company to explore in order to expand.

Strengths

For starters, the Walt Disney Company has many areas of expertise. They are more than just theme parks and movies. Disney owns many companies, such as ESPN and National Geographic (Disney SWOT Analysis, 2021). This broadens their reach to many more people than they could have reached without owning those companies. Disney makes a lot of money from several sectors that it owns. This money provides a lot of opportunities. They also started their own streaming service, Disney Plus, which really helped them during the pandemic when their theme parks were shut down. It made them a lot of money at a time when they were making significantly less than their usual, as well as losing money. Another strength of the company is that they only hire the best, most creative people to work for them (Disney SWOT Analysis, 2021). This means that the products, including new rides and attractions at the theme parks and new movies that come out, are always going to be the best work that they could possibly produce. Their system chooses only the best works, because millions of people around the world have fallen in love with Disney and are willing to spend a decent amount of money for Disney-related products and experiences. “Disney also has a very recognizable logo and name, leading to a strong brand reputation”, which is very important if they want to keep up with their competitors (Disney SWOT Analysis, 2021).

Weaknesses

A weakness of Disney is that it costs a lot of money to visit the theme parks (Shah, 2021). Many people cannot afford to go, which means that they are losing a large customer base and a lot of money along with it (Shah, 2021). Another weakness is how much money the Walt Disney Company lost when they were closed due to the pandemic (Shah, 2021). They adjusted their spending to fit the amount of money they were used to making. When they were shut down, they had to re-adjust their whole plan because they were losing so much money that they would normally be making. Disney has also had many complaints about the mistreatment of their employees in the theme parks. This is a huge problem because Disney has a reputation to uphold. It is not the happiest place on Earth if the people running it are not happy. It is Disney’s responsibility to take care of their employees. Disney has several employees that are crucial in keeping them happy.

Opportunities

Since Disney generates a lot of money, it opens many doors for the company. The Walt Disney Company has the ability to make these incredible attractions at the Disney Parks and these incredible movies that people fall in love with (Disney SWOT Analysis, 202). With every ride that comes out, the Imagineers show more of what they are capable of. They always have the opportunity to come out with new products to sell in their stores, which they take advantage of (Shah, 2021). They always have the opportunity to spread the Disney brand into countries and continents that do not already have it there (Shah, 2021).

Threats

The biggest threat to the Walt Disney Company is its competition. They are up against many other theme parks, as well as many other streaming services (Jurevicius, 2021). Another threat related to Disney’s competition is pricing. As I mentioned earlier in this paper, Disney is very expensive and not everybody can afford it. There are cheaper alternatives, such as Knott’s Berry Farm that people might choose over Disney because of price (Shah, 2021). Another threat is the threat of piracy. A few years ago, the Walt Disney Company came out with their streaming service, Disney Plus. This made them a lot of money quickly, but now they are facing a huge problem. People are sharing their accounts with each other instead of making new accounts, which is taking a lot of money out of Disney’s pocket (Disney SWOT Analysis 2021, 2021).

The Walt Disney Company operates in highly competitive markets. The company’s media networks segment competes for viewers with other TV and cable networks, independent TV stations, and other media platforms like various online video service providers and video game developers (“MarketLine Company Profile,” 2021). The increase in the number of networks in public by Multichannel Video Programming Distributors, resulted in greater competitiveness for the company’s advertising revenues that come from broadcasting and cable networks. Moreover, Walt Disney’s theme parks and resorts compete with other forms of entertainment, tourism, and recreational activities. Walt Disney’s game segment competes with other game developers and software companies and other kinds of home entertainment. The company also competes to obtain creative and performing talents, advertising support, and broadcast rights that are crucial for the studio entertainment segment. Moreover, Walt Disney’s licensing, publishing, and retail business competes with other licensors, publishers, and retailers of character, brand, and celebrity names.The company’s competitors include CBS Corporation, DreamWorks Animation SKG, Comcast Corporation, Lions Gate Entertainment, Marriott International, Time Warner, Twenty-First Century Fox, and Viacom (“MarketLine Company Profile,” 2021).

Recommendations Based on SWOT Analysis

The first opportunity is to expand the theme parks into more countries and continents. Disney has a lot of money in its pocket, which it could do a lot with, if the company chooses to spend its income. Disney could be making so much more money than it already does if it chooses to expand its operations. There are opportunities waiting for Disney in other parts of the world that it has not explored yet. The second opportunity is that there is a chance for Disney to create more merchandise and products that it can sell online, as well as in its stores around the world. The company already does this to a certain extent, but could definitely expand on it. This is a great way for Disney to make a greater profit than it has been making.

What comes with opportunities, unfortunately, are threats. One threat that Disney is constantly facing is competition. Disney theme parks are expensive. There are other theme parks that are more affordable that people choose over Disney everyday (Shah, 2021). There are many other popular theme parks that Disney needs to keep up with. This competition keeps Disney on its toes. Another threat that the Walt Disney Company faces is piracy. People are sharing their Disney Plus accounts with each other, rather than making their own, which is causing Disney to lose a lot of customers and money (Disney SWOT Analysis 2021, 2021).

Our recommendations for how the Walt Disney Company can respond to these opportunities are doing some research and finding a new country to expand the Disney theme parks into. There are untapped markets out there just waiting for Disney to come and integrate themselves into them. We think that Disney should expand as soon as possible. In terms of Disney creating new products and merchandise, they should take advantage of the incredible staff that they have working for them. This is a chance to be as creative as they can and come up with products that have not been seen before. Dealing with threats is a different game. For facing piracy, Disney is already doing what they can. There is a limit to how many devices one Disney Plus account can be logged into. One thing they could do to decrease piracy is lower that number. In terms of competition, there’s not too much they can do. If they were to lower their prices, they would have to adjust everything, including their spending. Creating new parks in different countries and new attractions at the parks that already exist, however, will draw in more people, therefore making them more money.

PESTELE Analysis

In the entertainment business, the possibilities are unlimited. And although there may be many benefits to this kind of work, the ever-changing tastes of audiences and diversity issues continue to be a constant problem for these types of businesses to deal with. The success of the “show” is heavily reliant on external factors. As a result, tactics such as PESTELE analysis are critical for analyzing the external factors that have a direct impact on a company's growth. With this being said, we are going to dive into the Political, Economic, Social, Technological, Environmental, and Legal factors of the Walt Disney Company.

Political Factors

A PESTELE study' political components include government laws, rules, and policies such as internal political issues, leadership, foreign trade policy, corruption, political stability, taxation, and more, all of which have a direct impact on a company's finances. It determines how the government, whether local or national, influences the business climate. The political factors we will be focusing on are: intellectual property regulations, trade policies, and political views.

Intellectual Property Regulations

The content of Walt Disney falls under intellectual property rights, and just like amusement park themes and media entertainment video content; IPR plays a key role when an entertainment company becomes global. They differ from one country to the next, depending on the political climate, and IPR is defined differently in different nations (Analysis of Disney). Because Disney is so well known all over the world and because they have parks across the U.S., Europe, and Asia, it is important that they keep their intellectual property in line and protected. Trade Policies

With the shifting political context, trade policies and government restrictions alter. When operating in different countries, like how Disney has different parks around the world, there are different policies that you must adhere to and learn to work with. The Chinese government, for example, regulates video content to a great degree (Harvard International Review). Disney has parks located in Hong Kong, China, as well as Shanghai, China, so this means that in order to comply with the Chinese laws, they may need to chop an entire program down if they do not approve.

Political Views

The Walt Disney Company's management has strong feelings about the current political situation. Their political opinions have an impact on the company's brand and fan base. For example, Igor, the former CEO of Disney, chastised Donald Trump, the former US President, for the Las Vegas shooting, which claimed the life of one of the company's employees. In his piece, he stated that Trump's supporters are silent on gun violence but enraged by the athlete's refusal to stand for the national anthem (Variety). Whether such viewpoints are correct or incorrect, they have an impact on the company's brand image and client base.

Economic Factors

Unemployment, job growth, employment rate, interest and inflation rates, labor costs, and consumer purchasing power all have an impact on the business environment. All of them are classified as economic factors. It aids in the development of the company's demand and supply model. The economic factors we will be discussing are the Disney: US markets, Asian markets, and their economic recession.

US Markets

Disney's revenue comes largely from amusement parks and resorts in the United States. In fact, they account for the majority of the company's entire revenue. To put it another way, the entertainment brand relies largely on the US market. The economic situation in developing countries is changing, and the expansion of emerging markets would lessen the risk element.

Asian Markets

There is a growing rate in Asian countries such as Japan, China, Singapore, Malaysia, India, and others. This means that people have additional money to spend, and they are willing to do so at Disneyland's theme parks and resorts. The growing rate of Asian countries explains why Disney has developed so many different parks in Japan and China.

Economic Recession

Disney is said to have lost more than 700 million dollars during the covid-19 epidemic year (MarketWatch). The widespread lockdown, the closure of parks and businesses, and social isolation have exacerbated the situation. In 2020, it will reduce Disney's annual sales by 6.06 percent and its net income by 125.91 percent (Macrotrends).

Social Factors

Social issues have an impact on a company's short- and long-term objectives. Cultures, traditions, norms, values, population, demographics, lifestyle, health and safety concerns, and other factors are all factors to consider. These are used to influence consumer behavior and purchase patterns. As a result, the company's profitability is affected. The Social Factors we will be focusing on are: customers’ behavior, online streaming, and cultural diversity.

Customers’ Behavior

The public's perception of amusement parks, television shows, video games, and movies has a tremendous impact on the Walt Disney Company. The reason for this is that the company is reliant on their customers’ satisfaction, because they are an entertainment company. As a result, the company's plans must be founded on people's expectations and attitudes, which means that customer input is crucial for the entertainment media organization.

Online Streaming

During the pandemic months of covid-19, the trend of online video streaming and online purchase has exploded. People enjoy spending their free time watching and ordering things from the comfort of their own homes. This has a lot to do with those who missed going to the parks when they were shut down, and those who just needed some extra Disney magic to make their day a little bit happier. This is something Disney should keep in mind while promoting its internet services to their target market.

Cultural Diversity

Over time, the general people have become more accepting of cultural variety. It is beneficial to the company's business because Disney can now create culturally diversified content that appeals to a wide range of audiences. Additionally, one of our team members was a fellow Cast Member at the Walt Disney World Resort and in 2021, the company introduced a new “Inclusion” key for their employees to follow. This made cast members and guests of different ethnicities and backgrounds feel more included and comfortable when attending the parks.

Technological Factors

Technological innovation, automation, technical awareness, and other factors may have a beneficial or bad impact on the firm. These elements are classified as technological. This element has an impact on both manufacturing and distribution of goods. The technological factors we will be discussing are: their usage of technology, competing technologies, as well as their video games.

Usage of Technology

Walt Disney uses technology to manage its social media platforms, such as Facebook, Google, Twitter, and LinkedIn, as well as its online video streaming platforms, like Disney Plus. Technology has enabled the organization to grow into a global brand and create content that would not have been feasible otherwise. Technology is also being used at the brand's parks and resorts, such as to create their amazing light and firework shows and their park app that allows guests to check wait times, make reservations, and more.

Competing Technologies

Competitor studios are using similar, if not better, technology. It requires the company to invest in research and development in order to develop innovative technology. Disney has improved the quality of its product by utilizing powerful computers and cutting-edge technologies. However, as long as new and better technology is being invented, Disney needs to make sure that they have the latest and the greatest to stay on top.

Video Games

Disney has also taken advantage of its well-known characters by including them into the videos. They've gained a lot of traction among video gamers and appeal to those who are not typically video gamers, but partake just because they are based on their favorite Disney characters and stories. Disney has made sure to place itself in every market opportunity to maximize their profits.

Environmental Factors

Environmental awareness and sensitivity have increased as a result of rising ecological challenges. When developing company strategies for a sustainable future, factors such as raw material scarcity, pollution, and other factors must be considered.

Environmental Challenges

Environmental and ecological issues are important and have an impact on Disney in a variety of ways. Some of the tops include worsening climatic cycles, resource availability, and unpredictable events. It is the company’s job now, to figure out how to deal with these challenges and work with them effectively. Disney has responded to these issues by trying to reduce their carbon footprint. They have done this by using renewable energy, by conserving fuel, by designing newer sustainable buildings, by reducing their waste and use of plastic, by using their water responsibly, by recycling and reusing, and investing in nature-based climate solutions (Environmental Sustainability).

Legal Factors

Legal indicators become increasingly important when a company works on a worldwide scale. The legal dimensions of PESTEL analysis include equal chances, consumer rights, health and safety discrimination laws, copyright laws, and others. The Legal Factors we will be focusing on are: government regulations and their consumer protection regulation.

Government Regulations

Disney's operations are governed by government rules and regulations, particularly in Europe and the United States, where regulations for entertainment corporations such as Disney have a strategic impact. For example, because the corporation owns a park, it is required to respect the environmental regulations of the particular country they are operating in.

Consumer Protection Regulation

Disney is a global multibillion-dollar corporation, and its consumer protection and safety rules are vital to reflect well on the company. Due to the parks' safety and injury issues, the corporation is facing over 50% of lawsuits (Analysis of Disney). Therefore, Disney’s Consumer Protection Regulation must be intact to protect the company and to protect their guests. However, there are people who take advantage of these regulations, which in turn can cost Disney money.

Porter’s Five Forces Analysis

The biggest driving force for the Walt Disney Company can be seen in increasing globalization. Although the company has already expanded its theme parks globally into three other countries, research shows that, “Over the five years to 2021, these companies [the Walt Disney Company] have increasingly focused on international markets for capitalizing on the growing demand and capturing new business opportunities” (Kennedy, 2021). As the company switches gears to focus on how they can make their theme parks more accessible to those who live internationally, they must also maintain the “magic” of its brand. This can pose a challenge for the company because of their reluctance to make vast changes to their parks, which can be viewed as “Americanizing.” Nevertheless, the Walt Disney Company continues to make strides towards international expansion. In 2018, Chairman Robert A. Iger announced, “We are strategically positioning our businesses for the future, creating a more effective, global framework to serve consumers worldwide, increase growth, and maximize shareholder value” (Lam). Attempts to serve consumers worldwide can be seen in multiple different ways, whether that be through media networks or parks and resorts, which will be explained through Porter’s Five Forces Analysis.

Bargaining Power of Suppliers

One of Disney’s major growth industries is the media and entertainment industry via their online streaming platform, Disney+. In relation to the five forces, Disney holds a pretty competitive position for their streaming service. Due to its bargaining power of suppliers, the company has little to no threat of substitutes or new entrants. Any movie, television show, or short film that the Walt Disney Company owns can be found on their Disney+ platform and since Disney owns the rights to each of their digital media, it will not be found on other streaming services, unless they’re specifically given the license. Disney+ holds a competitive price that people are willing to pay for since it is an accredited, trusted company name. For example, one of their branches of cable network, Disney Junior, has 66 million subscribers domestically and 166 million customers in the international markets since 2020 (“MarketLine Company Profile,” 2021).

Bargaining Power of Buyers

The Walt Disney Company’s large customer reach to cable network operations shows that it does have a competitive advantage within the power of buyers. The company’s large subscriber base allows for higher margins and better bargaining power with multichannel video programming distributors in which most of the revenues come from for Walt Disney Company (“MarketLine Company Profile,” 2021). Since the company has a broader reach with a large customer base and international operations, they have the ability to impose higher prices for advertising sales on the channels due to the customers’ inelastic behavior and demand for Disney. As a result, this large subscriber base and reach provides stability to the company’s operations (“MarketLine Company Profile,” 2021). The company’s strong brand portfolio attracts new customers while still maintaining existing ones.

Threat of New Entrants

The Walt Disney Company had the ability to take its theme parks internationally to three other countries: Japan, France, and China. The only other American theme park that was also able to do so was Universal Studios, which also has a sister theme park in Japan. The rarity of other countries allowing American theme parks to establish itself in their country leads to a competitive advantage for the Walt Disney Company as there is little to no threat for new entrants.

Threat of Substitutes

With Disney+ making its way to becoming one of the top most used streaming services, they are still at a competitive disadvantage due to other streaming platforms, such as Netflix and Hulu. Disney+ offers access to Disney exclusive content, which includes Marvel, Pixar, and its Original Motion Pictures, however, its collection is quite small compared to other substitutes. In 2020, Netflix offered their subscribers 3,781 movies to watch and Hulu offered 1,016 movies, while Disney+ could only offer 615 movies to its subscribers (Clark, 2020). The issue with Disney+ was that subscribers felt like their selection was being limited due to only being able to choose from Disney owned content. This issue allows room for other companies/substitutes to take advantage of the situation by advertising their large collection of movies and shows from a variety of production companies.

Rivalry Among Existing Competitors

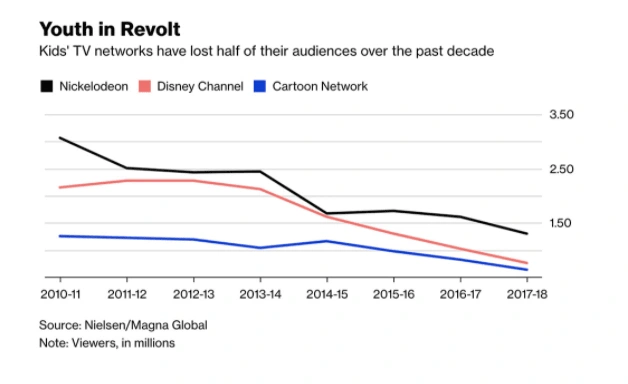

In the peak of traditional cable television, the Walt Disney Company’s network for children, Disney Channel, had two main competitors: Nickelodeon and Cartoon Network. The Walt Disney Company finds itself at a competitive disadvantage against one particular competitor, Nickelodeon, due to their differences in views per day. The Disney Channel and Nickelodeon battled back and forth between the number one and two spots, however, Nickelodeon seemingly took reign over Disney Channel for nineteen consecutive years. In the article, “Disney Channel Edges Nickelodeon in 2015 for First-Ever No. 1 Total-Day Finish,” the author expressed the excitement of Disney Channel finally beating Nickelodeon’s views per day by a mere 30,000 views (Kissell, 2015). The graph below displays an eight year time period of views between the three networks, while emphasizing Nickelodeon’s reign coming to an end in 2015.

International Expansion Opportunities

The Walt Disney Company can expand its operations internationally to Dubai, United Arab Emirates. Dubai is a very attractive location for future business expansion. There are other theme parks that have served as attractions for tourists and residents (Zeidler, 2014). Those attractions include Six Flags, IMG World, Legoland, and Dubailand. Dubailand has several rides that imitates the rides and concepts featured in Disneyland. Dubai would be a great city for international business and for opening up disney stores and a Disneyland (Zeidler, 2014). The reason Dubai is the perfect place for business is because the city has a large population of children and young adults as potential consumers.

There are over 135 million people between the ages of 1-14 that live around the country. Several neighboring countries like Kuwait, Oman, Qatar, Bahrain, and Saudi Arabia are 1 to 3 hours away from Dubai. People from those neighboring countries come to visit Dubai for its entertainment and popular attractions like Legoland (Zeidler, 2014). The closest Disneyland to the Middle East would be Disneyland Paris. There is a high demand for Disneyland in the Middle East region especially in countries with wealthy residents like in the United Arab Emirates.

Since Disney is classified as a US-based entertainment brand, its TV shows, apps, games, and films are sometimes criticized for not fitting into the Middle Eastern cultural framework (Zeidler, 2014). However, Dubai is a very diverse city with people from all backgrounds and the rulers of the country have established a culture for retailers and licensees to welcome foreign companies and perhaps consider US entertainment properties as opportunities for economic growth (Zeidler, 2014). Moreover, the most popular brands of Walt Disney’s character and entertainment industry in Dubai are Nickelodeon’s SpongeBob, Dora the Explorer, Sanrio’s Hello Kitty, Disney’s Cars and Princess, and The Smurfs. After Sony Pictures released the movie, The Smurfs, in 2011, the cartoon character has grown successfully as one of the best-selling brands in the Arab States of the Gulf. The majority of the sales were from people in Dubai, United Arab Emirates. This success has given Disney an increasing market share in the Middle Eastern regions like Dubai (Zeidler, 2014).

International PESTELE Analysis

Political Factors

There are seven states known as “Emirates” in the United Arab Emirates and they are Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Qaiwain, Ras Al Khaimah, and Fujairah. Sheikh Mohammad is not only the ruler and prime minister of Dubai but also the vice president of the United Arab Emirates. The rulers in the supreme court are considered to be the top policy making body in the country. The supreme court has seven rulers, each from one of the seven states. Each of the seven cities have their own local governments and have several municipalities and other departments. Dubai is the second largest city after Abu Dhabi in terms of population. Dubai’s main sources of revenue come from hospitality services, tourism, and real estate.

The United Arab Emirates has maintained strong diplomatic and trading relations with the United States, India, China, and other countries. When foreigners come to conduct business, they have limited political freedom in the country. The country provides more advantages to local business owners. Even in terms of elections, federal advisory bodies elect officials to run in the government. Residents and citizens' votes do not count. In other words, the civil liberties for both nationals and foreigners are restricted.

Economic Factors

Most of the revenues in Dubai are from property developments and real estate sectors. There is no opportunity for natural resources like oil and natural gas in Dubai. Dubai had a GDP of $414.18 billion in 2018. The United Arab Emirates have high exports in crude petroleum, refined petroleum, gold, diamonds, and petroleum gas. The country’s top exports are India, Japan, China, Switzerland, and the USA. The United Arab Emirates is considered as one of the richest countries in the world in terms of per capita income. The country has made great economic progress within 50 years of existence due to the country’s economic diversification, innovation, and inflow of foreign direct investment.

A great advantage of operating businesses in Dubai is that companies are not obligated to pay any taxes on income or wealth. However, oil and gas based companies and subsidiaries of foreign banks are responsible for corporation taxes. Those corporations' taxes cost a maximum rate of 55%. Dubai’s government has established a diversification of trade strategy that enabled tourism to be the main factor to contribute to property and real estate economic growth. Property prices have appreciated massively in recent years. Some major development projects that exist today in Dubai include Burj Khalifa, Burj Al Arab, the Palm Islands, and huge theme parks like Dubailand and Wild Wadi.

However, Dubai’s property market has experienced a major global recession where property prices had fallen in 2008. The economic crisis got worse in 2009, causing decreased property value, delayed construction projects, and increased unemployment. A most recent issue in Dubai these days is real estate prices have fallen because of how expensive living costs have become in Dubai and people are leaving the country. As more people left the country during the pandemic, property prices have fallen more than 50% in a year. Dubai’s debts are estimated to exceed $50 billion.

Social Factors

The United Arab Emirates has only 20% of citizens and the rest of the population are foreigners from other countries. Most of the foreigners that live and work in Dubai are from India, Pakistan, UK, USA, Iran, Canada, China, and Philippines. Islam is the major religion practiced in the country. Due to religious reasons, the country does not have a tax-based policy because it is sinful to tax people. Arabic and English are the most commonly used languages in Dubai. The majority of the country’s residents and citizens have high standards of living. Children in Dubai tend to spend more than an average American child would spend. The standards of living are costly in Dubai. The wealthy environment has forced people in Dubai to blend with the norms of wearing branded clothes and appearing the best in public. There is a stressful competition amongst people based on wealth matters such as quality of cars, sense of fashion, living lifestyle, and college degree.

Technological Factors

The information technology software solutions industries in the Gulf region has been known to double the rate of Europe. The computer sales in the Middle East has shown a 12% increase of quantities sold compared to the global growth of 8%. People in Dubai spend an average of 2.56 hours on their phones and social media on a daily basis. About 82% of the population have accounts on Snapchat and Instagram. Snapchat is the most commonly used platform in Dubai as it is very secretive in communication methods and people like their features and messages to be hidden and deleted right away due to cultural taboo and societal fears. Moreover, the United Arab Emirates came up with the concept of e-Dirham card in 2001 to process payments for government and nongovernment services. For 50 years of the country’s existence, the government has invested heavily in space science, nuclear science, and information and communication technology.

Environmental Factors

Dubai is a country that is not rich in its resources but in its innovation strategies only. The majority of the city’s organic fruits and vegetables arrive from foriegn countries. Dubai is considered a safe city for females to travel alone. Dubai is one of the safest places in the world and people often do not fear for their personal things to get stolen. It has only been 50 years since the country has developed and for that reason there are several continuing environmental challenges that continue to grow such as there are several construction noises, the existence of invasive species, increased carbon footprints, limited water sources, air pollution, land degradation, and overfishing.

Legal Factors

The United Arab Emirates follows a federal constitutional monarchy. It has a labour law that applies to all employees regardless of nationality. Employees can work a maximum of 48 hours per week in Dubai. There are low crime rates in the country, making it a safe country to conduct business and build employee relations. Dubai’s legal system is based on civil law principles and is partially influenced by the Islamic Sharia Law. There are several different areas in Dubai known as free zones to conduct business. Those free zones have different laws and regulations that are much easier to comply with in terms of business practices. Operating a business in a free zone area allows for 100% foreign ownership of companies, meaning companies are not obligated to rename the business to a local Arab person as in other areas of the city. Moreover, operating business in a free zone area allows for no limit on profit earning, making the location a very attractive place for business practice.

Opportunities and Threats

There are multiple opportunities and threats at hand if Disneyland took their business to the United Arab Emirates. If Disneyland were to expand their business operations in Dubai, United Arab Emirates, this would increase their target market. The addition of another country benefits the company because it increases profitability through a bigger reach. Another opportunity for practicing business in Dubai is being able to expand quicker. While Disneyland has been in business for many years, there is always room for expansion. Expanding in Dubai would benefit the company because the country’s consumers would most likely welcome the new business to operate in their country.

After all, it is a universal company that has an excellent reputation. On the other hand, there is a threat for increased competition if Disneyland decided to operate in Dubai, UAE. Specifically, this entails entering a global market that provides substantial competition, which could be entering a crowded market. Other non-native companies may have limited opportunities because the addition of Disneyland makes it more difficult for native businesses to thrive. As a result, the globalized company can have limited opportunities for employees and reduce the expected profit for shareholders. Additionally, due to the COVID-19 pandemic, there are lower tourism revenues in Dubai. A substantial percentage of the customers would be tourists, so it may be difficult to reach the potential customers due to the lack of tourism at the moment.

Recommendation

To respond to the opportunity of an increased target market in Dubai, UAE, I would take advantage of the expansion. With a larger market, the more income is brought in. As the company, Walt Disney has more business products and services than Disneyland alone, this benefits every other area as well. This could lead to various business deals with companies in Dubai that may diversify the company with a new perspective and skills. The more diversified Walt Disney is, the stronger the company is, and the more the stock is worth.

Expansion is what Walt Disney is prepared for by being in business for so many years with so many different ventures. The quicker the company expands, the more changes are happening. With the change, comes new opportunities, and this cycle continues. On the contrary, I would respond to the threat of increased competition by going into the situation with an open mind that there is an abundance to go around for all of the businesses operating in Dubai. Of course, it is necessary to be sure of being able to expand by this opportunity, but the circumstances of globalization have promising qualities to expand Walt Disney there. The products and services that Walt Dinsey have created are confirmed by the public that the majority of people are interested in it, which is how it continues to grow. With the support of so many customers, Disney should be able to make it in Dubai because of the tourism there and because of its good reputation.

Additionally, I recommend that the Walt Disney company should pursue its expansion in Dubai even though there is a threat that there is less tourism due to the COVID-19 pandemic. The reason being is because history proves that after a pandemic dies down, the consumers are desperate to have fun again after being quarantined for so long. A new Disneyland is a site that many people would love to travel to after being separated from the world for over a year. Also, the locals who live in Dubai would have the opportunity to experience a new attraction in their hometown, which would provide the company with an immediate customer base. This is the time for new entertainment leisures to open because the public will be anticipating the excitement after the pandemic. Overall, the opportunities outweigh the threats for Walt Disney to expand in Dubai, United Arab Emirates.

International Expansion Decision and Conclusion

I believe that the Walt Disney Company should go for this international expansion decision in Dubai, United Arab Emirates because the country does not have tax policies and allows for the company to obtain the majority of its profits without worrying about tax payments. Also, the country has several free zone areas where the company could consider purchasing lands to establish a Disneyland and other Walt Disney business operations. This way the free zone areas allow for full ownership of the American company without government interference. The Walt Disney Company has welcoming opportunities in Dubai where it can also form joint ventures with the country and come to agreements for how the government and company wants the business to operate. If another branch of Disneyland opens in Dubai, several people from neighboring countries will bring their children for vacations to Dubai and this could potentially boost the revenues of the company since Dubai is already the world’s most luxurious city. Every country goes through a period of recession and it is common. Dubai is still growing and developing, towers are still being built, people are transitioning to Dubai, and the country has high growth opportunities.

References

Amidi, A. (2018, April 30). Nickelodeon, Disney Channel, And Cartoon Network Ratings Are In

Free Fall. Cartoon Brew. https://www.cartoonbrew.com/business/nickelodeon-disney-channel-and-cartoon-network-ratings-are-in-free-fall-158139.html

BBC (2014) United Arab Emirates country profile. https://www.bbc.co.uk/news/world-middle-east-14703998

Brenner, L. (2021). Rated C for censored: Walt Disney in China's pocket. Harvard International Review. Retrieved December 8, 2021, from https://hir.harvard.edu/rated-c-for-censored-walt-disney-in-chinas-pocket/.

Brown, Lisa. (2017). Walt Disney Company SWOT Analysis and Recommendations. http://panmore.com/walt-disney-company-swot-analysis-recommendations

Clark, T. (2020, June 11). How Netflix, Prime Video, and Hulu compare to new streaming rivals

like Disney Plus and HBO Max. Business Insider. https://www.businessinsider.com/streaming-comparison-netflix-hulu-disney-plus-hbo-max-prime-2020-6?international=true&r=US&IR=T

Disney Net Income 2006-2021: DIS. Macrotrends. (n.d.). Retrieved December 8, 2021, from https://www.macrotrends.net/stocks/charts/DIS/disney/net-income.

Disney SWOT Analysis. (2021). Disney SWOT Analysis EdrawMax. Edrawsoft. https://www.edrawmax.com/article/disney-swot-analysis.html

Disney SWOT Analysis 2021. (2021). Disney SWOT Analysis 2021. Business Strategy Hub. https://bstrategyhub.com/swot-analysis-of-disney-2019-disney-swot-analysis

Dowd, K. (2021). In 2000, a Disneyland ticket cost $41. A price hike just increased

it to $164. SFGATE. https://www.sfgate.com/disneyland/article/Almost-every-Disneylan

Like this project

Posted Dec 18, 2021

The paper suggests Walt Disney should expand to Dubai for tax benefits, free zone opportunities, and the city's growth potential.

Likes

0

Views

5.3K

Clients

The Walt Disney Company Europe, Middle East, and Africa