ACH Payments for Cannabis Dispensaries: A Comprehensive Guide

Note: This article was originally published on LinkedIn and can be accessed via this link.

This past April, the DEA moved to reschedule cannabis from a Schedule I to a Schedule III Drug, leaving some retailers to wonder if there will be relief for payment restrictions. However, until cannabis gets removed from the list of regulated drugs, there will always be banks ready to block dispensaries for fear of legal trouble.

Luckily, there’s a current solution for your dispensary. In this article, we’ll walk you through the most compliant digital payment type. Explore ACH payments, how they operate, and how they benefit the cannabis industry.

Compliance, Payment Rails, and FinCEN

Payment rails refer to the infrastructure or platforms that enable funds transfer between financial institutions, facilitating payments, transfers, and settlements. They can vary based on the payment type, speed, technology, or location. These payment rails are the backbone of the financial system, allowing money to move efficiently between the payer and payee.

ACH transactions operate on federally regulated rails, making them a safe and compliant payment option in industries where regulatory compliance is crucial. ACH processing follows the 2014 FinCEN guidelines, allowing banks to participate in legal markets with cannabis businesses.

Mastercard and VISA, however, strictly prohibit cannabis transactions. Since Mastercard and Visa own their payment rails, they can shut down specific transactions.

How do ACH payments work?

Due to federal regulations, traditional banking services--including credit card processing--are often unavailable to cannabis-related businesses. ACH payments remain the most secure choice for cannabis retailers, mainly due to the digital technology that helps this payment type process. “ACH” stands for Automated Clearing House, a US financial network that enables funds to be transferred directly between bank accounts.

Overseen by NACHA (National Automated Clearing House Association), ACH payments are direct and don’t require wire transfers, checks, cash, or card networks.

ACH is also known as EFT or electronic bank transfer. Likely, you’ve already sent or received some form of ACH payment because they are common. You’re probably familiar with these digital payments from deposits like payroll, reimbursements, tax refunds, bill payments, and peer-to-peer transfers.

How long do ACH payments take to process?

NACHA operates with two time periods: Same Day and Next Day ACH. Next Day ACH gives the banks three business days to process the transmission receipt of an ACH transfer. Same Day ACH is an expedited solution that gives the bank 48 hours to process each transaction. Same Day ACH processes daily batches before 3 pm EST.

Now NACHA shares in their article The ABCs of ACH, “Same Day ACH went live in 2016 and has grown in popularity as innovation continues.” Retailers benefit from Same Day ACH, as the expedited processing speed opens cashflow in a business that typically runs on net terms.

Future NACHA and Federal Reserve offerings

The President and CEO of the Federal Reserve has requested comments to expand the operating days of NACHA to include weekends and holidays operating seven days a week. The support of the National Settlement Service (NSS) could allow for even faster processing times.

In addition to potentially expanding the NACHA operating hours, banks and credit unions can soon take advantage of the FedNow Service that will allow these institutions to "send and receive instant payments in real time, around the clock, every day of the year.

Financial institutions and their service providers can use the service to provide innovative instant payment services to customers, and recipients will have full access to funds immediately, allowing for greater financial flexibility when making time-sensitive payments.” This service is still in the early testing phase and might not extend to the cannabis industry.

Why does my dispensary need ACH payments?

ACH is not just the future of cannabis payments; it's a present necessity for retailers. By partnering with an ACH provider, dispensaries can offer their customers a convenient payment experience, increasing loyalty and driving growth while staying compliant and reducing costly downtime.

Adding ACH payments to your dispensary boosts:

Checkout efficiency: ACH payments streamline the checkout process, making it faster and more convenient than dealing with cash or facing the uncertainties of card payments.

Spending flexibility: ACH allows your customers the freedom to make larger purchases, leading to higher overall revenue.

Payment security: Nacha reports that it returns fewer than 0.03% of ACH transactions because they're unauthorized. That means that ACH payments are safer than wire transfers or card payments. With a dispensary payment tool like Spendr, the receipt of your payments is guaranteed, and you also get the added double-encrypted security of Plaid when linking your business bank account.

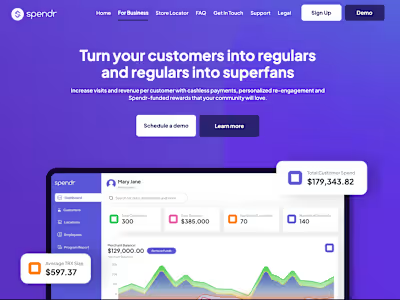

Access to customer incentives: You can only access ACH payments through a mobile app or web interface. Partnering with an ACH app like Spendr makes it easier to incentivize your customers through rewards, dispensary promo outreach, and more. You’ll want a tool to encourage repeat visits in legal markets where competition is fierce.

Let Spendr do the work and watch your ATV grow.

Spendr processes bank-to-bank transfers using Same Day ACH within 24-48 hours. You’ll feel confident and have better control of your business funds. Plus, Spendr provides rewards that incentivize your customers to buy more cannabis at a time and visit Spendr retailers more often. Our partners report a 22-25% increase in average order value.

Disclaimer: This article is intended for informational purposes only and should not be considered legal advice. Consult your state's up-to-date regulations for more.

Like this project

Posted Sep 19, 2025

Explored ACH payments for cannabis dispensaries, highlighting benefits and compliance.

Likes

0

Views

2

Clients

Spendr