Retail Banking Customer Default Probability

Background: This research focuses on predicting credit card default, specifically examining

instances of more than 90 days of past due. Utilizing Exploratory Data Analysis

(EDA) and Machine Learning in Python, complemented by graphical representations

in Python and Tableau.

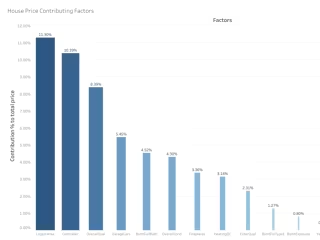

Objectives: Identify key factors influencing the probability of default, such as age, debt ratio,

monthly income, open credit lines, dependents, and past due occurrences in the

past 2 years.

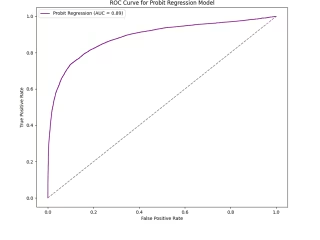

Methods: Employing a Probit model, achieving a 93% accuracy, and an AUC-ROC curve of 0.7, indicating good explanatory power and potential adverse selection of credit

card issues up to 7%.

Results: Significant variables include age, debt ratio, monthly income, open credit

lines, dependents, and past due occurrences. The Probit model demonstrates a

high accuracy of 93%, with the AUC-ROC curve confirming its robust explanatory

power.

Conclusion: This research highlights demographic and financial factors crucial for predicting

credit card default. The developed Probit model offers a reliable tool, with a

93% accuracy, potentially reducing adverse selection in credit card issuances.

See the full project at https://github.com/georgeoiko3/Personal-Projects/blob/main/Pj1-Report.pdf

Like this project

Posted Mar 3, 2024

Discovering determinants of default probability using EDA and Machine Learning in Python.

Likes

0

Views

0