Built with Bubble

Creator Lending App with $65Mn+ transactions — Built from MVP

This app is currently live. Can share link in DM

My Role

Senior Bubble Developer

Introduction

This company revolutionizes financing for creators. By developing credit models that assess loan eligibility using advanced data, addressing the gap left by traditional banks. As India's first creator financing platform, they’ve already provided over $45 million in loans to content producers, from influencers to movie makers.

Features I Built

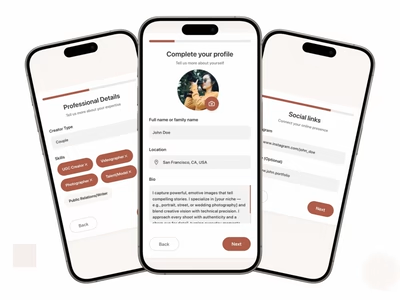

Single-Step Onboarding

Financial Data Integration

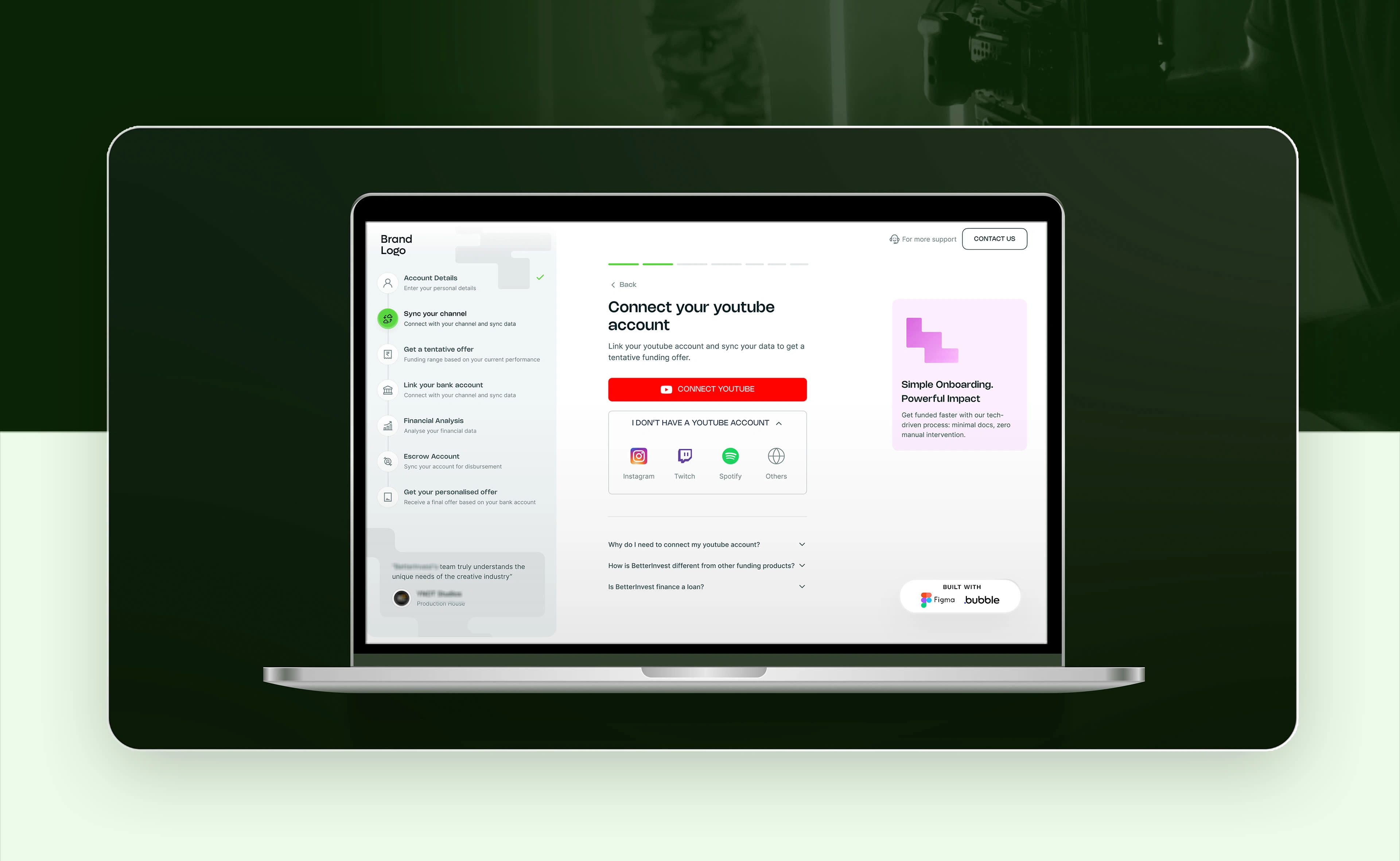

Real-Time Content Performance Data

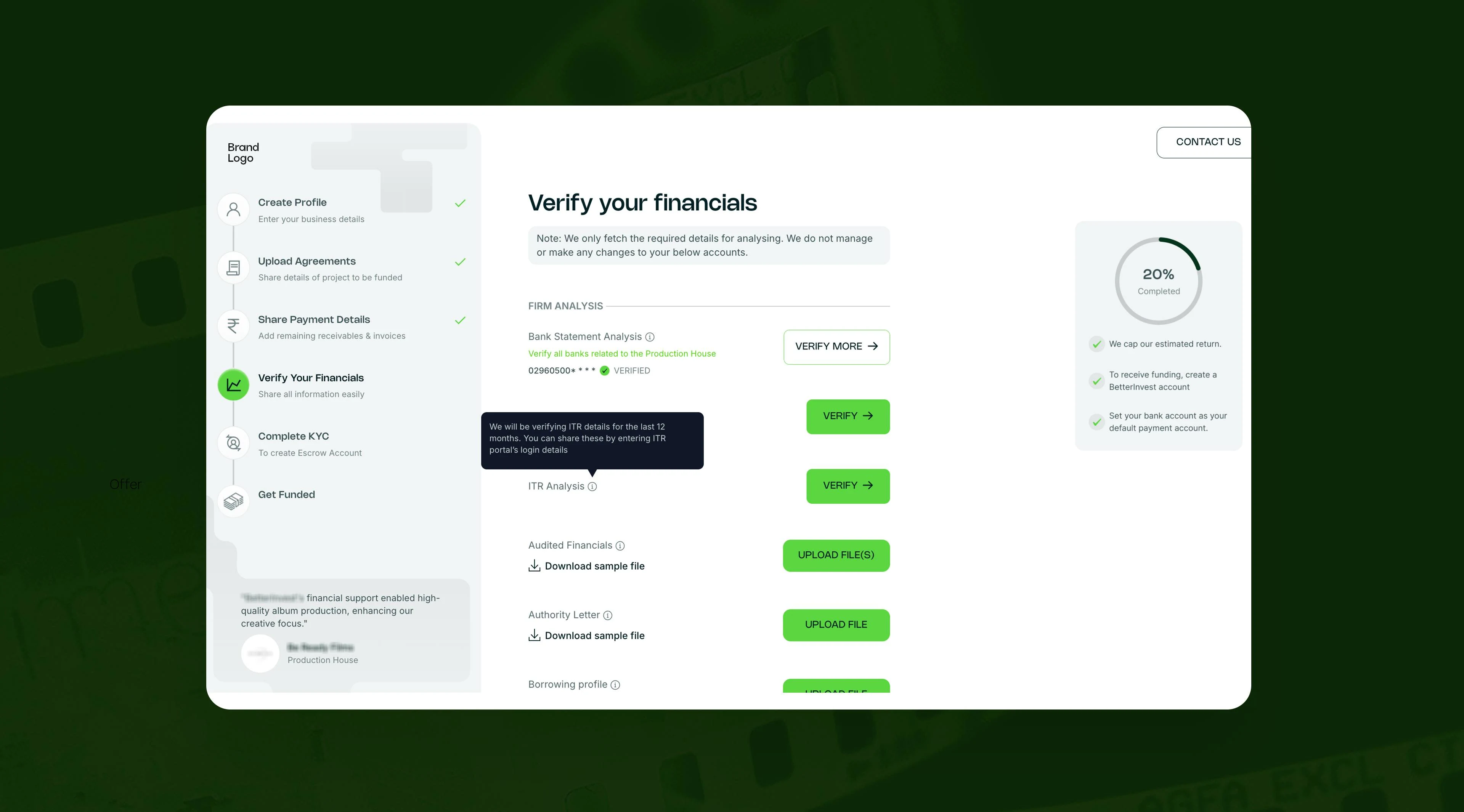

End-to-End Data Verification

Credit Score Generation Module

Comprehensive Admin Dashboard

It felt like they were truly part of my team, which made a big difference. They got the problem I was aiming to solve with my app and even took the time to come up with new ideas and features.

~ Sriram, Product Lead

Client Requirement

The company initially processed loan applications manually, requiring 15+ documents and over 30 pieces of information via email. This slow process took two weeks for approval. They aim to streamline this by fully digitizing the loan application process.

Design Process

The team needed a loan application and creator onboarding product that gathers, processes, and verifies information with government sources via APIs. The app must be user-friendly with a seamless experience.

1. Ideation & User Research

We discussed current onboarding processes and interviewed two content producers to understand the challenges. A process flow chart was created to align all stakeholders.

2. Competitor & Relevant Industry Research

We researched US and European platforms and analyzed Indian loan apps like Yubi and Recur to gather industry best practices tailored to the Indian market.

3. Creating User Journeys

We designed simple user journeys to streamline loan applications, minimizing input effort. These journeys, created in Miro and Whimsical, were approved by the Product Lead and sent for development.

Features In Detail

In two months, we built a creator onboarding app with 10+ integrations, real-time data retrieval, validation with sources, and a user-friendly admin dashboard—developed using Bubble.

1. Single-Step Onboarding

Previously, creators provided 15+ details for onboarding. Now, they just share their government ID, and the rest is auto-filled. The process now takes under a minute.

2. Financial Data Integration

We integrated an automated bank statement analyzer, allowing users to provide consent via net banking credentials or OTP, generating detailed reports for risk rating and credit scoring.

3. Real-Time Content Performance Data

We integrated a Universal Creator API to onboard influencers and track their social media data across platforms in real-time.

4. End-to-End Data Verification

We integrated multiple 3rd party APIs to verify personal, company, and financial data from official government databases, reducing fraud and ensuring user credibility.

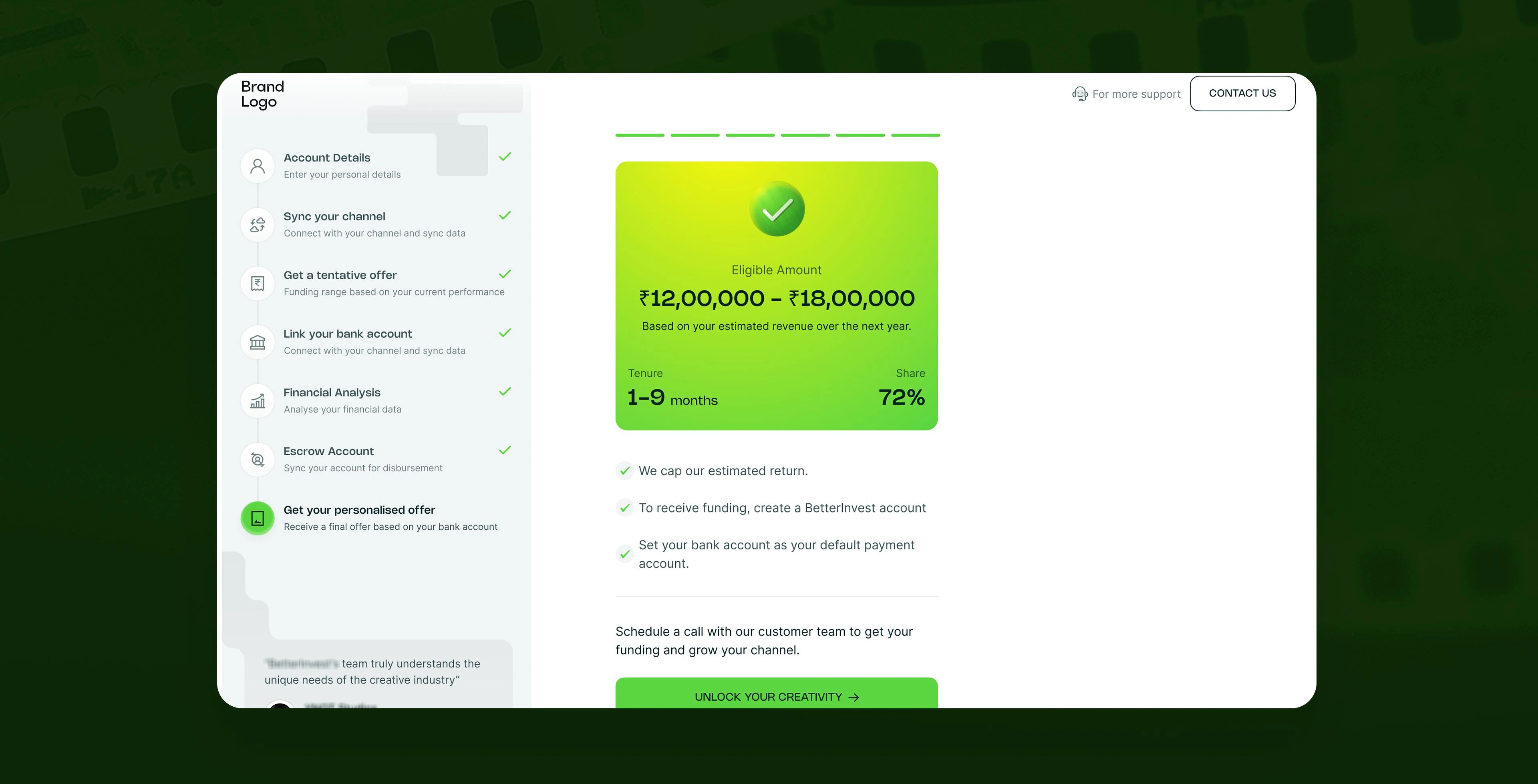

5. Credit Score Generation Module

Collected data is processed to generate a credit score, automating and speeding up the previously tedious loan approval process.

6. Comprehensive Admin Dashboard

This central hub allows the Risk team and Creator Onboarding team to manage loan applications, with admins reviewing each application and accessing all relevant data.

Like this project

Posted Oct 15, 2024

India’s first platform dedicated to financing creators of all sizes, from social media influencers to movie producers. The company needs a "Loan Application &

Likes

0

Views

55