Credit Risk Management & Boost Efficiency with 6 Sigma

Project Details:

The 6 Sigma financial system is a comprehensive solution designed to empower banks and corporations to navigate the evolving financial landscape. It tackles challenges like Basel regulations, IFRS 9, and credit risk assessment (ICAAP).

Key Features:

Modular Design: Cater to various banking needs with modules like ESG, EMM, PRR, Credit Processing, and more.

Automated Workflows: Streamline credit applications, obligor due diligence, and exposure management processes.

Data-Driven Risk Assessment: Leverage AI and advanced analytics for accurate risk ratings and portfolio insights.

Regulatory Compliance: Ensure adherence to Basel, IFRS 9, and other critical regulations.

Enhanced Reporting: Generate comprehensive reports with Green Asset Ratios, ECL calculations, and more.

Benefits:

Reduced Risk: Mitigate credit risk through improved due diligence and portfolio analysis.

Improved Efficiency: Automate workflows and free up resources for strategic tasks.

Faster Decision-Making: Gain data-driven insights for quicker and more informed decisions.

Regulatory Compliance: Meet regulatory requirements with confidence.

Cost Savings: Reduce operational costs through process automation and improved efficiency.

Target Audience:

Banks (retail, corporate, investment)

Financial Institutions

Corporates with complex credit needs

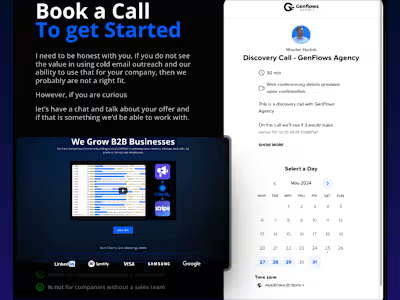

Schedule a Free Consultation: Make it easy for potential clients to take the next step with a clear call to action.

Like this project

Posted May 25, 2024

The 6 Sigma financial system empowers banks and corporates to tackle credit risk challenges. It offers modules for ESG compliance, credit processing, and exposu