Kniru - AI Fintech Mobile App Design

Like this project

Posted Aug 13, 2025

Designed a fintech app with dual onboarding and AI features for Kniru.

Likes

4

Views

10

Timeline

May 13, 2024 - Nov 1, 2024

Clients

Kniru

Kniru - Fintech Mobile Application Design

Service : Mobile app design

Price : Monthly retainer client

Timeline : 5 months

Live Preview : https://www.kniru.com/

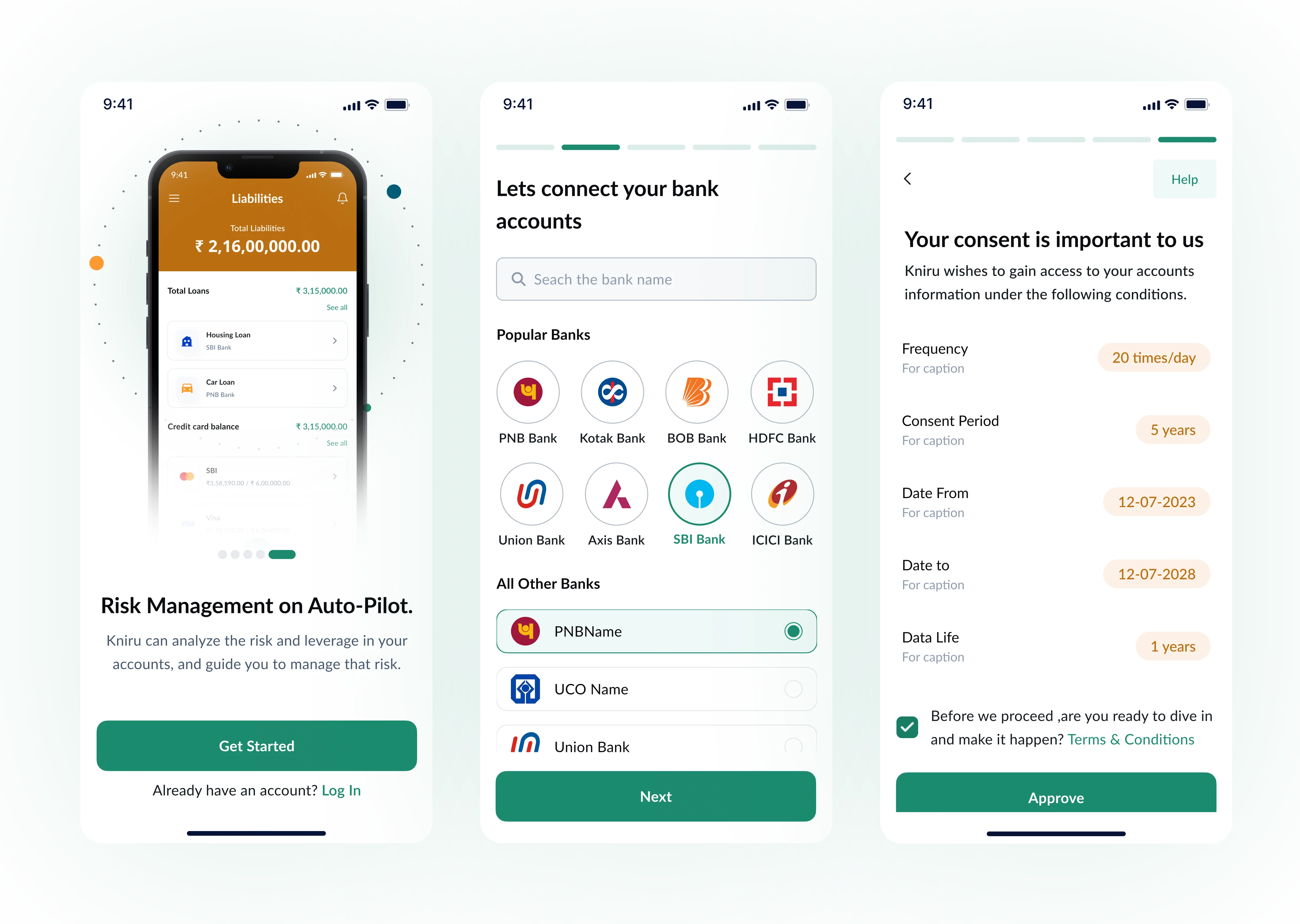

Implemented a dual onboarding system to cater to both Indian and international users.

Plaid for international markets (US, UK, Canada), the system fetches bank details, while Indian users have a direct integration.

This simplified the user journey and consent process, creating a frictionless experience.

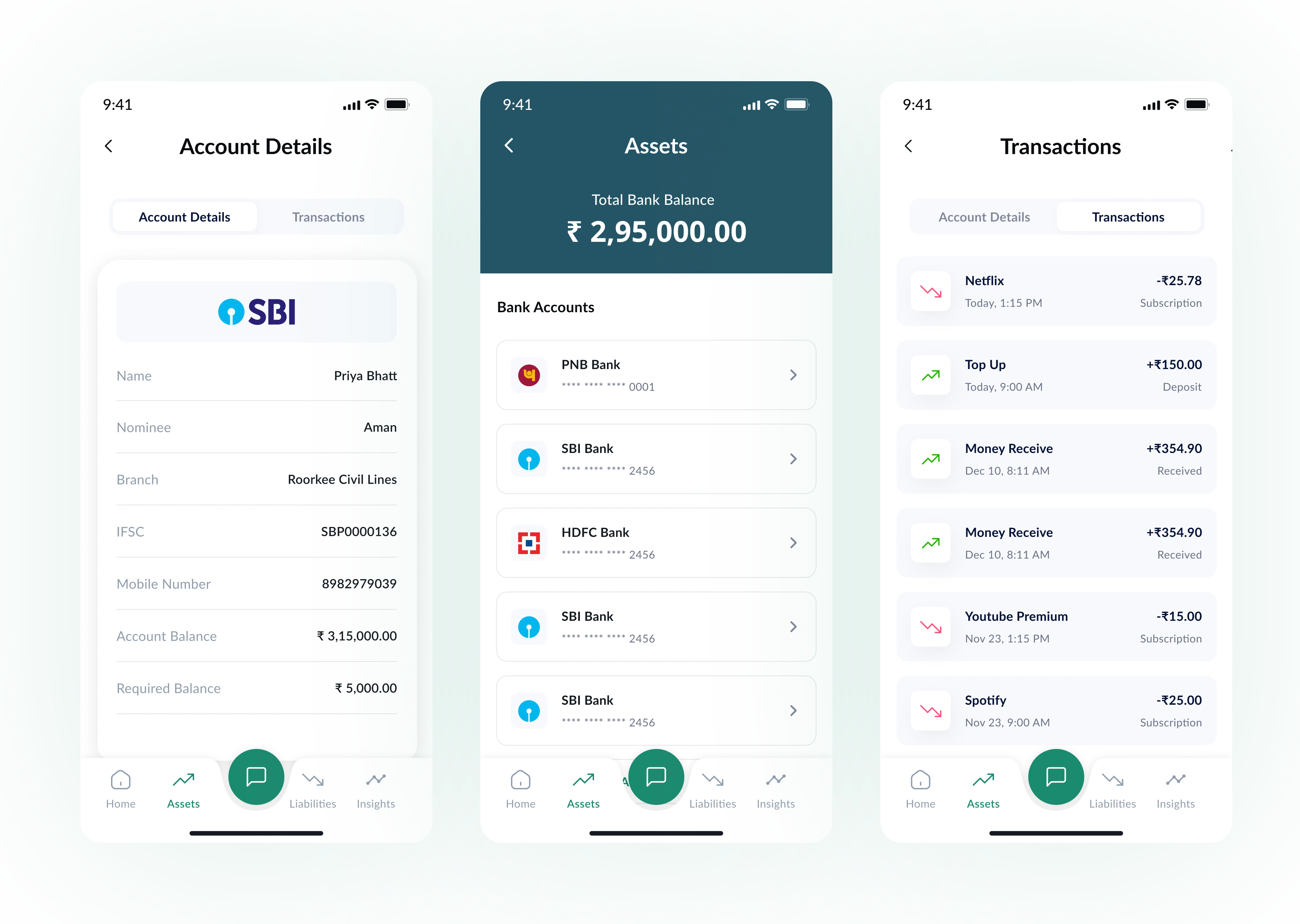

Feature: Unified Asset Dashboard

The app provides a consolidated view of a user's complete financial portfolio.

It aggregates data from all bank accounts linked during onboarding, displaying balances, transactions, and investments like mutual funds and SIPs.

This gives users a single, clear overview of their assets and financial health without needing to check multiple sources.

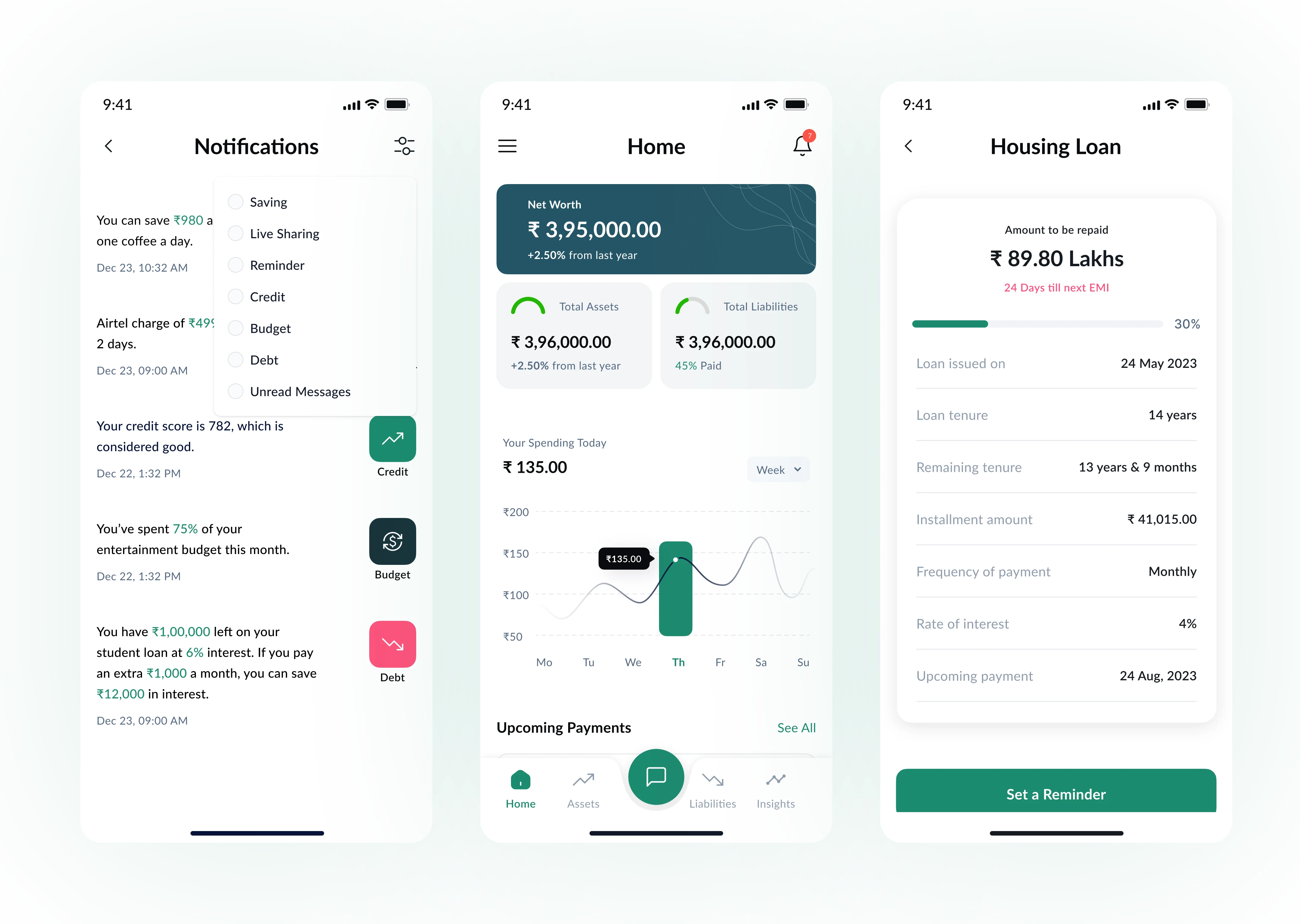

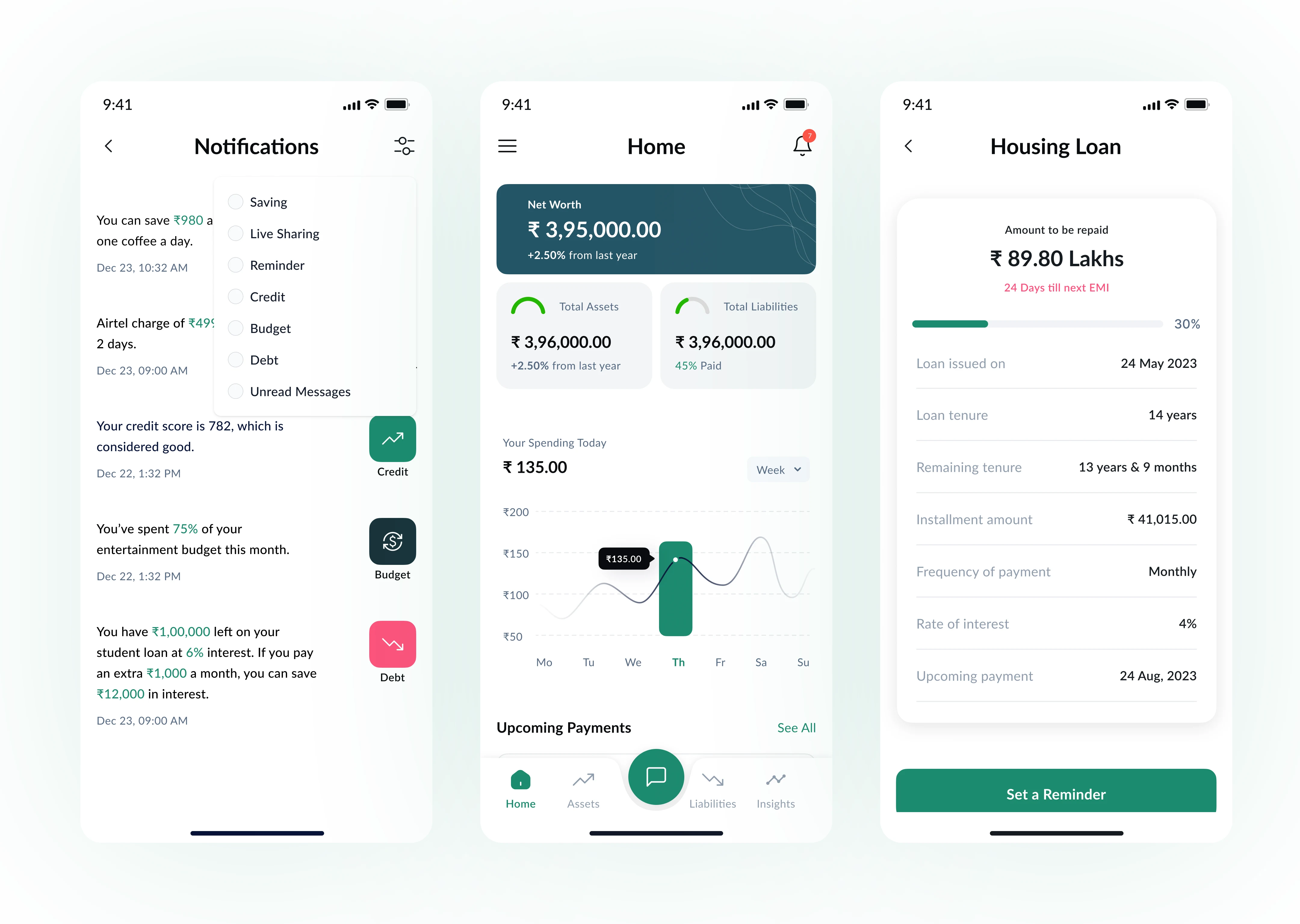

Feature: The All-in-One Financial Dashboard: The "Home" screen provides a comprehensive, real-time overview of the user's financial status, designed for quick insights and proactive management.

Intelligent Notifications: The system automatically filters and categorizes all financial notifications (e.g., savings updates, life insurance premiums, bill reminders) to reduce clutter and highlight what's important.

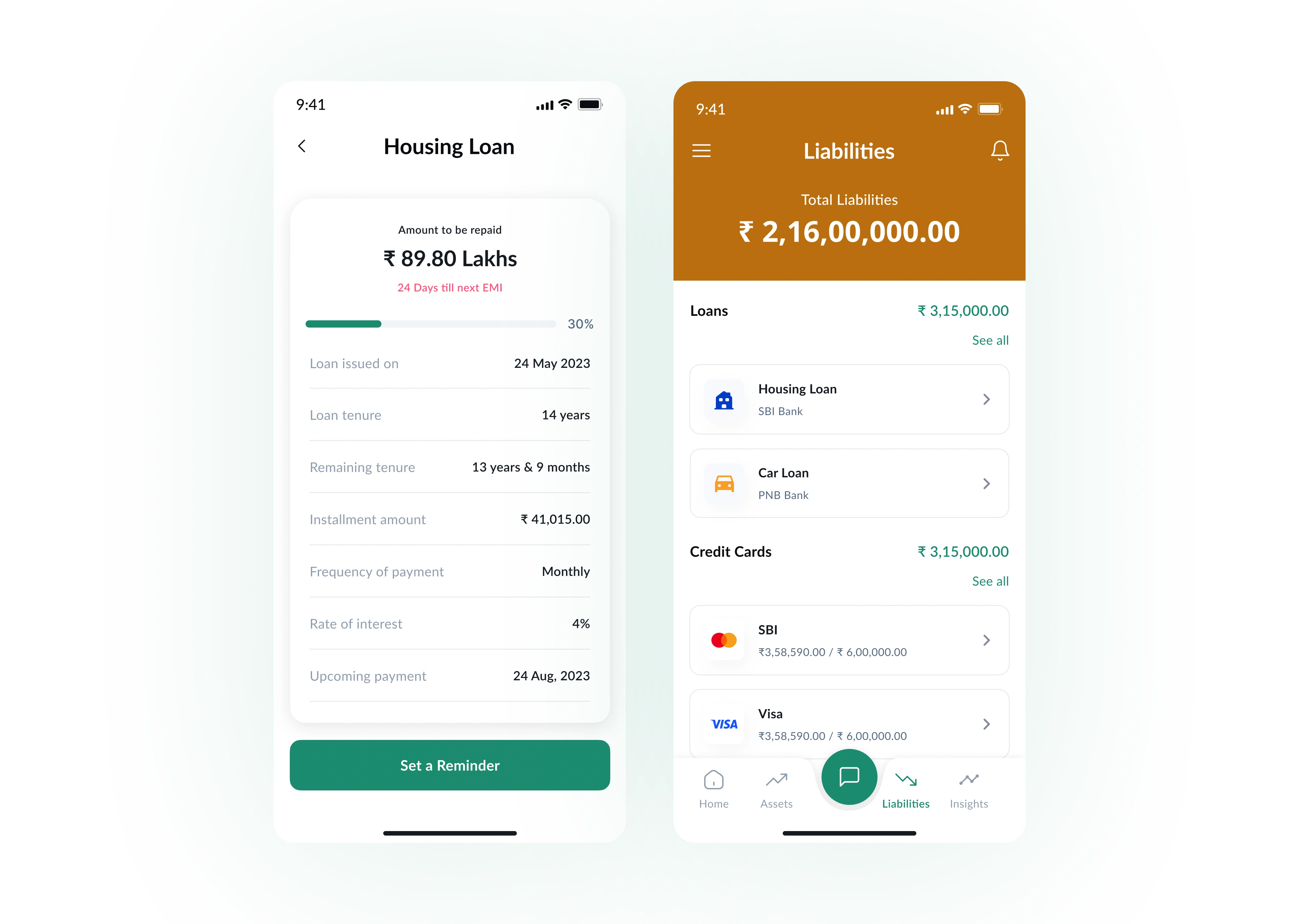

Proactive Loan Management: A dedicated section for loans details the outstanding amount and the next EMI due date. Users can also set personalized reminders for their loan payments to avoid missing them.

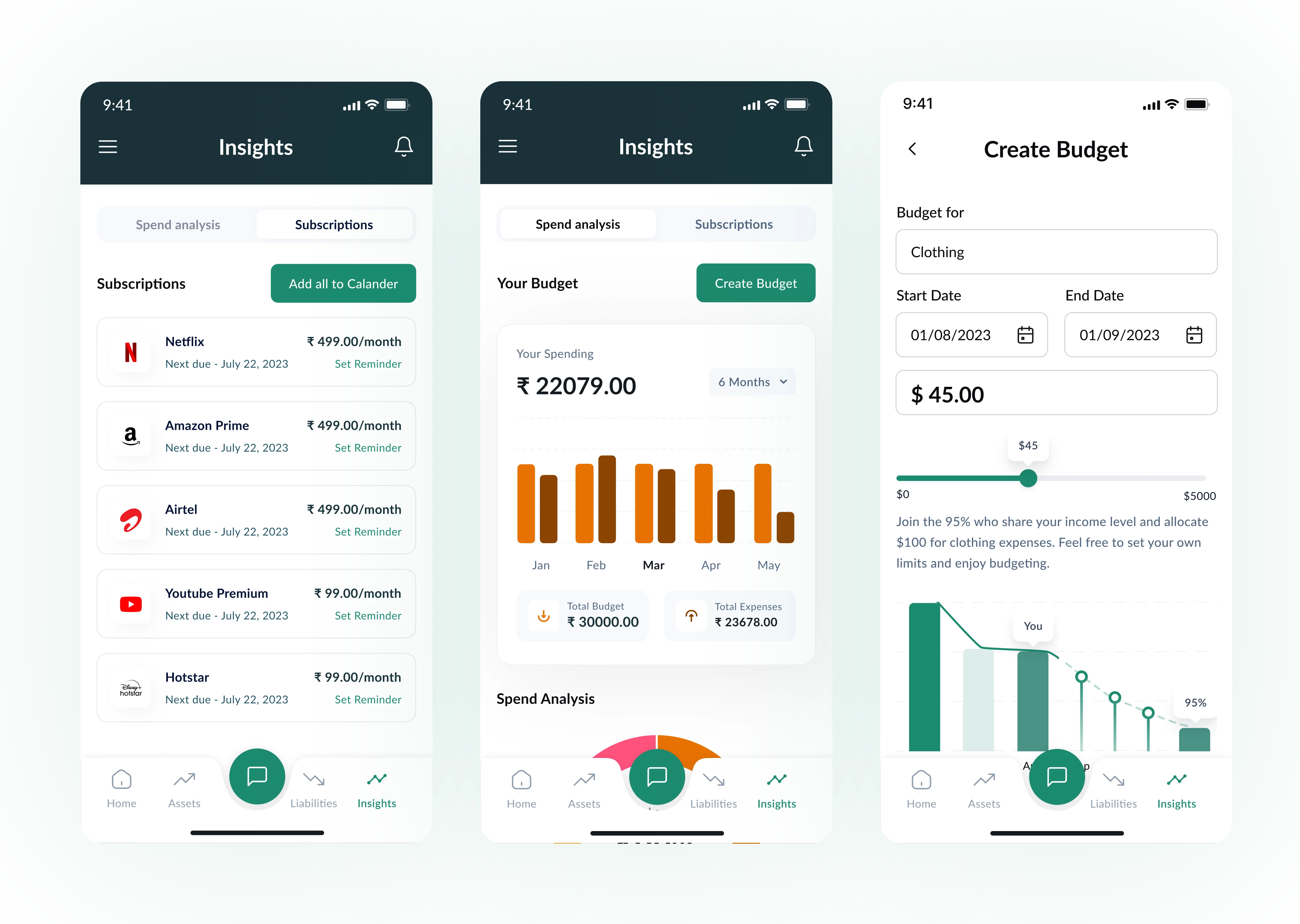

Feature: AI-Powered Budgeting and Subscription Insights

The app offers an advanced insights engine that automatically tracks all recurring subscriptions like Netflix.

Users can set renewal reminders or add them to a calendar, empowering them to cancel unwanted services.

All financial data is visualized through clear charts for easy analysis. The core of this feature is an AI-driven budgeting tool that forecasts potential monthly savings based on user-created budgets, helping them make smarter financial decisions.

Feature: Unified Liability Tracking

To provide a complete financial picture, the app includes a dedicated section for tracking all liabilities. It consolidates outstanding debts, including personal loans, credit card balances, and other dues into a single, clear dashboard.

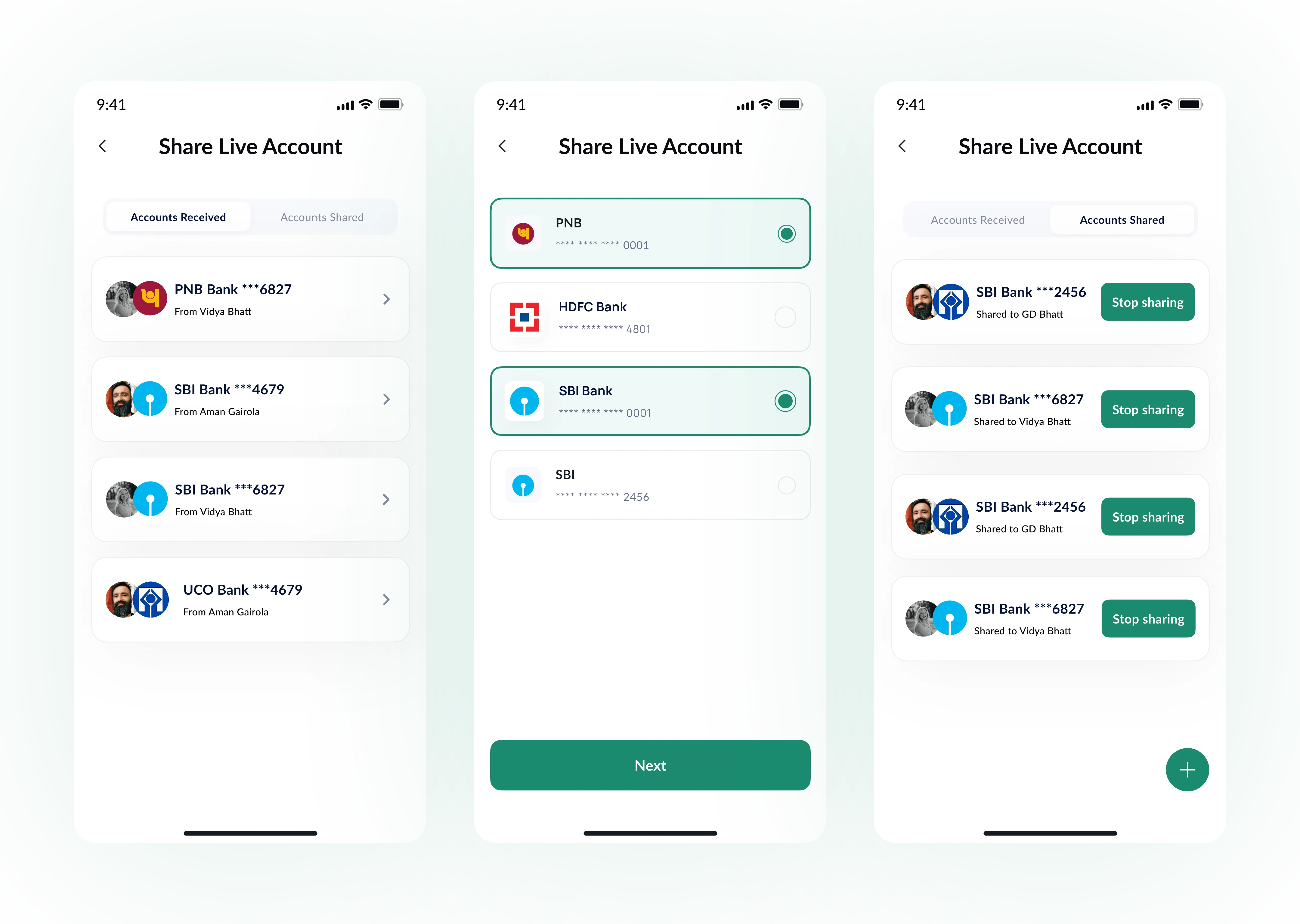

Feature: Secure and Selective Financial Sharing

The app introduces a secure sharing feature, allowing users to grant trusted contacts, like family members, live access to their financial data. The key innovation is granular control: users can select exactly what information to share such as transaction history or account balances and what to keep private. This facilitates collaborative financial management without compromising individual privacy.

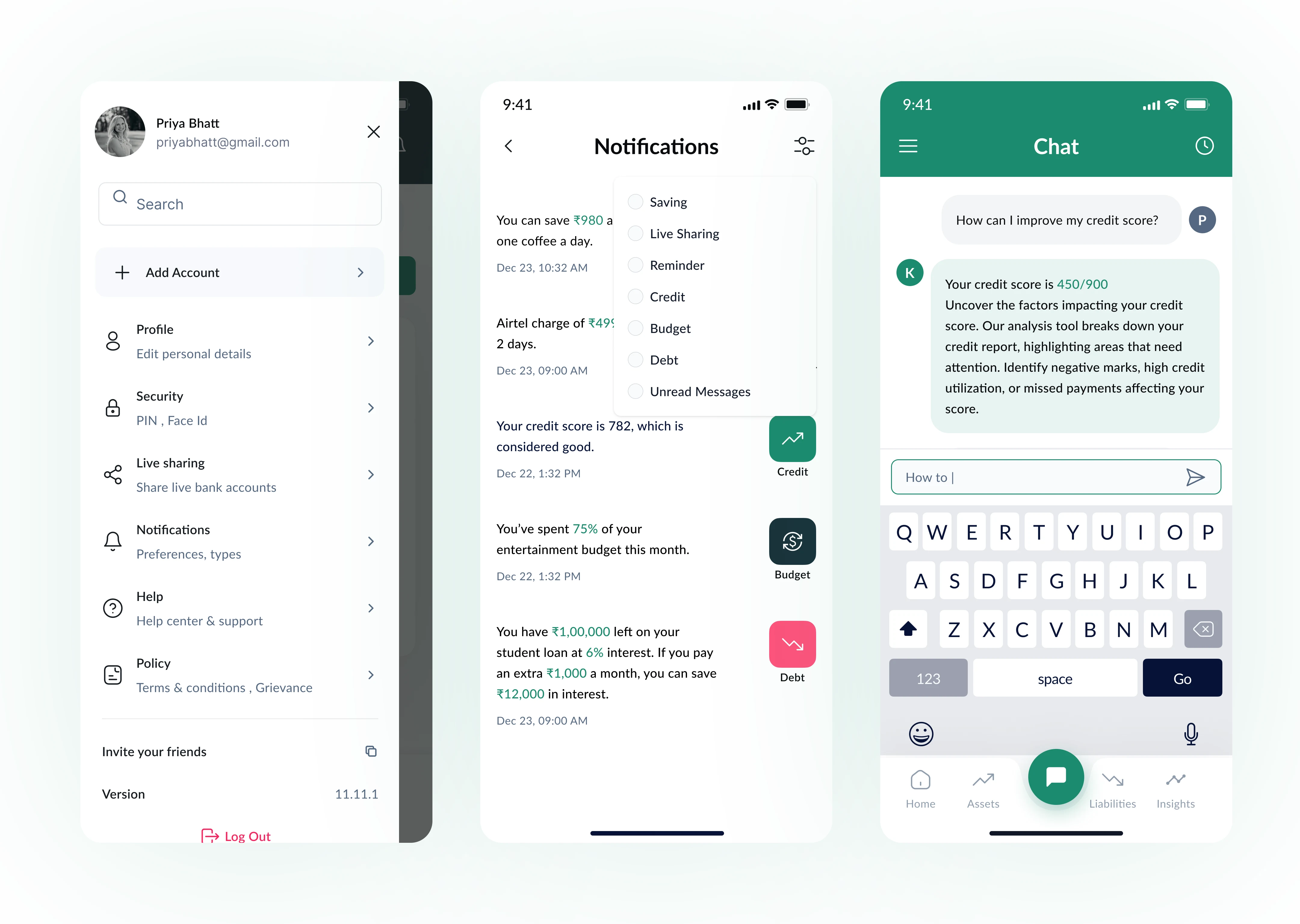

Feature: Centralized Control & AI Financial Assistant

The app centralizes all core functions within an intuitive navigation drawer, giving users one-tap access to settings for their profile, security, notifications, and sharing preferences. The standout feature is an integrated AI chat assistant.

Users can ask complex, natural-language questions about their finances and receive personalized advice, such as actionable strategies to improve their credit score, directly within the app.