Personal Portfolio Trading Game Report

OBJECTIVES

My objectives for the trading game was to end up with a diversified portfolio and a most valuable portfolio. Also, my objectives were to have high and positive returns and profits. My objectives were to follow a simple rule of trading where I can follow the basic set of rules for trade entry, exit, time frame, order types, and markets. I took my position in the market by initiating a purchase price and then entering to determine my profits on a weekly basis and stop my losses by selling them off. I also enter the market to “take profit” and have “stop-loss” orders to be able to have a smooth limited loss while exiting from the trade. My trading strategy is based on following rules and being able to adjust profit targets or stop orders by initiating action before exit of the market.

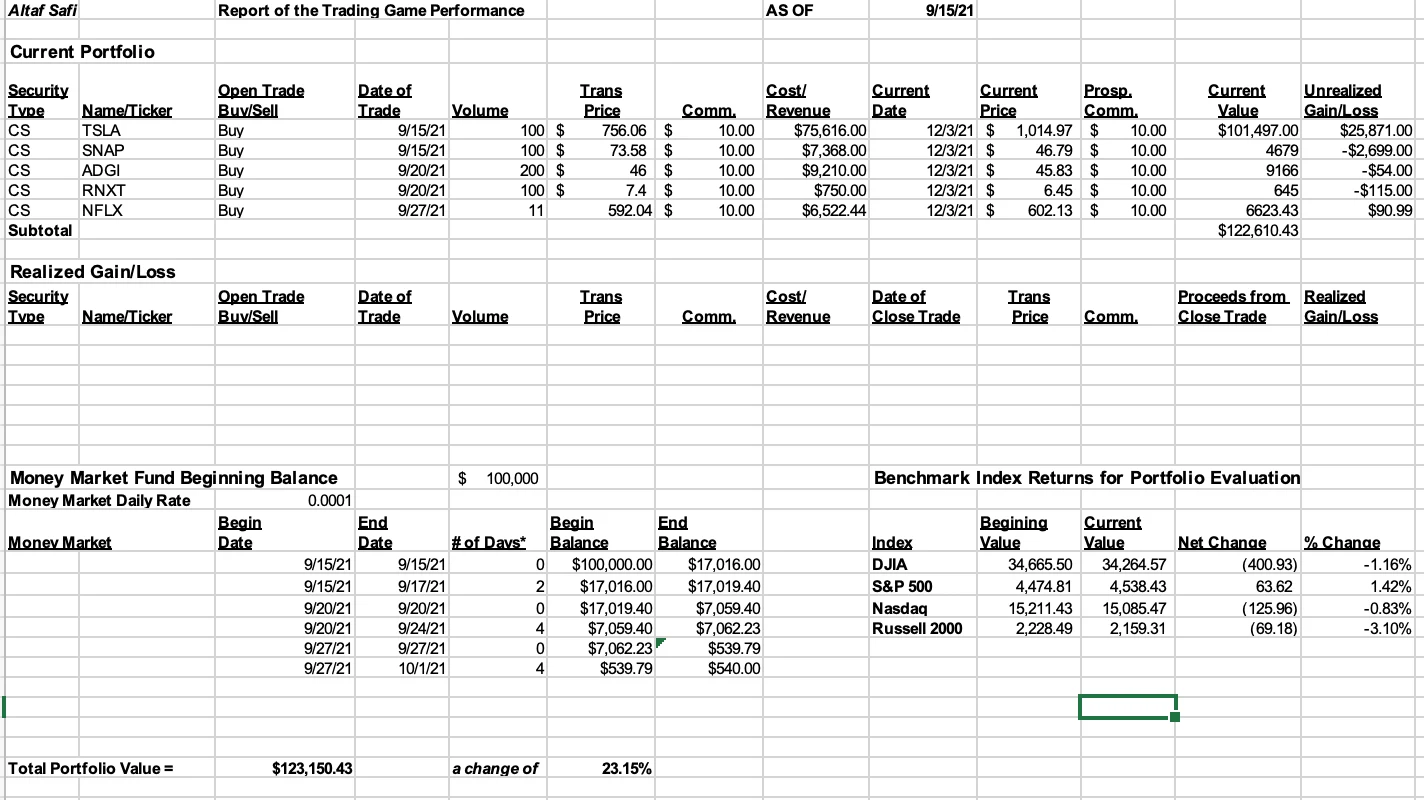

As a first time trader with lack of experience and skills about market analysis and for interpreting trade signals, I believed that executing trade transactions based on the basic set of rules was appropriate to guide me through the trade exits and entries. This way it can minimize my trading confusion and lower my stress level. Executing such a trading strategy helped in minimizing my trading losses and other mistakes that were driven by hesitation, confusion, stress, and emotion. The strict rules of trading explained by course concepts also helps in providing risk protection. I built a diversified trading portfolio where I ended up having about $123,150 in total portfolio value. The prices of securities can undergo unexpected changes. My position as an objective trader with lack of experience shows how I can not continuously adjust to market conditions quickly along with price fluctuations. I feel more constrained by trading rules. For this reason, I do not feel comfortable and skillful enough to transition successfully though rapidly changing market conditions, pressures, and trends.

SECURITY SELECTION

I bought common stock securities from TSLA, SNAP, ADGI, RNXT, and NFLX. I did not sell any of my securities because now that I reached the final week of trading, I realized that the securities that incurred heavy losses are pulling themselves up into the market and reaching a high price at a slow pace. I used a strategy to understand how many shares of stock to buy from a security type. I first evaluated how much money I have in my money market and am willing to invest. In my case, I had $100,000 in my money market fund balance. I also understood the importance of diversification and allowing my portfolio to be diversified as learned from finance concepts. I allowed my investment portfolio to be diversified. Then, I investigated the potential commission and brokerage fees to be applied and deducted from profits. I also took into account if any of my securities had dividend payments, however, in my case, none of my securities had dividend payments due.

My objective is to make higher returns and profits, so for that reason I determined first the prices from Yahoo Finance during markets open time. I looked at their historical prices throughout weeks and months to analyze if prices are continuously rising or declining. Secondly, diversification was key to giving high returns. Instead of buying most of my shares from one stock company, I used the investment strategy to spread my funds across a few different companies and industries like pharmaceuticals, entertainment and media, technology, and automotive industries. My goal was to buy low and sell high. As an investor that utilizes a buy and hold strategy, I choose stocks based on the companies’ long-term prospects. I looked at the historical prices over years for those companies. Then, I realized for some of the companies, the increases in the stock prices over years were based on the company’s fundamentals, like earnings per share and sales from high demand products based on economic conditions like vaccine sales during the COVID-19 pandemic. I also chose stocks based on the companies’ expertise and vision of its management and rating position within the industry.

I relied on information and sources from the Wall Street Journal. For instance, I figured out that RenovoRx is a biopharmaceutical company that provides chemotherapy to tumors that are difficult to treat. I purchased 100 shares of RNXT stock at the price of $7.4 and it has declined to $6.45 as of December 3rd. The advanced medical equipment and technology of the company will enable physicians to micro-perfuse targeted tissues with small molecule chemotherapy. The RenovoRx advanced equipment and new procedural treatments have increased the stock over 40% on the opening bill during September 7, 2021. There were signals that a new treatment can attract investors to purchase the pharmaceutical trial, product, and project, to increase profits in sales.

Moreover, Adagio Therapeutics develops antibody-based treatments to provide rapid protection for patients with Covid-19 symptoms. After their public announcement of their new treatment for COVID-19, the stock gained over 70%. The pharmaceutical industry is in high demand during the pandemic and stock prices are fluctuating very quickly and in high amounts after every announcement companies make regarding their clinical trials and new treatments. Additionally, the FDA has recently granted a new 510 K clearance to RenovoRx Inc (RNXT) RenovoCath Delivery System. A new technological equipment that serves as a component device for RenovoGem, has increased the stock prices up by 64.9% recently. This rise was also due RenovoRx plan on conducting a Phase 3 trial to evaluate RenovoGem on patients with pancreatic cancer. RenovoRx has collected 44% of patient enrollment and will involve about 200 patients for the study trial. The availability of time during the pandemic and necessity to save lives has boosted several medical trials and made the pharmaceutical industry more in need and in high demand.

Recently both stocks RNXT and ADGI have been declining from their initial stock purchase price due to some failure and delay in clinical trials and other treatment developments. However, after several weeks through the trading game, both of the stocks are rising again. For example, Adagio Therapeutics (ADGI) stock has increased by 319% recently because the company has found a treatment of ADG20, an antibody drug, to treat the new strain of COVID-19 called Omicron. Also, the stock is expected to rise heavily because of the economic circumstances where the company will file for emergency use authorization for its drug before Omicron spreads heavily around the country.

RISK

My portfolio has two common stocks that are very risky and those are from the pharmaceutical industries. ADGI and RNXT increase more slowly than it falls. Both of these stocks are very risky because they can decline in heavy amounts in an economic downturn and cause a huge loss. I did learn that investing in pharmaceutical companies is riskier than investing in the communications and media industries like Netflix. In terms of diversification, there are a broad mix of investments I have made in my portfolio. I am holding a mix of automotive stocks, healthcare stocks, tech stocks, media, entertainment, and communications services stocks. Those companies are Tesla (TSLA), Adagio Therapeutics (ADGI), RenovoRx (RNXT), Snapchat (SNAP), and Netflix (NFLX). There is a huge rise in the demand for technological services like Snapchat, however, the arrival of TikTok has broken records and Snapchat is no longer the most popular and most used application as before. Snapchat stocks have been falling since my initial purchase. It has not increased during those weeks to reach my peak target price at least close to my purchase price. All of my stock purchases are common stocks in terms of security type.

RESULTS

The value of my portfolio on the closing date of December 3, 2021, was $123,150.43. There was an increase of 23.15% from my initial investment balance of $100,000. Netflix stocks are classified to have a systematic risk because it follows the market closely. Netflix’s market risk is very steady since it has a sharpe ratio of 0.0022%, which means it has this much of return per unit of risk. Netflix stocks change in correspondence to market change. Netflix has a beta of 0.56. It can be understood that when the returns in the market increase, Netflix’s returns are also expected to increase slightly less than the market. ADGI has a beta of -1.75, determining that if market returns increase, Adagio returns would decrease in larger amounts. ADGI is very regressive towards the market in terms of economic sensitivity.

TSLA market risk is very steady and has a beta of 0.73. SNAP’s market risk is not too volatile and its economic sensitivity almost mirrors the market. SNAP has an unsystematic risk with a beta of 1.11. SNAP returns are very sensitive to the returns in the market. This means that if the market goes up or down, SNAP goes in the same direction as the market. RNXT stock almost ignores market trends in terms of economic sensitivity. RNXT has a beta of -0.21 and this means that if returns in the market increases, RNXT returns will decrease at a much lower rate. RNXT is likely to outperform the market.

If I was to play the same trading game again next semester, what I would do differently is do more research based on stock purchases. I regret purchasing pharmaceutical stocks because they have been declining steadily at a faster pace than rising. A deep stock research through FactSet, Yahoo Finance, and Wall Street Journal would be valuable before purchase of shares.

Like this project

Posted Dec 13, 2023

In the trading game, I aimed for a valuable, diversified portfolio with positive returns using a rule-based strategy and effective risk management.