Classification Algorithms for Identifying Neighborhood Typology

1

— Home vacancies remain a major problem that

many medium-large cities deal with. They use up valuable land,

are often uninhabitable, cause a tax burden on the city, and bring

down property values for the neighborhoods they are in. This

paper explores the assumption that there is a relationship

between home vacancy and the level of distress within their

neighborhood. We will use a 2011 Housing Market Typology

report from Baltimore Open Data to analyze whether or not

certain classification algorithms can be implemented to classify

the typology of a neighborhood with the hopes of being able to

apply this algorithm in future studies to help predict

neighborhood statuses based on real-time housing metrics.

I. INTRODUCTION

In 1950, Baltimore’s population was recorded at just under

a million people and it ranked as the sixth largest city in the

United States. Today, Baltimore’s population is around

620,000 representing a 35% decline in the city’s population

over the last 60 years. The result of this dramatic decrease in

population is that the city contains an inflated amount of

vacant homes. According to an article in

2014, Baltimore has upwards of 16,000 vacant homes and

vacant homes outnumber homeless people 6 to 1. While the

city has tried for years to address this issue, most policies have

fallen short of making a large-scale difference in the problem.

One philosophy to solving the problem of vacant homes is to

increase the property value of the surrounding area, thus

incentivizing people to move in and either renovate or replace

these homes.

Using the 2011 Housing Market Topology dataset from

Baltimore Open Data, we are attempting to create a model that

accurately predicts the market category that a neighborhood

will fall into based on a variety of other indicators.

In the paper that follows, we will provide a description of

the dataset, results from our EDA (exploratory data analysis),

develop a training and testing dataset, and then run three

classification algorithms against the testing dataset to

determine the best possible classification model for our

experiment.

II. DATASET DESCRIPTION

Open

Baltimore

Baltimore that provides free datasets relating to the city. The

dataset is called “2011 Housing Market Typology” and was

created in order to inform neighborhood planning efforts, also

informing residents of the local housing market conditions in

their communities. The entire dataset has 626 records,

contains 12 fields, and can be found by going to the following

Below each of the fields will be described in detail.

blockGroup

Baltimore census block groups can be found at

marketCategory

of the following groups…

Regional Choice

markets with high owner-occupancy and

high property values

Middle Market Choice –

above the city average with strong

ownership rates, low vacancies, but slightly

increased foreclosure rates

Middle Market –

as well as high ownership rates. Higher

foreclosure rates, with slight population

loss.

Middle Market Stressed –

home sales than city average and have not

shown significant sales price appreciation.

Vacancy and foreclosure rates are high and

the rate of population loss has increased.

Distressed –

housing stock. Contains high vacancy and

the lowest homeownership rates. Most

substantial population loss.

sales20092010 –

from 2009 to 2010.

salesPriceCoefficientVariance –

standard deviation from 2009-2010 divided the mean

sales price from 2009-2010.

commericalResidentialLandRatio –

and institutional land area divided by residential land

area.

unitsPerSquareMile –

square mile.

residentialPermits –

equal to $50,000 divided by residential lots plus

vacant lots.

Analysis of 2011 Housing Market Topology

Data for the City of Baltimore

Robert Brasso

2

vacantLots –

residential plus vacant lots.

vacantHouseNotices –

divided by residential plus vacant lots.

foreclosureFilings –

2010 as a percentage of privately owned residential

lots.

medianSalesPrice20092010 –

price for homes in census block from 2009-2010.

ownerOccupied –

residential units that are owner occupied.

III. EXPLORATORY DATA ANALYSIS

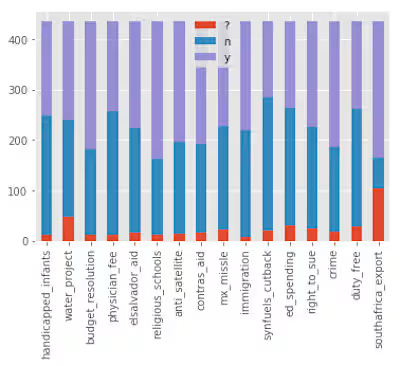

Beginning our exploration of the dataset, the first piece of

information we needed was the breakdown of the amount of

records for each of the market classifications. 209 of the

census blocks were reported as Distressed, 117 as Middle

Market Choice, 114 as Middle Market Stressed, 94 as

Regional Choice, and 92 as Middle Market.

The next task was to take a look at all of the specific

attributes and identify how they interact with each other. In

figure 2.1 (end of paper) you will see a scatter matrix of all of

the attributes. The attribute names have been adjusted slightly

for readability. From a review of the very large scatter matrix,

there were a handful of relationships I wanted to explore

further. Below are a series of box plots used to analyze these

relationships.

The first relationship examined was between market

categories and Vacant Land Percentage. Based on the above

figure, it appears there is a higher percentage of vacant homes

in the distressed and middle market distressed neighborhood

blocks.

Additionally, on the next boxplot we see that the owner-

occupied rates for those neighborhoods is significantly less

than the others.

Additionally, it appears that the sales price coefficient may

be a significant indicator of distressed and middle market

stressed communities.

While there are likely more relationships that could be

identified, it is fair to say that the attributes in this dataset

provide some insight to the classification they have and

3

therefore will be a good candidate for our classification

algorithm testing.

IV. CLASSIFICATION MODELS

Our goal with testing the following classification algorithms

is to isolate and algorithm that will accurately classify housing

categories based on a variety of statistics. Once we have

identified the best algorithm, we can identify how the values

entered into the algorithm impact the classification, however

that is beyond the scope of this paper. Future research can use

this algorithm to identify the key indicators that describe

neighbors and attempt to provide early detection when

neighbors begin to fall into distressed and middle market

distressed categories

For testing this data against the classifier algorithms, we

used a 70/30 split to create our training and testing datasets.

The three algorithms we will be analyzing are K Nearest

Neighbors, Random Forest, and Naïve Bayes. Below are

descriptions of the results from each of our algorithm testing

A. K Nearest Neighbors

For K Nearest Neighbors we set the distance measure as

Euclidian distance and first set N = 2. The initial results from

N = 2 were promising, but in order to maximize the accuracy,

recall, and precision, we wanted to test how various N values

impacted the results. Below is a chart of the N values and their

corresponding metrics.

N - Value Accuracy Precision Recall F-Score

1 .9521 .95 .95 .95

2 .9521 .95 .95 .95

3 .9468 .95 .95 .95

4 .9628 .96 .96 .96

5 .9521 .95 .95 .95

6 .9521 .95 .95 .95

7 .9415 .94 .94 .94

After testing several values of N, we see that the best results

came from N=4. While the algorithm clearly works well with

all values of N under 7, performance appeared to be optimized

at N=4. The lowest performance was when N=7 and leads me

to believe that even higher values of N would result in lower

scores. To test that, I re-ran the algorithm with N=50 and

while the scores were lower than N=4, they were almost

identical to N=7.

B. Random Forest

Similar to our testing for K Nearest Neighbors, we will

make a chart of the accuracy, precision, recall, and F Scores

where the N_Estimator value is changed. Below is our test

results for Random Forest.

N_Estimator Accuracy Precision Recall F-Score

5 .8830 .89 .89 .89

10 .8883 .89 .89 .89

50 .9149 .92 .91 .91

100 .9521 .95 .95 .95

150 .9309 .93 .93 .93

200 .9309 .93 .93 .93

300 .9309 .93 .93 .93

For the Random Forest algorithm, it appears that the best

we can do is .9521 accuracy with a .95 f-score. While these

values are very strong, they fall short of K Nearest Neighbors

when N=4. Our optimized value for Random Forest appears to

be when N_estimator = 100.

C. Naïve Bayes

Plugging our training and testing datasets into the Gaussian

Naïve Bayes model, we received the following scores;

accuracy = .9309, precision = .94, recall = .93, and f-score =

.93.

V. CONCLUSION

After reviewing all of our data it became evident that all of

the algorithms we tested do a fair job at classifying data into

the various housing categories. However, the clear winner of

our testing is K Nearest Neighbors which got us up to a .96 f-

score with .9628 accuracy. Beyond that, K Nearest Neighbors

was also the most accurate in all of those scores for each of the

individual classification categories. Comparatively, while the

Naïve Bayes model was close in terms of overall scores, it

performed relatively poorly when classifying regional choice,

providing a precision score of .79, which was the lowest score

seen for any category during this testing. This leads me to

believe that the best algorithm of the ones we tested for this

dataset is K Nearest Neighbors, while Naïve Bayes was the

worst.

REFERENCES

FIGURES

2.1

Like this project

Posted Aug 24, 2024

Used several classification algorithms to identify which would be best at classifying neighborhoods based on reported economic factors.

Featured on