1,700-word blog for Hive: What is an EORI number? A guide

When importing or exporting goods within the European Union (EU), an essential requirement is to obtain an EORI number.

The EORI number is a unique identifier assigned by customs authorities to companies doing business throughout the EU. In this article we provide you with a complete guide to EORI numbers, including:

What is an EORI number?

Do I need an EORI number?

When do I need to use my EORI number?

What if I do not have an EORI number?

What information do I need before applying for an EORI number?

How to apply for an EORI number: get an EORI number in 8 simple steps

How long does it take to get an EORI number?

Looking for a fulfillment solution to carry your products throughout Europe?

What is an EORI number?

An Economic Operators Registration and Identification Number, or EORI number, is a unique numbering system used by customs officials and other authorities across the European Union. The number is used by customs authorities as a unique identifier for people or businesses involved in customs procedures to quickly exchange information.

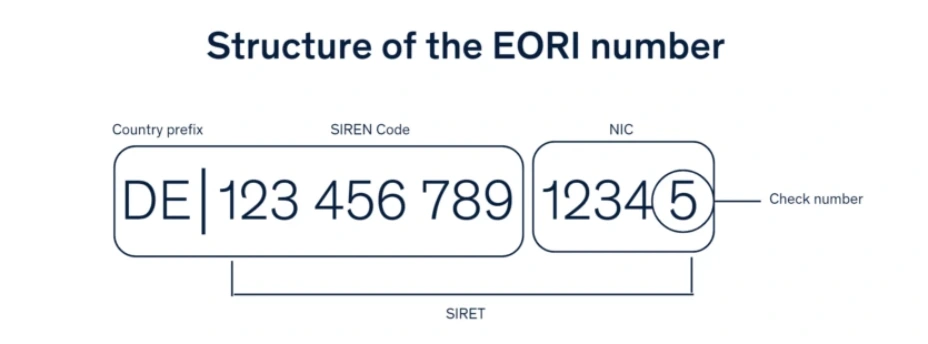

EORI numbers feature two parts:

The country code of the issuing Member State.

A code or number that is unique to the Member State.

Examples of EORI number

Up to 17 characters can be used in an EORI number, and each country assigns EORI codes differently.

For example, a German EORI code features the letters DE followed by 14 numbers - DE 123456789 12345.

An EORI number that starts with NL followed by 9 digits will be for the Netherlands, for example, NL123456789. The 9 digits represent a company's fiscal code.

A UK EORI has 12 digits after the letters GB. For example, GB123456789000. The digits in a UK EORI number typically represent an organization's VAT number if they are VAT registered.

To distinguish goods originating from Northern Ireland and Great Britain, a separate EORI code exists known as an XI EORI number. The XI code is used as a prefix for EORI numbers assigned to individuals or companies originating from Northern Ireland.

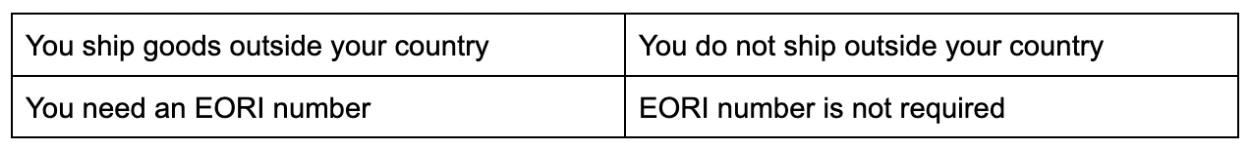

Do I need an EORI number?

Whether you are self-employed, a sole trader, in a business partnership or a fully fledged company, if the goods you are importing or exporting to or from an EU country are for business purposes, you will most likely need an EORI number.

However, you don't necessarily need to have an EORI number to move goods in and out of the EU, what matters is whether you are importing or exporting the goods in your name.

You can find more reasons why to use an EORI number later in the article.

How to check if you have an EORI number already

If you are a VAT registered business, it's likely that you already have an EORI number. If you are not sure whether you have an EORI number, it's quick and easy to check using the EORI number checker on the European Commission website.

For UK EORI numbers, you can check here. You will need to enter the prefix GB, followed by your 9-digit VAT number and suffix with '000' - for example GB405659293000.

When do I need to use my EORI number?

You will need an EORI number in all sorts of shipping scenarios, particularly if your business is not based in the country that you are moving goods to or from.

When you need an EORI number

It is important to have an EORI number in the following cases with your goods:

Make a customs declaration

Submit an entry summary declaration

Make an exit summary declaration

Submit a temporary storage declaration

Make a customs declaration for temporary admission or re-export declaration where you have a guarantee

Act as a carrier for transporting goods by air, sea or inland waterway

Act as a carrier connected to the customs systems and you want to receive notifications about the lodging or amendment of entry summary declarations

Appoint someone to deal with customs requirements on your behalf

Use customs systems, including the CHIEF system and the Import Control System Northern Ireland

Apply for a customs decision

When you do not need an EORI number

In the following cases it is not necessary to have an EORI number for your goods or products:

Not controlled goods

For personal use only

What if I don't have an EORI number?

An EORI code allows your goods to pass through customs. Without one, your goods will be stuck at the border, and you will be unable to access them. This can be costly, especially if you use sea or air freight to ship goods.

The longer your goods are held at the border, the more costs you incur. You will have to pay for storage (demurrage) while your goods are detained. Plus, delays are likely to hold up transactions causing cash flow problems and unhappy customers. You could also rack up significant returns shipping and customs clearance fees.

What information do I need before applying for an EORI number?

The information required to apply for an EORI number depends on whether you are applying as:

A VAT registered business

If you are applying as a VAT registered business, you will need to provide contact details of the business and its owners, and your VAT registration details. You will also need to confirm that you do not already have an EORI code.

A non-VAT registered company and importer/exporter

To apply as a non-VAT registered entity, you must provide the National Insurance number of any business owners or directors, plus your incorporation or registration details if you are a limited company or charity. As part of your application, you will need to confirm that it meets all the necessary criteria.

Your application comes with an option to have your EORI number listed on all validation checking systems. It's recommended that you take up this option so that you can easily find your EORI code when you need to.

A company applying for XI EORI number

To apply for an XI EORI number, you need to provide basic contact details, plus your VAT registration number or regular EORI number. When applying for an XI EORI code, you will be asked if your application relates to an existing application on an EORI number that's already in use. You will need to specify that it's a current EORI number application.

How to apply for an EORI number: get an EORI number in 8 simple steps

An EORI number is free to apply for, and it's really straightforward. You can get an EORI code by applying to the responsible authority in each country that an EORI number is needed. This can be done online using the official website of the relevant authority.

Once you have completed the relevant forms online - or in some countries signed and sent the necessary documents to customs authorities by post - you will be notified about the status of your application.

Remember, unlike a VAT number, each company or person only needs one EORI number. The EORI code that is issued, and the data of the owner, is stored in a central EU database - provided that written consent is given by the data owner.

The EORI number and data is then used for all customs requirements, whether its for importing or exporting in the country of registration or another country in the European Union.

UK VAT registered business

If you are a UK VAT registered company, you can apply here by giving the following information:

Full name

Position in the company

Contact details

VAT registration number

VAT registered name

VAT address

Tick the 'include these details on the GB EORI validation checker' box

Tick the 'I agree with the above statement' box in the declaration section

As a VAT registered business, you can apply for an XI EORI code at the same time.

UK Non-VAT registered business and importing and exporting

If you are a UK non-VAT registered organization that's importing, you can apply here by specifying the following information:

Business name.

Business address.

Contact details.

The legal status of the business.

Description of the goods being imported - including volume and value.

Supplier details.

Freight or courier information.

Import method.

Extra steps

All UK EORI number applications

For all types of UK EORI number application, you will need a Government Gateway user ID, which would have been issued to you when first registering as a business.

Sole proprietorships and EORI numbers

If you are a sole trader, you will need your National Insurance number. A Unique Taxpayer Reference (UTR) may be needed if your business is listed in the Companies House database. You will need to provide the start date of your business and the Standard Industrial Code (SIC).

Apply for EORI number in Ireland or Great Britain

To apply for an XI EORI number, you will first need to apply for a GB EORI number. HMRC will provide you with a registration form for an XI EORI number once you have received your GB code.

How long does it take to get an EORI number?

The issue time for an EORI number varies from country to country.

EORI Number in Germany and France

In Germany, it can take up to three weeks for an EORI number to be issued. French authorities tend to issue EORI codes within a few hours.

EORI number in Spain

In Spain, if a trader has previously been assigned a tax identification number, EORI registration will take less than a week (5 working days). If not, the timeframe will depend on the time needed to get a tax identification number (about 10 working days).

EORI Number in the Netherlands and outside the EU

The time for a manually assigned EORI number for a Dutch organization will take 1 working day.

For a company established outside the EU, the time for a manually assigned EORI number will take a maximum of 5 working days.

EORI Number in the UK

In the UK, if you are VAT registered, a GB and XI EORI number can be issued immediately, unless HMRC needs to make any checks on your application. If they do, your application can take up to five working days to process

As a non-VAT registered company, your application can take up to 10 working days to process if you need an XI number because you first need to apply for a GB EORI number before you can apply for an XI code.

Looking for a fulfillment solution to take your products across Europe?

Hive’s Pan-EU fulfillment solution allows you to expand your brand across Europe, all while saving on delivery time and costs. Hive’s holistic approach to Pan-EU operations means your freight forwarding, fulfillment, and delivery is taken care of by our team of experts. Find out more today.

Like this project

Posted Aug 19, 2023

A 1,700-word, ghost written SEO blog for Hive, which explains EORI numbers and their significance to the import-export process.