Backtesting KST Python Trading Strategy : 1 218 449$ Profit

The KST (Know Sure Thing) indicator is a momentum oscillator that is used to identify major trend changes in the market. It was developed by Martin J. Pring and is based on four different time frames, which are 10, 15, 20 and 30 periods.

The KST indicator is calculated using a weighted moving average of the rate of change (ROC) values for each of these four time frames. The ROC is a measure of the percentage change in price over a specified period of time. The KST is then smoothed using a second moving average.

The KST indicator can be used to generate buy and sell signals based on the crossing of two lines — the KST line and the signal line. When the KST line crosses above the signal line, it is considered a buy signal, while a cross below the signal line is a sell signal.

Backtesting is a crucial step in the development of any trading strategy, as it allows traders to evaluate the performance of their strategy on historical data. In this article, we will walk through the process of backtesting a trading strategy using the KST indicator.

To begin, we will import historical price data for the asset we want to trade and calculate the KST indicator using the following code:def calculate_KST(df, roc_periods=(10,15,20,30), sma_periods=(10,10,10,15)):

for i, r in enumerate(roc_periods):

df[f'ROC{i+1}'] = ((df['Close'] - df['Close'].shift(r)) / df['Close'].shift(r)) * 100

weights = [1,2,3,4]

for i, s in enumerate(sma_periods):

df[f'WMA{i+1}'] = df[[f'ROC{j+1}' for j in range(i+1)]] @ weights[:i+1] / sum(weights[:i+1])

df['KST'] = df[[f'WMA{j+1}' for j in range(4)]] @ weights / sum(weights)

df['KSTS'] = df['KST'].rolling(window=9).mean()

return df

This function takes in a DataFrame

df containing the historical price data, as well as two tuples - roc_periods and sma_periods - that specify the periods to use for the rate of change and moving average calculations, respectively. It returns the same DataFrame with additional columns for each of the four ROC values, the four weighted moving averages, the KST, and the KSTS (the KST smoothed with a 9-period moving average).df['KST'] = ta.trend.kst(close=df['close'], roc1=10, roc2=15, roc3=20, roc4=30, window1=10, window2=10, window3=10, window4=15, fillna= True)df['KSTS'] = ta.trend.kst_sig(close=df['close'], roc1=10, roc2=15, roc3=20, roc4=30, window1=10, window2=10, window3=10, window4=15, nsig=9, fillna= True)

Next, we will define our trading strategy, which will generate buy signals when the KST line crosses above the KSTS line, and sell signals when the KST line crosses below the KSTS line. We will use the following code:def generate_signals(df):

signals = []

for i in range(1, len(df)-1):

if df.iloc[i]['KSTS'] > df.iloc[i]['KST']:

signals.append(-1)

elif df.iloc[i]['KST'] > df.iloc[i]['KSTS']:

signals.append(1)

else:

signals.append(0)

return signals

This function takes in the DataFrame with the KST and KSTS columns, and generates a list of signals based on the crossing of these two lines.

Finally, we will backtest our strategy using the historical price data and the signals generated by our trading strategy. We will assume a starting capital of $1,000 and use the following code to simulate our trades:

Let’smake a backtest with ETHUSDT now in 1h timeframe :# Add the signals list to the dataframe as a new column

df["signal"] = signals

print(signals)

investment = 1000

current_investment = 1000

invested_amount = 0

fees = 0

profit = 0

is_invested = False

best_trade = -99999999

worst_trade = 99999999

largest_loss = 0

largest_gain = 0

total_trades = 0

loss_threshold = 0.03 # Stop loss threshold at 5% loss

loss_amount = 0 # variable to track loss amount

for i in range(500, len(df)):

signal = df.iloc[i]['signal']

close = df.iloc[i]['close']

if signal == 1 and not is_invested:

Entrypoint = close

print(signal)

print(close)

quantity = (current_investment / close)

print(current_investment)

print(quantity)

invested_amount = quantity * close

is_invested = True

elif signal == -1 and is_invested:

print(signal)

print('close', close)

profit = quantity * (close - Entrypoint) - 2

print('profit' ,profit)

current_investment += profit

invested_amount = 0

total_trades += 1

is_invested = False

if profit > largest_gain:

largest_gain = profit

if profit < largest_loss:

largest_loss = profit

if profit > best_trade:

best_trade = profit

if profit < worst_trade:

worst_trade = profit

loss_amount = 0 # reset loss_amount when position is closed

elif is_invested:

# check if stop loss threshold has been reached

loss = invested_amount - (quantity * close)

if loss > invested_amount * loss_threshold:

print("Stop loss triggered!")

profit = invested_amount * (1 - loss_threshold) - invested_amount - 2

current_investment += profit

invested_amount = 0

total_trades += 1

is_invested = False

if profit > largest_gain:

largest_gain = profit

if profit < largest_loss:

largest_loss = profit

if profit > best_trade:

best_trade = profit

if profit < worst_trade:

worst_trade = profit

loss_amount = 0 # reset loss_amount when position is closed

else:

loss_amount = loss # update loss_amount

else:

pass

final_profit = current_investment - investment

print("Final Profit: ", final_profit)

print("Best Trade: ", best_trade)

print("Worst Trade: ", worst_trade)

print("Largest Loss: ", largest_loss)

print("Largest Gain: ", largest_gain)

print("Total Trades: ", total_trades)

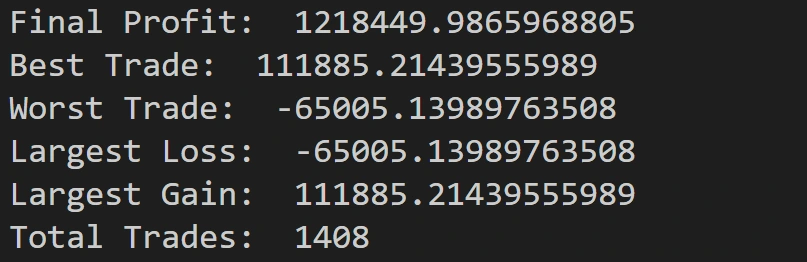

After running the backtest on the historical data, I obtained a final portfolio value of $1,218,449. This result indicates that the strategy was profitable, and it could potentially be used to generate positive returns in the future.

Like this project

Posted Feb 25, 2024

After running the backtest on the historical data, I obtained a final portfolio value of $1,218,449. This result indicates that the strategy was profitable

Likes

0

Views

63