How to Bill a Client for the First Time: A Step-by-Step Guide

Starting as a freelancer or new small business owner is a stressful time.

And, one task that will bring joy and nervousness is billing a client for the first time.

If you want to ensure you get paid on time, you must get invoicing right with a clear, professional invoice and billing process.

But this process doesn’t have to be complicated or scary.

We’ve put together a helpful tutorial to help you create your first invoice. This article includes it, along with guidance on late payment follow-ups and some common billing mistakes to avoid.

Let’s take a look.

How to bill a client step-by-step

Invoicing clients doesn’t have to be stressful. It’s quite easy if you know which steps are involved.

We’ve created this handy step-by-step guide to help you set up your first invoice and send it to the client quickly.

1. Choose an invoicing system

The right invoicing system will depend on the work you do and the contract you have agreed with your client.

Some different invoicing methods include:

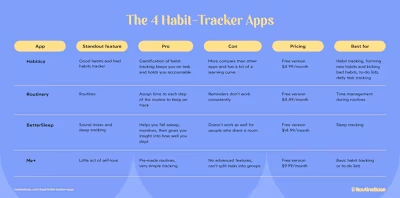

Document or spreadsheet templates

Ideal for freelancers or very small teams invoicing for fixed-price contracts where time spent is irrelevant. They can be created on Canva, Google Sheets, or Microsoft Word and are a cheap solution, but require manual filling and can be tedious and prone to error.

Billing and invoicing software

Software like Zoho Invoice and PayPal are good invoicing solutions for larger businesses. They provide an efficient and accurate invoicing system, the ability to track payments, and improved financial management. However, they can be complicated and expensive.

Time billing software

Time tracking software like Toggl Track is an ideal solution for individuals and teams of all sizes that bill for their time. This system records exactly how long each task or project takes and compiles the billable time data into an invoice to send to the client.

2. Create a custom invoice template

Your invoice must match your brand colors and style.

If you’re using a document invoice, tools like Canva have many invoice templates you can edit to fit, or you can create a new one from scratch.

You can also download our PDF invoice template here.

Include your company name, logo, tax information, and contact information.

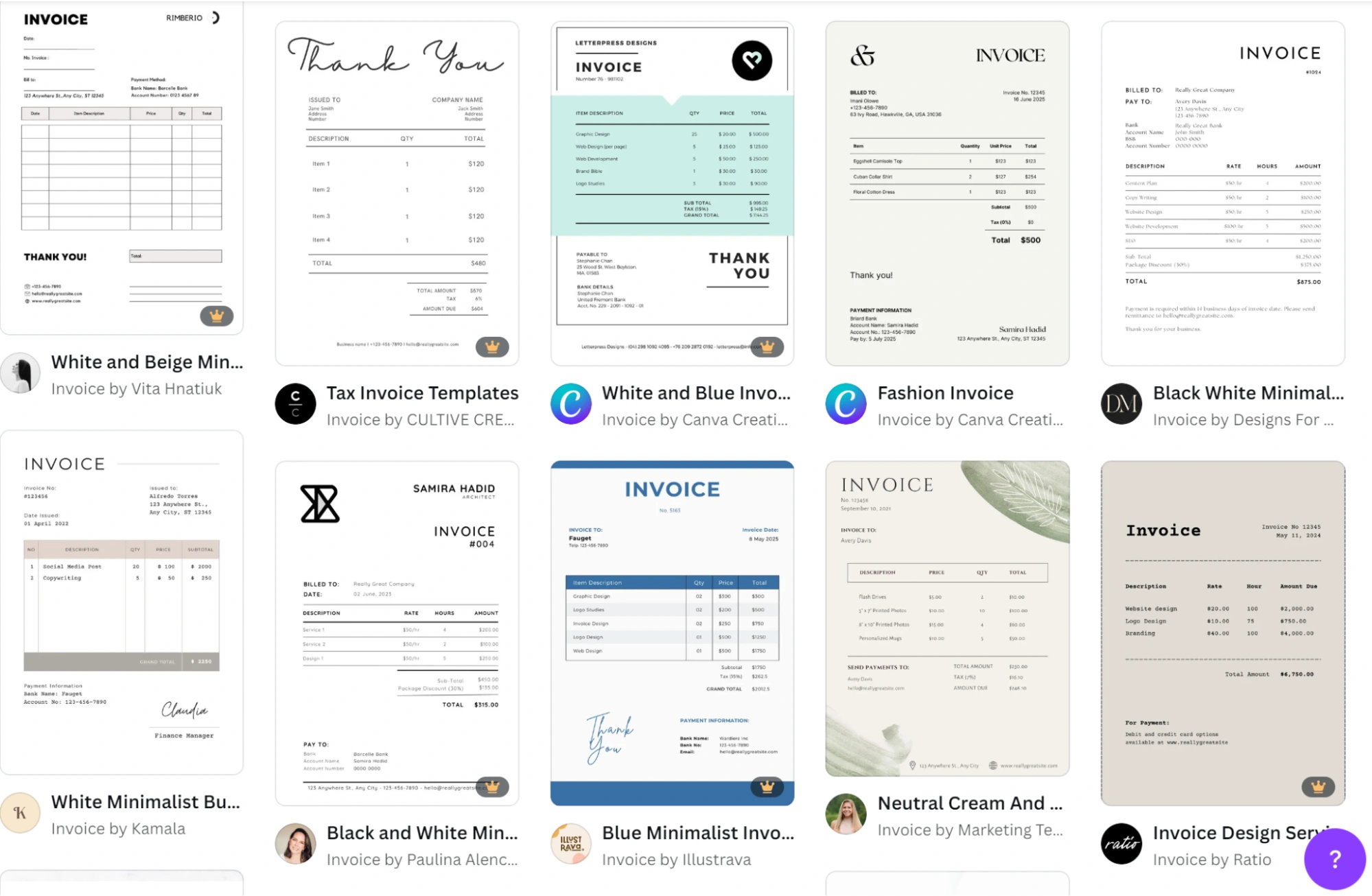

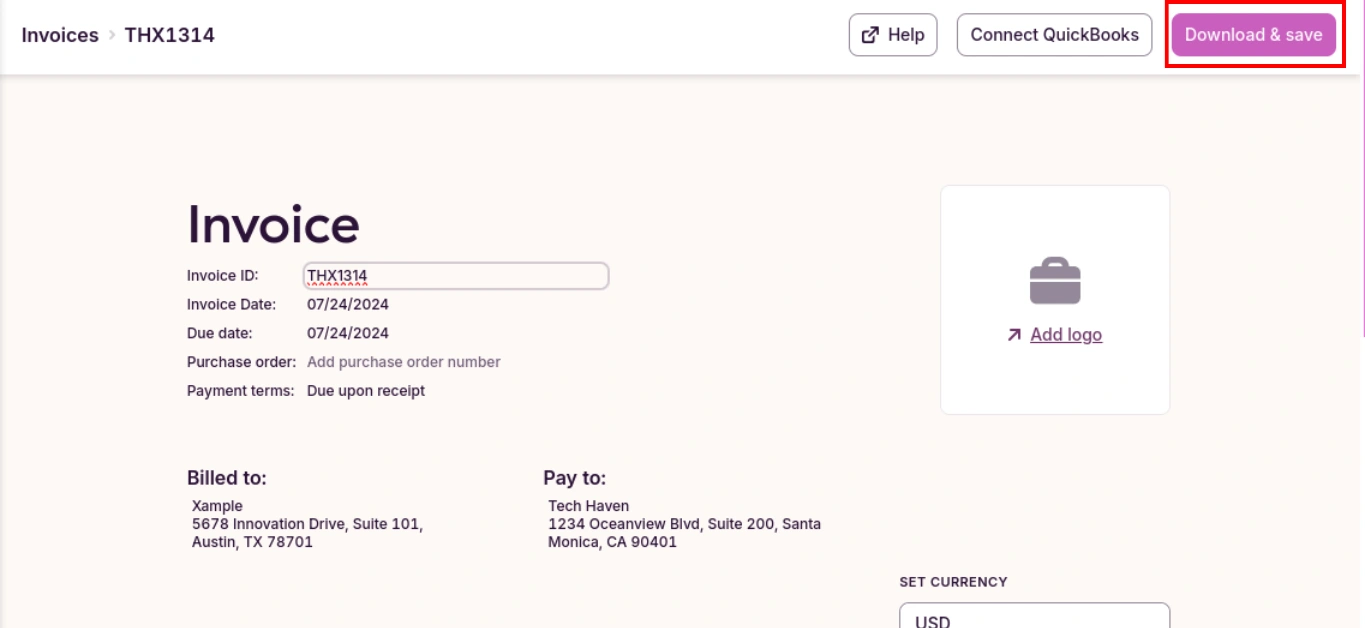

If you’re using Toggl Track, you can quickly customize your invoice template from the invoice edit view. You can replace any pre-populated information and add custom fields with custom data. The screenshot below shows all the fields you can edit.

3. Create the invoice

There are a few crucial pieces of information that you must include in your invoice. Follow these steps to make sure you include everything:

Add the client’s name, address, and contact information in the “Bill to” section.

Create a unique invoice number so you can track the invoice and payment.

Specify the invoice date, which should be the day you create the invoice.

Add the payment due date according to the payment terms.

Clearly define each service, product, or deliverable provided and list them in the body of the invoice alongside a description, the quantity, hourly rate, and total amount due for each item.

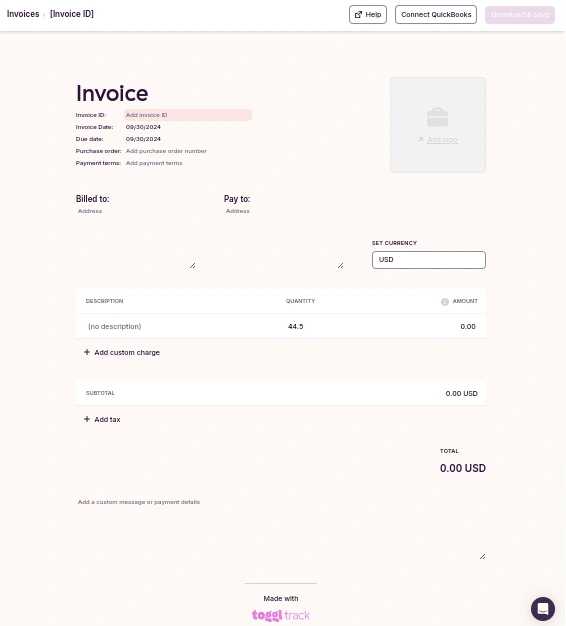

Toggl Track’s invoicing features automatically populate the invoice with data from your time report. To create an invoice, head to the Reports view, select the desired time frame, and click Create Invoice.

The invoice editor window will open, where you can edit your invoice and add all the required information. If you’re on a paid plan and have a billable rate set for your hours, the cost of your worked hours will automatically be calculated and populated. Data can also be manually entered.

When you’ve added everything, click the Download & Save button.

This will save the invoice you’ve created to your Toggl Track workspace and automatically download a hard copy.

4. Summarize the totals

If you have multiple invoice pages or need to add taxes, fees, or discounts, adding subtotals to your invoice is helpful. You can add the subtotal for each page and/or the subtotal before any other expenses in a subtotal section on the invoice.

Add applicable taxes and extra fees, like out-of-hours charges, surcharges, processing fees, late fees, and service charges. Then, calculate the full amount and display the total at the bottom of the invoice.

5. Specify payment terms

There are a few different options for payment terms. Some common terms include:

Upon receipt: Payment must be made as soon as the client receives the invoice.

Net 15: The client has 15 calendar days to make a payment. The 15 days start from the date the invoice is sent when sent digitally. If it’s sent by mail, the 15 days start when the client receives the invoice.

Net 30: The same as Net 15 terms, except the client has 30 calendar days to pay.

Note the payment terms on the invoice so both you and the client can keep track and know when payment is due. Mention any fees and interest charges for late payments.

6. Provide payment instructions

Ensure your payment details are displayed and are accurate to avoid payment delays.

If you can accept multiple payment options, include the details on your invoice. This could be:

Provide your bank account details for bank transfers. For international wire transfers, please include the SWIFT code and any other relevant information.

Your PayPal, Stripe, or Wise details.

A postal address for sending cheques.

A link to a payment platform for online debit and credit card payments.

7. Add a personal touch

Maintaining healthy client relationships is vital for business success, and personalizing invoices is a step in the right direction.

Thank the client for their business and add any necessary notes, project details, or reminders about future work. The client will be grateful for it.

8. Review and send the Invoice

Before you send the invoice, you must ensure all the information is correct to prevent invoice queries that could delay payment.

Double-check that all information is accurate, and then, when you’re happy, send the invoice to the client through your invoicing software’s delivery options or via email. If necessary, confirm that the client has received the invoice.

Congratulations! You just billed a client for the first time. 🎉

How to follow up on an unpaid invoice

Unfortunately, there may be times when your clients are late making payments. Follow the steps below to ensure you receive your payment.

1. Set up automated reminders

Depending on your invoicing system, you may be able to automate payment reminders to notify your clients that the due date is approaching or passed if they haven’t made payment.

This method means you don’t need to remember to chase payments and gives clients the gentle nudge they might need if making payment has fallen off their radar.

2. Don’t shy away from following up after missed payments

Even though you want to build and maintain healthy relationships with your clients, that doesn’t mean you should be afraid of following up when they don’t pay. After all, you deserve to be paid for your work.

Remember that a missed payment could be a simple, honest mistake, or the client could have issues with cash flow that are slowing down their ability to pay on time.

If it’s their first late or non-payment, be gentle. But if they consistently miss payments, you may need to consider letting them go or asking for upfront payments in the future.

Offering flexible payment solutions or discounts can be a good workaround for clients with cash flow issues.

3. Resort to legal action as a final recourse

If a client pays late or misses payments on multiple occasions, it will begin to affect your business and bottom line. You may need legal action if all communication and recovery attempts have failed.

Speaking with an attorney about your legal options is a good idea. Small claims court may be suitable depending on the size of your business and the amount the client owes you. For large amounts, civil court proceedings may be in order.

You can also use a factoring or collection agency to recover the debt.

Remember that legal action generally results in losing the client. It should only be used as an absolute last resort after all other recovery methods have failed.

What common client billing mistakes should you avoid?

Making mistakes in the client billing process can slow down or even halt your payments. Here are a few common mistakes you should be aware of so you can enjoy a smooth invoicing and payment process.

Sending invoices late: Forgetting to send invoices on time could cause you to miss the client’s payment cycle or cause other setbacks that delay your payments.

Missing or incorrect information: If your invoice is full of errors, it looks unprofessional and can damage your reputation or even result in payment disputes.

Unclear payment terms: Payment terms establish the payment timeline, so make sure they’re clearly explained and leave no room for misinterpretation.

Only providing one payment option: Give your client multiple payment options to decrease the likelihood of non-payment due to cash flow restrictions.

Staying ahead of these client billing mistakes will help streamline and prevent issues in your invoicing process.

Back to you

Client billing doesn’t have to be scary.

Following the steps outlined in this article, you can soon be on your way to a smooth and speedy billing process.

Toggl Track is an ideal tool for individuals and teams of all sizes to track the time spent on tasks and use the data to create accurate client invoices.

Sign up for Toggl Track for free and start creating time-based invoices today.

Frequently Asked Questions (FAQs)

We’ve gathered the answers to frequently asked questions to help you bill clients confidently.

Should you bill a client before service?

Generally, invoices are sent to the client after work is completed. However, there may be instances where upfront payments are required, such as in clients with a non-payment habit.

Usually, invoices are only sent before service for advances or deposits.

What are the consequences of late payments for clients?

Repeatedly paying service providers late can cause them to impose stricter payment terms, charge late fees or interest on overdue payments, cancel future contracts, or even take legal action.

How much interest can you charge on an unpaid invoice?

The standard interest rate on unpaid invoices is between 1% and 2% per month, but you can choose the amount at your discretion.

What should I do if a client disputes an invoice?

If a client disputes an invoice, resolve it by:

Speaking to the client: You can often resolve the dispute by discussing the problem. Give the client a phone call or email, remaining polite but firm until you understand the problem.

Offer replacements: If the client is unhappy with the goods or services you provided, first assess if their reasoning is sound. If goods are faulty, ask for them to be returned and replaced. If the client is unhappy with services, offer revisions or changes until they’re happy.

Refer to the contract: If you have upheld your side of the contract, cite it as evidence that you have stuck to the terms.

Legal action: If you are certain that there was no negligence, poor service, or faulty goods, and the client still refuses payment, take the case to small claims court.

Like this project

Posted Nov 16, 2024

Learn how to bill clients accurately and confidently to ensure timely payment for your work.

![The 4 Best Meditation Apps: Tried, Tested, and Reviewed [2025]](https://media.contra.com/image/upload/w_400,q_auto:good,c_fill/edegah98r8pdlcm9ep0g.avif)