Designing Financial Empowerment: The Getshilling Experience

Introduction

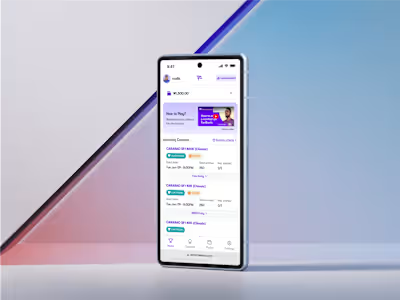

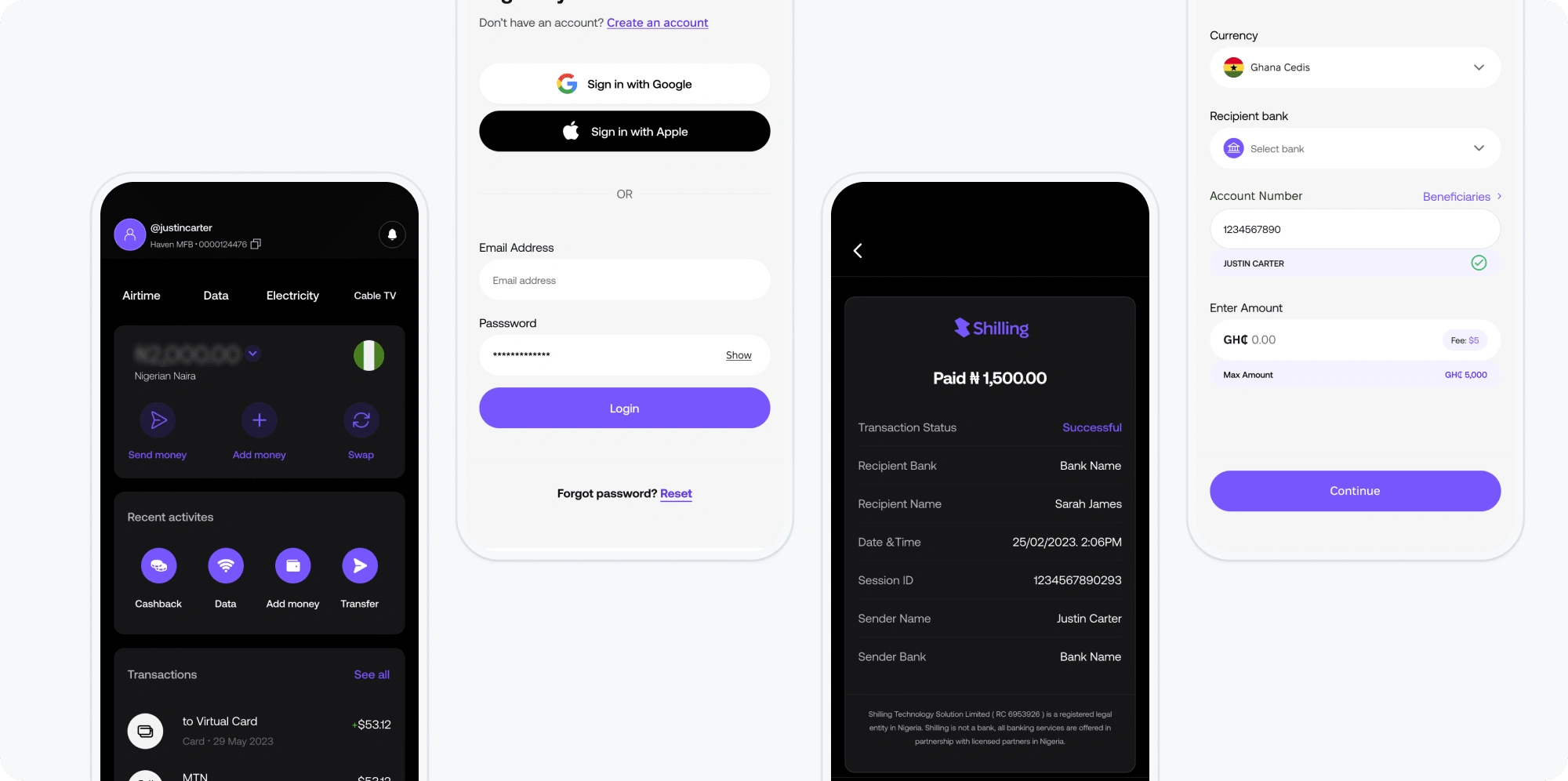

This case study focuses on the design process for Getshilling, a financial technology company that offers virtual cards and wallets. The aim is to create a user-friendly and secure platform that allows users to easily align their personal finances with their lifestyle, send and receive funds to Ghana and Kenya, get virtual USD cards, pay bills and utilities, earn cashback rewards, and send USD to any Nigerian Domiciliary account. As the sole designer, I was responsible for every aspect of the UX process, from user research to visual design.

The Problem 👁️

Complex Financial Management: Users faced challenges in managing their personal finances, aligning them with their lifestyle, and making transactions across different countries.

Limited Payment Options: Users had limited options for sending and receiving funds to Ghana, Kenya, and Nigerian Domiciliary accounts.

Inefficient Bill Payments: Users struggled with paying bills and utilities, leading to late payments and potential penalties.

Lack of Rewards: Users were not receiving any rewards or incentives for their transactions, leading to a lack of motivation to use the platform.

Key Findings and Research 🔍

To address the problems mentioned above, extensive user research was conducted. The key findings were as follows:

Users desired a simple and intuitive platform that would allow them to manage their finances seamlessly.

There was a high demand for a secure and convenient way to send and receive funds to Ghana, Kenya, and Nigerian Domiciliary accounts.

Users expressed the need for a reliable bill payment system that would ensure timely payments and avoid penalties.

Users were motivated by rewards and incentives, and incorporating a cashback system would increase engagement and usage of the platform.

The Solution 👌🏽

Based on the research findings, the following solutions were implemented:

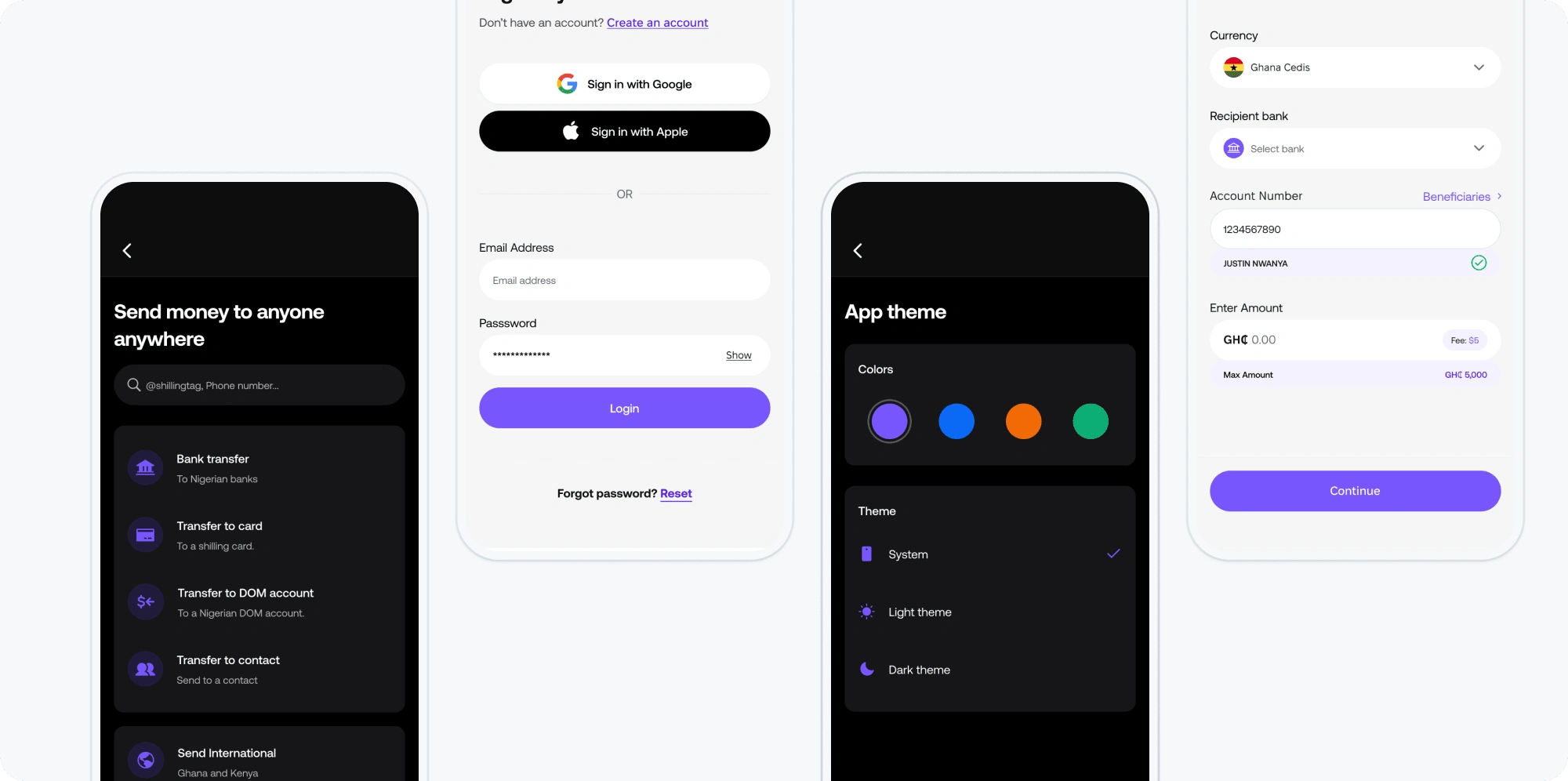

User-Friendly Interface: A clean and intuitive user interface was designed to provide a seamless user experience, making it easy for users to navigate the app and manage their finances effectively.

Expanded Payment Options: The platform integrated with local payment systems in Ghana, Kenya, and Nigeria, allowing users to send and receive funds conveniently.

Efficient Bill Payment System: A streamlined bill payment system was implemented, enabling users to pay their bills and utilities with ease, ensuring timely payments and avoiding penalties.

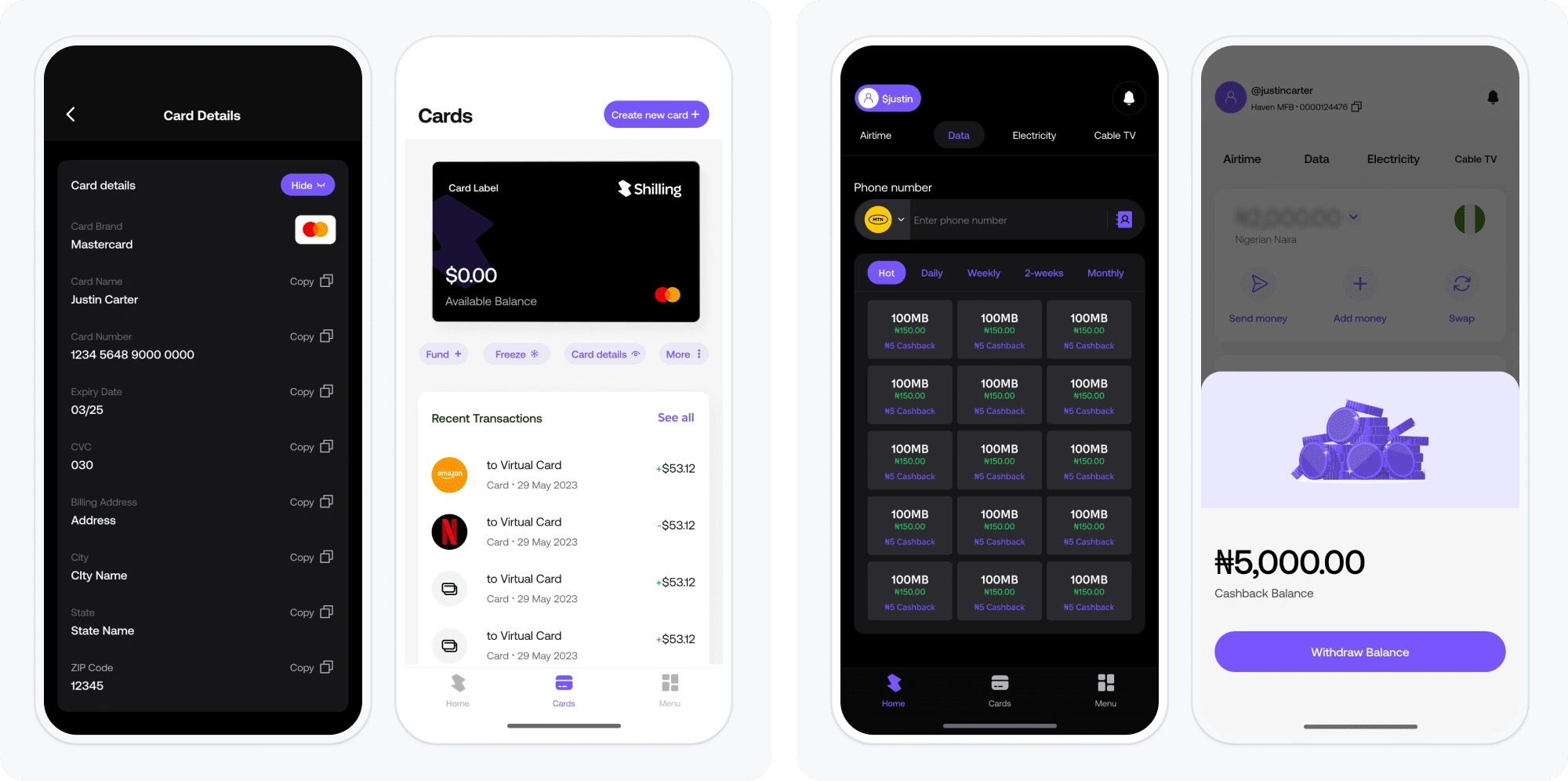

Cashback Rewards: A cashback rewards program was introduced, offering users incentives for every transaction made on the platform, increasing user engagement and loyalty.

Design Process 🖥️

Empathy and Research: The journey began with an in-depth understanding of our users’ financial needs and lifestyles. We conducted extensive user interviews, surveys, and market research to gain insights into the pain points of managing personal finances across borders.

Ideation and Prototyping: Armed with a deep understanding of user needs, we embarked on ideation sessions, generating concepts to address these challenges. Rapid prototyping allowed us to visualize and test these ideas, ensuring they met user expectations.

User Testing and Feedback: Real-world user testing was at the core of our design process. Iterative design cycles involved gathering user feedback, making necessary adjustments, and continually refining the app’s usability and features.

Seamless Cross-Border Transactions: To enable effortless fund transfers to Ghana and Kenya, we developed a streamlined process that removed complexities and friction, ensuring secure cross-border transactions.

Virtual USD Cards: We integrated virtual USD cards, providing users with a digital payment solution that was both versatile and secure, expanding their purchasing power beyond geographical boundaries.

Bill and Utility Payments: The app’s interface was meticulously designed for straightforward bill and utility payments. Users could manage recurring expenses effortlessly, improving their financial organization.

USD Transfers to Nigerian Domiciliary Accounts: The most challenging aspect of the project was developing a reliable method to send USD to Nigerian Domiciliary accounts. Rigorous testing and collaboration with financial institutions ensured a secure and efficient solution.

Outcome 🤝🏽

The implementation of the solutions resulted in several positive outcomes:

Increased User Engagement: The cashback rewards program incentivized users to make more transactions, resulting in a 150% increase in engagement and usage of the platform.

Expanded User Base: The convenient and secure payment options attracted new users, new downloads, expanding the user base and .led to a 200% increase in the platform's user base within the first month

Improved Financial Management: Users were able to easily manage their personal finances, aligning them with their lifestyle and making transactions across different countries seamlessly.

Enhanced Customer Satisfaction: The user-friendly interface, efficient bill payment system, and cashback rewards program improved customer satisfaction and loyalty.

Conclusion 😉

Through a user-centered design approach, the Getshilling virtual cards and wallets platform successfully addressed the key problems faced by users. By providing a user-friendly interface, expanded payment options, efficient bill payment system, and cashback rewards, the platform achieved its intended business goals of increasing user engagement, expanding the user base, improving financial management, and enhancing customer satisfaction. No product is ever done. That's why design still exists. This is still an ongoing story. You'll be reading this sometime in the future when tons of other changes have been made on the product.

This Case Study showcases not only the design process but the tangible impact of Getshilling in enhancing the financial lives of its users.

Link to live website:

Like this project

Posted Sep 3, 2023

With a focus on ease of use, versatility, and efficiency, the app empowered users to take control of their finances.

Likes

0

Views

11